Commentary

The problem-child cities have finally released their annual comprehensive financial reports (ACFRs) for the year ended June 30, 2023. Compton was once again the last to post its report, at the end of June, two years after the close of the fiscal year.

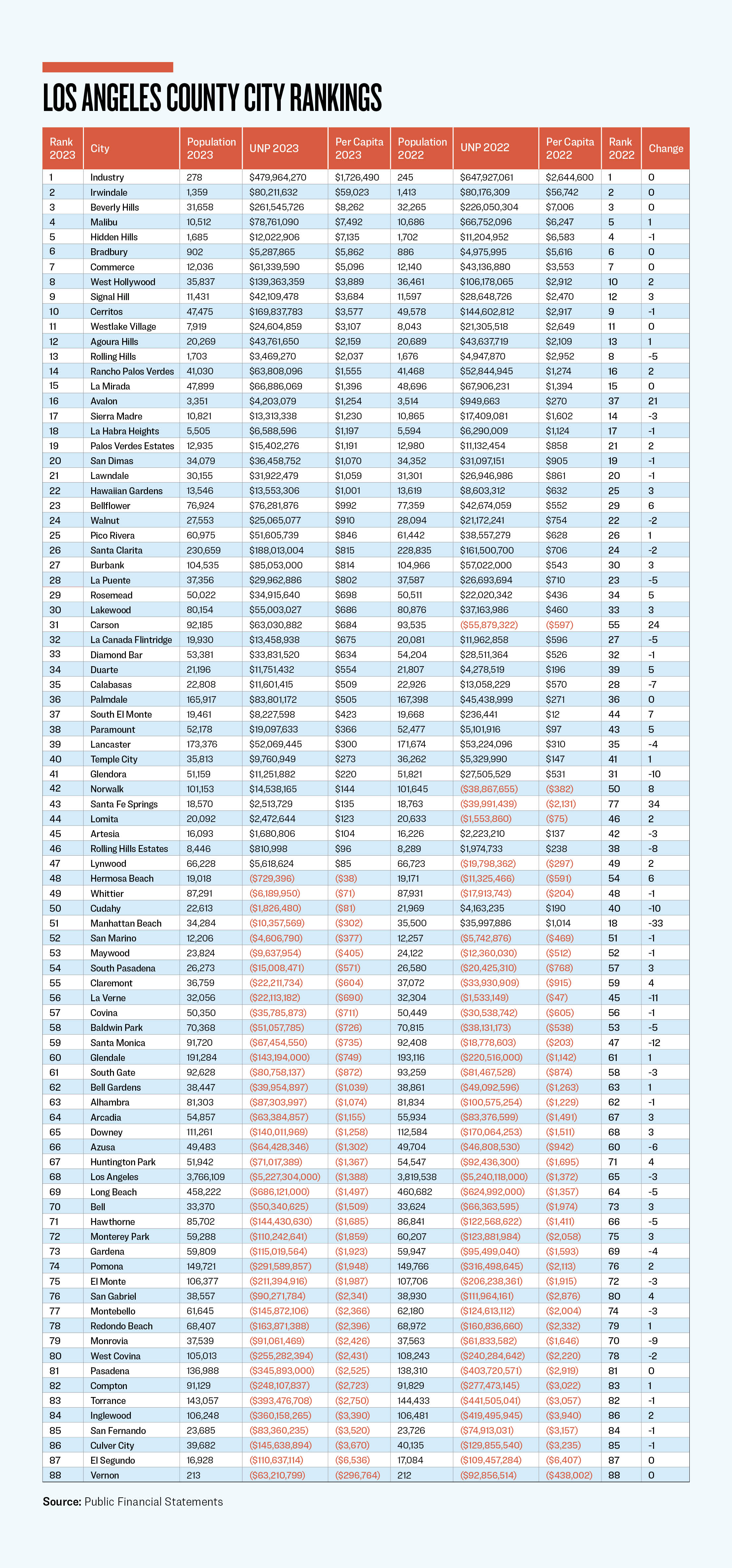

If you live in one of the 88 cities in Los Angeles County, how well managed is your city from a fiscal perspective? The ACFRs provide the basic story, based on the rankings of the balance sheets on a per capita basis. Overall, these California cities lowered their combined unrestricted net positions by $613 million, making 2023 a good year.

By reviewing the chart below, the first thing that one notices is the amount of movement during this fiscal year. Eight cities moved dramatically, up and down, by double digits. Another eight between six and nine places.

The city of Santa Fe Springs moved up 34 places. This deserves a very close look. It had revenues of $87.5 million exceeding its net expenditures of $49.1 million. This $38.4 million net revenue explains the bulk of the increase of $42.5 million in its unrestricted net position. The prior year, it had revenues in excess of expenditures of $19.1 million.

