Commentary

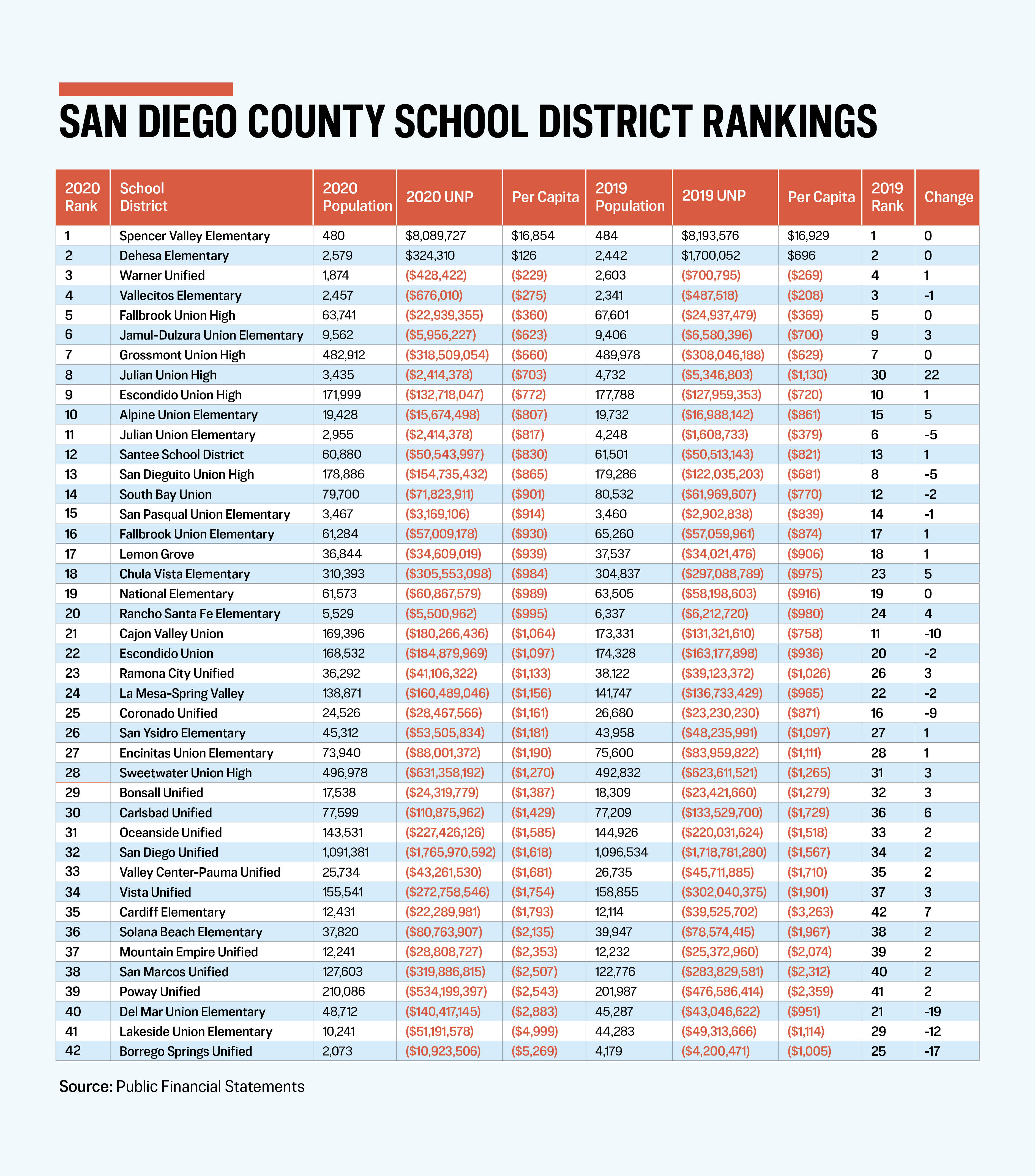

It was the beginning of the coronavirus lockdown on California schools—the impacts of this initiative that started in March of 2020 were felt by many of the 42 school districts in San Diego County. Let’s see what happened financially in the first year and following, during this five-year period, starting with the fiscal year ending June 30, 2020.

