Commentary

The city of Ione in central California has finally provided its published annual comprehensive financial report (ACFR) for the fiscal year ending on June 30, 2021, allowing us to complete the latest ranking for this region.

Ione is a beautiful city, and I know it as the home of California State Historical Landmark No. 506, the Cathedral of the Mother Lode, and No. 788, another brick building used for the general merchandise store on Main Street, both built in 1856. However, No. 867, Preston Castle, is the most memorable for me.

Here is what the landmark plaque states: “The ‘Castle,’ built in 1890-1894, is the most significant example of Romanesque Revival architecture in the Mother Lode. It was built to house the Preston School of Industry, established by the State Legislature as a progressive action toward rehabilitating, rather than simply imprisoning, juvenile offenders. Doors of the 120-room ‘Castle’ closed in 1960 after new facilities were completed.”

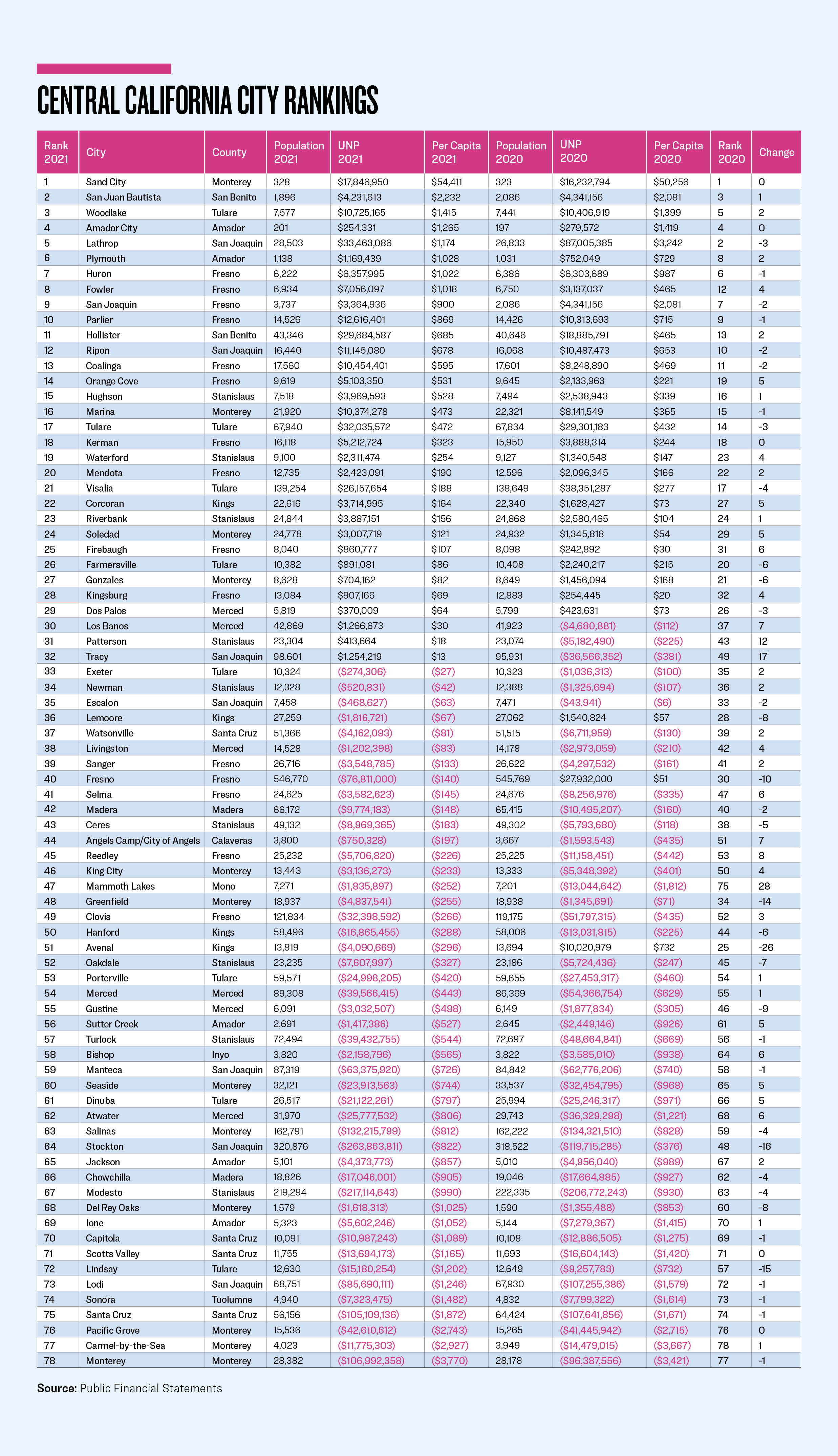

Obtaining the ACFRs of California’s cities is important, as actual hard data, audited by independent certified public accounting firms, should give a ranking of how cities compare. The central area of California has 78 cities and encompasses at least 15 counties with cities.

