WASHINGTON—Robert Kiyosaki, coauthor of one of the bestselling finance books of all time, “Rich Dad Poor Dad,” has empowered millions of people to think like the rich and take control of their personal finances.

Now he’s sounding the alarm on what he says are hidden communist methods that are capturing the nation’s financial systems and silently robbing Americans of their purchasing power.

Kiyosaki diagnosed the United States’ fiscal health during an interview with Jan Jekielek, host of “American Thought Leaders,” on EpochTV.

He described symptoms across the nation, including increased homelessness, a fragile economy, and a lower quality of life for many Americans.

Knowledge Is Power

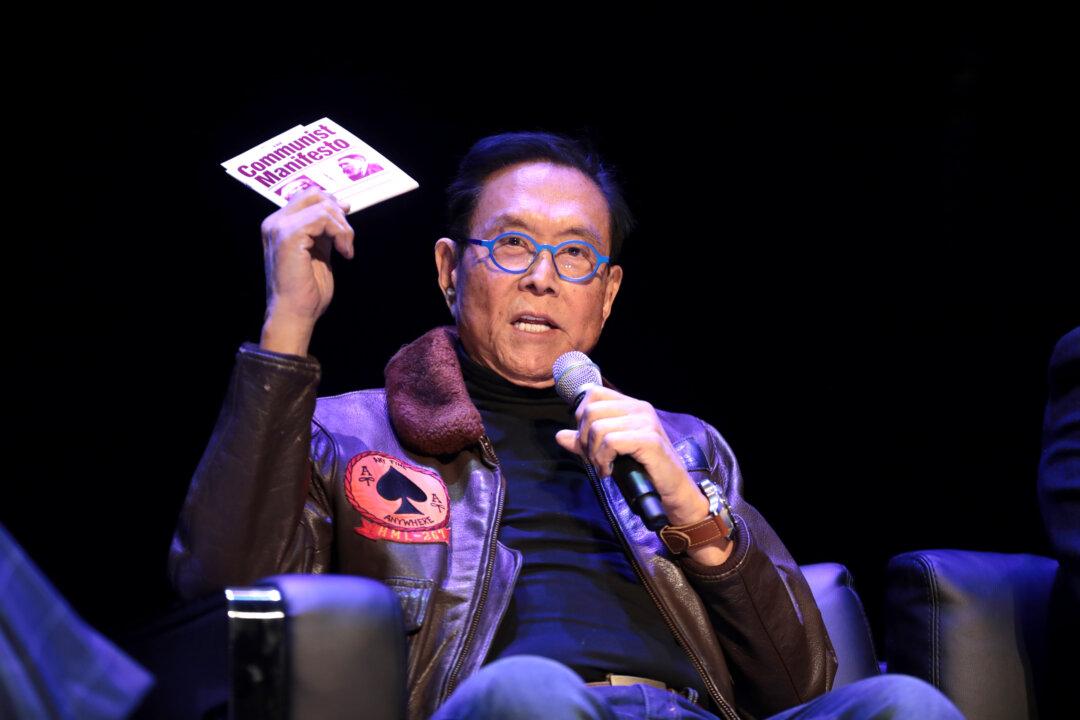

While Kiyosaki was studying in New York at the age of 18, an economics professor advised him to read Karl Marx’s “Communist Manifesto” because it was important to “know your enemy.” That lesson lingered, and later encounters with communism strengthened his resolve to combat communist ideology.

In the early 1970s, he served as a Marine Corps first lieutenant in Vietnam, fighting against the communist North Vietnamese in the Battle of Quang Tri, among others.

“We lost so many men that day,” Kiyosaki said. “Since then, I’ve been fighting communism by teaching capitalism.”

According to Kiyosaki, similar communist ideologies are now ingrained in academia across the country, he said.

“I teach capitalism, but our schools are taught by Marxists,” Kiyosaki said.

“The problem is our school system; the communists are academics ... our professors.”

Some lack awareness of the ideology’s infectious spread or its consequences because they’ve never lived under communist rule, he said.

They are good people, he said, but they don’t realize that their whole value system is based on their education status and perceived intelligence.