By taking the unrestricted net position (UNP) on the audited financial statements and dividing it by the population served by the school district, one comes up with a per capita. This provides a range to see how each school district is fairing.

As you can see from the graph below, four moved up by five or more positions and four dropped by double digits. To determine their stories, a closer look at these eight school districts should provide lessons to be learned or avoided.

Julian Union High had revenues in excess of expenditures of $392,916 and transferred $218,330 into restricted assets. In the net position section of the balance sheet, the net investment in capital assets was reduced by $3,417,222, but there was no reduction in the capital assets and no increase in long-term liabilities. The footnotes are silent about the supposed reason for the reduction. That’s because there isn’t a reason. This is a common problem that needs a simple solution: disclose the details of the net investment in capital assets account. But it explains why the unrestricted deficit was reduced by $3,591,808, explaining its jumping up 22 positions. Once this oversight is discovered and corrected, expect it to drop by a similar amount.

Cardiff had revenues in excess of expenditures of $1.4 million and transferred $6.6 million out of restricted assets. The district spent $2.4 million on its net investment in capital assets, leaving $5.6 million to reduce its unrestricted net deficit. It moved up seven places.

Carlsbad Unified has a good module for reviewing its audited financial statements going back to 2014. In 2020 it had revenues in excess of expenditures of $4.5 million. It transferred $12.5 million into restricted assets. It also reduced its net investment in capital assets by $32.6 million, which somewhat explains the reduction in its unrestricted net deficit of $22.7 million.

There’s one problem. The capital assets actually increased by $13 million. The solution to the mystery can be found in Notes 8 and 16 of the financial statements. A restatement was made to add $52.8 million in debts related to general obligation bonds from the 2006 election. This very unique activity helped the district move up six positions.

Chula Vista Elementary had expenditures in excess of revenues of $28.7 million. It transferred $63.7 million into restricted assets. But it reduced its net investment in capital assets by $83.9 million, to only have an $8.5 million increase in its unrestricted net deficit.

The answer is found in Note L to the financial statements. The district increased its general obligation bond debt by $60.9 million and its certificates of participation debt by $25.8 million. With a minimal increase in capital assets, this explains the very rare $83.9 million reduction.

This activity would normally see a district drop in the rankings. But, with a significant increase in the district’s population, it actually moved up five places.

Cajon Valley Union had expenditures in excess of revenues of $5 million and allocated $43.6 million towards its net investment in capital assets, explaining the $49 million increase in its unrestricted net deficit and moving it down 10 places.

Lakeside Union Elementary also had expenditures in excess of revenues of $5 million, it moved $4 million out of restricted assets and appropriated $1 million to net investment in capital assets. Combined, the unrestricted net deficit grew by $1.9 million. It dropped 12 places.

The audited financial statements for the June 30, 2019, year end for Borrego Springs Unified School District shows an unrestricted net deficit of $2.4 million. But 2020 shows $4.2 million. Using the latter amount, the district had expenditures in excess of revenues of $0.6 million, it transferred $7.4 million into restricted assets, and for some reason reduced its net investment in capital assets by $1.3 million. The combination increased the unrestricted net deficit by $6.7 million. The district’s voters approved $8.6 million in general obligation bonds during the year. Their issuance generated a premium of $1 million, showing that setting funds aside for a capital improvement is a much less costly method. The amounts going into the net investment in capital assets and restricted assets may just be the $9.6 million in new debt. This unique activity resulted in the district dropping 17 places.

Del Mar Union has a similar story. It had voter approved general obligation bonds of $186 million and issued $55.3 million with a $3.9 million premium. It also issued special tax bonds of $39.1 million with a premium of $4.5 million. It appropriated $15.2 million toward work in progress.

Del Mar Union had revenues in excess of expenditures of $4.6 million, increased its net investment in capital assets by $10.5 million, and transferred $91.5 million into restricted assets. Combined, the unrestricted net deficit increased by $97.4 million. The reporting of the construction activity dropped the district 19 places.

Audited financial statements have big stories to tell. That’s why you should encourage your school board to post them on the district’s website. The goal is to slowly move up the rankings. The ultimate goal is to reach a positive unrestricted net position. How did your district do?