Roughly one-third of them, 25, completed their audit field work by Dec. 31, 2021, the expected due date. Another 25 completed theirs by March 31, 2022, the recommended last day. Four completed theirs in April, four in May, six in June, one in July, two in September, two in October, two in November, one in April 2023, Turlock on June 6, Greenfield on July 6, and Manteca on Aug. 2.

Then 2024 rolled around and Avenal finished its on March 15 and Hollister on May 9. Then we go all the way to Oct. 15, 2025, to have the last one completed from beautiful downtown Ione. And it was just released to the public last month.

Now let us see what happened during this COVID-19 pandemic lockdown period in California’s current history. By taking the unrestricted net position for governmental activities from the basic financial statements and dividing it by the city’s population, a per capita is derived. The graph provided below provides the rankings.

There are four basic reasons why cities make significant moves in the rankings. The first is revenues in excess of expenditures, or vice versa. The second is moving funds in or out of restricted assets. The third is acquiring or disposing of capital assets. And the fourth is accounting and reporting errors in the ACFRs.

Reviewing those cities that moved by double digits, the biggest upward mover was Mammoth Lakes. It enjoyed revenues in excess of expenditures of $5.3 million, of which $2.3 million was transferred into restricted assets.

Note 7 in the financial statements reflects retirements of $5.3 million, acquisitions of $7.9 million, and depreciation of $3.8 million, for what should be a reduction to the net investment in capital assets of $1.2 million. But the statement of net position (balance sheet) reflects an additional reduction of $7 million. And liabilities that could have been related to capital assets did not increase by this or a higher amount. Chalk this up to an accounting or reporting error. But this explains why the unrestricted net deficit improved by $11.2 million and the move upward of 28 positions, recovering from its 17-place drop the previous year.

Tracy had revenues in excess of expenditures of $58.4 million, transferred $15.7 million into restricted assets, and made supposed acquisitions totaling $15.2 million for its net investment in capital assets. Combined, it should explain the $37.8 million increase in the unrestricted net position. But it does not, as $10.3 million is unaccounted for. And after reviewing the disclosures provided with the ACFR, this accountant could not figure out why. It moved up 17 places and into positive territory.

Patterson had revenues in excess of expenditures of $8 million, transferred $4.2 million into restricted assets, and somehow reduced its net investment in capital assets by $1.8 million. Combined, the unrestricted net deficit enjoyed a reduction of $5.6 million that also moved it into positive territory and up by 12 places.

Fresno had expenditures in excess of revenues of $32.4 million, transferred $65 million into restricted assets, and appropriated $7.4 million for its net investment in capital assets. The net result of $104.8 million took a positive unrestricted net position of $27.9 million to an unrestricted net deficit of $76.8 million, having the city go from positive to negative territory and dropping by 10 positions.

Greenfield had expenditures in excess of revenues of $2 million, transferred $1.1 million into restricted assets, and allocated $1 million to net investment in capital assets. There was also a previous period adjustment of $0.7 million. Combined, the unrestricted net deficit grew by $3.4 million, nearly fourfold, and dropping the city by 14 places.

The annual comprehensive financial report for the city of Lindsay has the words “as restated” mentioned 17 times, with a lengthy explanation in Note 12: “The restatements recorded in the governmental funds were to correct receivables relating to utility billing, reinstate as requested by the State of California Auditor’s Office interfund advances previously written-off, segregate funds identified as restricted from the General Fund, and reclassify certain loan programs assigned to [the California Department of Housing and Community Development] as custodial funds.”

The restatement would increase Lindsay’s beginning unrestricted net deficit of $9.3 million to $26.4 million. It incurred revenues in excess of expenditures of $1.8 million, transferred $8.4 million out of restricted assets, and had depreciation expense reduce its net investment in capital assets by $1 million. Combined, the unrestricted net deficit would end up at $15.2 million. The net result found Lindsay dropping by 15 positions.

Stockton continued its slide from the previous year. It had revenues in excess of expenditures of $83.2 million and allocated $8 million toward its net investment in capital assets. But transferring $219.3 million into restricted assets resulted in a $144.1 million increase in its unrestricted net deficit, dropping it by another 16 positions.

Avenal also made a massive drop, taking the top spot because of a 26-position drop. In the 2020 ranking, I stated that this city dropped by 18 places, but it actually dropped only one place. Such is the joy of missing one digit in its unrestricted net position amount. I apologize for the proofing error.

This year, it had expenditures in excess of revenues of $1.3 million, liquidated its restricted assets of $3.2 million, and allocated $1.9 million toward its net investment in capital assets. Combined, it should have left the unrestricted net position the same. But it dropped by $14.1 million into negative territory. And maybe I’m not the only one who made a typographical error, as I cannot seem to be able to explain the detailed reason for its major drop.

This is why we do the rankings. As one wise businessman once told me, “Detect and correct.” I’m only sorry that we are a few years behind and cannot obtain all of the answers in real time. We will have to see how things shape up in the subsequent years as the delinquent cities do their residents and the rest of the region a favor and provide the required annual financials. And then we can ask the critical questions with more current information.