For this fiscal year, expenses were up by $4.3 million, but program revenues were up $11.2 million and general revenues were up by $12.4 million. Grants for public safety were up $4.7 million, and capital grants for public works were up $2.8 million, making them the two major components of the program revenues increase. An increase of $6.0 million in revenues from the use of money and property explains a big portion of the jump in general revenues. Santa Fe Springs was in 86th place in 2019 and is now in 43rd place. It has been moving up the old-fashioned way, earning more than it spends. It is now case study material.

The city of Carson went from an unrestricted net deficit of $56 million to an unrestricted net positive position of $63 million, a $119 million increase, moving it up 24 places. Having revenues in excess of expenditures of $128 million provides the story. Program expenses were up $25.9 million over the prior year, and program revenues were down $17.5 million, but sales tax revenues were up $15.6 million, franchise taxes up $3.5 million, and its unique oil industry business tax was up $68.7 million (exceeding the budgeted amount of $4.2 million by a long shot).

Oil industry business tax was a new revenue source that started in 2018, and the jump may have been the result of the city auditing the oil refineries for accuracy in payments and charging applicable penalties. This unique source of revenue may be a bonanza for Carson, but it may also be a reason for the increase in the price of gasoline for everyone in neighboring cities.

The city of Avalon continues its soar up the rankings, as this tourist destination is recovering from heavy-handed COVID-19 lockdowns, moving up 21 places. It had revenues in excess of expenditures of $3 million, explaining the improvement to its unrestricted net position of $3.3 million. Avalon jumped up 16 places in 2022 and 10 places in 2021. It was in 63rd place in 2020 and is now in 16th.

The four cities that deserve honorable mentions for moving up are Norwalk (8 places), South El Monte (7), and Bellflower and Hermosa Beach (6 places each).

Manhattan Beach went in the complete opposite direction of Santa Fe Springs, dropping 33 places. Its unrestricted net position dropped by $46.4 million. Expenditures in excess of revenues of $36.5 million explains nearly 80 percent of the drama. Moving $2 million into restricted assets and $8.9 million into capital assets helps explain the rest. Residents may want to sit down with the finance director for an explanation of why 2023 governmental activity expenses were $105.6 million higher than 2022.

The city of Santa Monica, after moving up 16 places in 2022, regressed back 12 places in 2023. After having $74 million in revenues in excess of expenditures in 2022, it had expenditures in excess of revenues totaling $44 million in 2023, a swing of $118 million. One wonders what is really going on with the beach cities. Santa Monica’s unrestricted net deficit grew by $49 million. And if that wasn’t bad enough, in Note 12 of its ACFR, its pension plan liability grew by $156 million. One thing is for certain, Santa Monica is bouncing.

The city of La Verne had expenditures in excess of revenues of $18.8 million, explaining the bulk of the increase in its unrestricted net deficit of $20.6 million, and its dropping 11 places.

The city of Glendora had expenditures in excess of revenues of $6.8 million and moved $7.1 million into restricted assets, explaining the bulk of the $16.3 million drop in its unrestricted net position. It dropped 10 places.

The city of Cudahy saw its unrestricted net position cave by $6 million, even while its revenues in excess of expenditures were $17 million. Moving $7.6 million into restricted funds and allocating $15.6 million for capital assets explains the net drop. It also dropped 10 places.

Other dropping cities were Monrovia (9 places), Rolling Hills Estates (8), Calabasas (7), and Azusa (6). Otherwise, there was minimal movement by the other 72 cities. Being in positive territory was accomplished by 47 cities. If you reside in one of the 41 cities in negative territory, it may be time to inquire of your elected council members, what is their plan for moving up the rankings?

Obviously, generating more revenues than what is spent is a key component of building a financially healthy city. It takes a little luck and a lot of discipline. If your city is doing well, then it may be time to enjoy a visit to Catalina Island to celebrate. And if your city is timely in reporting, that’s one more thing to celebrate. The city of Los Angeles, the second most populated city in the nation, completed its audit field work on Jan. 24. If L.A. can get it done in 204 days, the 87 other cities should be able to do the same or better.

Nearly half of the county’s cities, 39, completed their audit field work on or before Dec. 31, 2023. Another 32 cities were completed by March 31, 2024. That left 17 cities that were delinquent. Ten of them were completed on or before June 30 of 2024. The last seven cities to provide fiscal transparency to their residents were Huntington Park (July 1, 2024), Palos Verdes Estates (July 23), Bradbury (July 26), Commerce (Aug. 19), El Monte (Sept. 16), Maywood (Oct. 18) and, seven months later, Compton (May 12, 2025—but posted at the end of June).

This lack of emphasis on public reporting is not unique to Los Angeles County. In May, Texas Governor Greg Abbott signed Senate Bill 1851 into law, a bill that flew through the Texas legislature, implementing a severe penalty for cities that did not file their annual audits within 180 days of the end of the fiscal year. Now that it’s July and some twenty L.A. County cities are still delinquent with their 2024 ACFRs. Let’s see if the problem-child city of Compton, and its cohorts, can step up their transparency game.