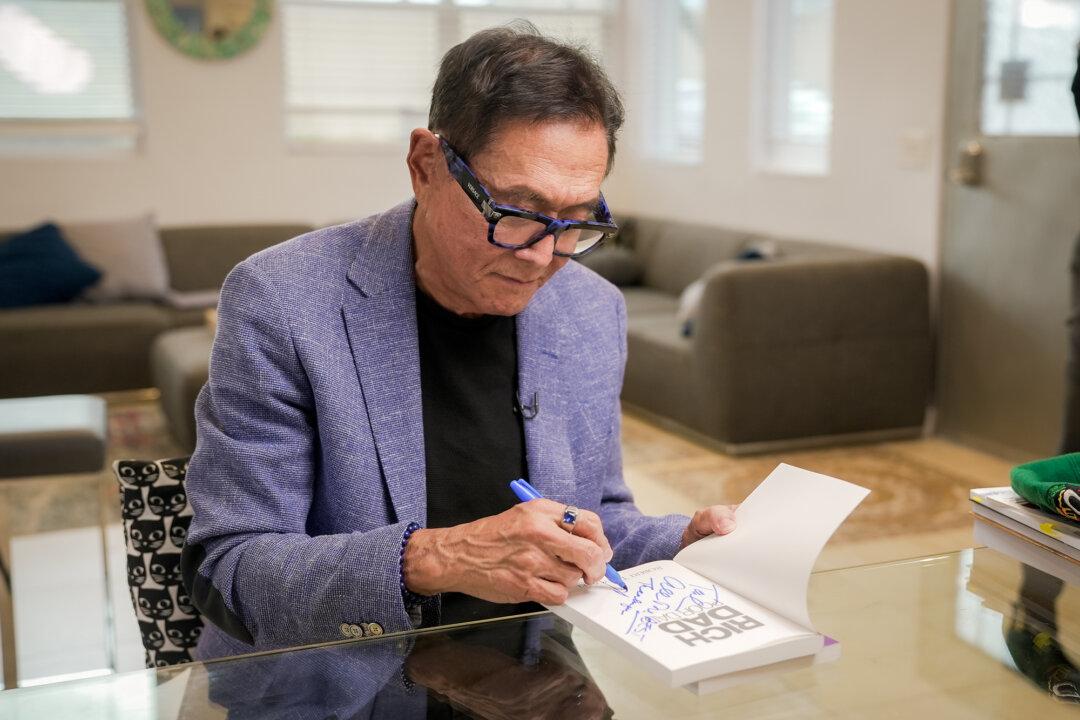

Robert Kiyosaki, author of the bestselling personal finance book “Rich Dad Poor Dad,” in Phoenix on Nov. 18, 2020. Kiyosaki said hidden communist methods are capturing the United States’ financial systems and silently robbing Americans of their purchasing power. (Tal Atzmon/The Epoch Times)

“They don’t know anything about money,” Kiyosaki said.

His father, Ralph, the inspiration for the “poor dad” in his book, was an academic who rose to the rank of superintendent of education in Hawaii.

The “rich dad” was an entrepreneurial father of a friend who taught young Kiyosaki how to use money and debt to his advantage.

Understanding money and monetary policy is essential to building wealth, according to the tycoon, who suggested that the nation’s current fiscal system is devaluing the dollar.

Controlling the Money

Kiyosaki described the U.S. Federal Reserve Bank—established in 1913 with a goal of stabilizing the nation’s monetary supply following years of extreme volatility, and preventing panic—as a Marxist organization.

“When the Fed came to America, it was the end of America—and our freedom is being stolen via our money,” Kiyosaki said.

“As most people know, there’s a big movement to end the Federal Reserve Bank, because it’s not federal, it’s not a reserve, and it’s not a bank.”

He cited Gresham’s Law—a financial principle named after Sir Thomas Gresham, which states that debased or bad money chases good money out of economic systems—while warning of the central bank’s monetary policies.

U.S. currency was once tradeable for silver or gold. The Federal Reserve notes in circulation today, however, carry no guarantees, which results in significantly devalued currency, Kiyosaki said.

Marxists want to destabilize society by “taking the currency,” Kiyosaki said.

“You make the currency fake, and that’s what happened when the Federal Reserve Bank came in,” he said.

The Federal Reserve in Washington on July 21, 2025. Kiyosaki said the Fed’s policies are devaluing the currency because today’s Federal Reserve notes aren’t tradeable for gold or silver. (Madalina Kilroy/The Epoch Times)

Learning by Example

Kiyosaki traveled the globe observing how monetary policies and authoritarian ideologies affect economies.

Spending time in Zimbabwe during the period of extreme hyperinflation gave him an inside perspective on the situation, and he said he sees similarities in the United States.

“They kept printing money ... and Zimbabwe collapsed,” Kiyosaki said. “America is doing the same thing.”

Loose monetary policy over the past five years exacerbated wealth disparity and contributed to societal problems, according to Kiyosaki.

“Homelessness is exploding, because every time you print money, two things go up: taxes and inflation,” he said.

The number of homeless people rose by 18 percent nationwide between 2023 and 2024; at least 770,000 people live on the street across the country, according to the most recent data from the Department of Housing and Urban Development.

Workers loosen a stack of $1 bills on a vibrating table before they are cut into singles at the Bureau of Engraving and Printing in Washington on March 26, 2009. (Mark Wilson/Getty Images)

Consequences of Taxation

Kiyosaki suggests that everyone study the history of the United States and the establishment of the IRS.

He cautioned that taxes are vital components of communist systems and said that the United States “was founded as a tax revolt against Mother England,” with a long history of protesting taxation.

He advises his accounting team to avoid taxes using every legal option available.

“I’m a capitalist. I pay zero taxes legally,” Kiyosaki said. “I refuse to play that game because what those taxes are used for is to create wars. It’s tragic.”

A Form 1040 individual income tax return sits atop a stack at the Des Plaines Public Library in Des Plaines, Ill., on March 23, 2006. Kiyosaki said taxes are central to communist systems and reminded Americans that the nation “was founded as a tax revolt against Mother England.” (Tim Boyle/Getty Images)

Understanding Capitalism

Although he warns of these problematic internal systems, Kiyosaki said he encourages people to remain optimistic and focused. Success in capitalist endeavors requires planning and an understanding of debt, finance, and how to use money to generate positive cash flow, he said.

Leveraging equity to acquire more assets—by borrowing money when home values appreciate, for example, to buy more rental properties—is a method he said produced significant rewards throughout his career, although the process is little understood by those not involved in it.

Kiyosaki built his empire by saving money to invest in hard assets, including residential and commercial properties, silver and gold, cattle ranches, oil wells, and other items.

“I’m a see, touch, and feel guy,” Kiyosaki said. “So I stay with what I like and what I’m interested in.”

Robert Kiyosaki holds a copy of “The Communist Manifesto” while speaking with attendees at an Arizona State University event in Tempe, Ariz., on Feb. 8, 2023. Kiyosaki said his college economics professor urged him to read Karl Marx’s book to “know your enemy.” (Gage Skidmore/Flickr)

Suggestions for Investors

He said that no two paths are the same and that every individual must find what works for him or her.

“There’s a million ways to financial heaven,” Kiyosaki said. “There’s a billion ways to financial hell, and most people go to financial hell.”

He predicted volatility in the stock market that could negatively affect many current and future retirees who invested their savings in index funds, 401(k) plans, IRA accounts, and other traditional financial instruments.

“My generation of boomers, they’re going to have a rug pulled out from underneath them,” Kiyosaki said. “Because when this market comes down, which it is coming down now, they have no retirement.”

He said that bonds are too risky for his taste because China and Japan are sellers. He said that real estate investing is one of his favorite strategies and that he manages a portfolio of approximately 1,500 rental properties.

Those looking to follow his lead are advised to find a topic they are passionate about and dedicate the time and resources to identify opportunities.

A businessman walks by the New York Stock Exchange in New York City on July 7, 2025. Kiyosaki predicts volatility in the stock market that could negatively impact many current and future retirees who invested their savings in index funds, 401(k) plans, IRA accounts, and other traditional financial instruments. (Spencer Platt/Getty Images)

“To this day, you can ask my assistants, all I’m doing is looking at deals,” Kiyosaki said. “It becomes a habit ... so you can train yourself to have the skills and the mindset of a rich man, but you have to do the work.”

He said that the board game Monopoly taught him a lot about capitalism and financial freedom and that he still considers himself a 10-year-old boy playing a game.

“I’ve lost a lot of money in my time. I made a lot of mistakes, but I’m still playing Monopoly,” Kiyosaki said.

“Sometimes you win, and sometimes you lose, but every time you lose, you get smarter.”