After speculation erupted into controversy that donations from billionaire Greg Flynn—founder, chairman, and chief executive officer of the Flynn Restaurant Group—to California Gov. Gavin Newsom totaling $226,800 since 2018 resulted in unique exclusions to a new law regulating fast-food restaurants, the governor’s office Feb. 29 dismissed the notion.

“The Governor never met with Flynn about this bill and this story is absurd,” Alex Stack, spokesperson for the governor, told The Epoch Times by email Thursday. “Our legal team has reviewed, and it appears Panera is not exempt from the law.”

The Flynn Restaurant Group operates Panera Bread franchises, while the restaurant chain is owned by JAB Holding Company.

According to Mr. Stack, who was advised by the governor’s legal team, all aspects of bread-making must be conducted on-site to qualify for the exemption, and because chain bakeries like Panera Bread mix dough off-site and send it to locations for baking, they will not be exempt.

A sign is posted in front of a Panera Bread restaurant in Novato, Calif., on Nov. 1, 2023. (Justin Sullivan/Getty Images)

Suggesting the process by which the measure was constructed was the result of discussions between interested parties, the governor’s office said the evolution of the bill’s language was part of normal legislative deliberations and had nothing to do with campaign donations or discussions with Mr. Flynn.

“This legislation was the result of countless hours of negotiations with dozens of stakeholders over two years,” Mr. Stack told The Epoch Times by email Feb. 28. “Staff in the Governor’s Office met with dozens of business owners as well as union representatives, as is expected when policies of this consequence are moving through the Legislature.”

Mr. Newsom’s office pushed back on allegations that campaign contributions from Mr. Flynn—totaling $58,400 in 2018; $100,000 to oppose recall efforts in 2021; and $68,400 in 2022, according to the Secretary of State’s website—were instrumental in the franchisee successfully lobbying the government to revise AB 1228 and suggested the restaurant will not be exempt from the new law, which would raise the minimum wage to at least $20 for some fast-food establishments, once it takes effect April 1.

But saying the governor is “spinning the narrative,” the Senate’s Republican Caucus responded to his office’s claims by calling for further investigation.

A Feb. 28 Bloomberg article alleged Mr. Flynn pushed Mr. Newsom’s staff “to reconsider whether fast-casual chains such as Panera should be classified as fast food,” and people involved had claimed the resulting changes were due to “the governor’s longstanding relationship with a Panera franchisee.”

“I think we really do need to take a serious look at this issue,” state Sen. Scott Wilk said in the Senate’s session Feb. 29. “If what is alleged is true, it’s not acceptable.”

His colleague agreed and said that lawmakers need to prioritize Californians rather than campaign contributors.

“For Pete’s sake, stop making exemptions just for the people who have the connections and the ability to pay, because that’s what this is,” state Sen. Kelly Seyarto advised colleagues in the Senate chamber. “That’s bad legislation, and we should be ashamed of ourselves for passing stuff like this.”

Critics suggest money is influencing politics in California and leading to exemptions that create unfair competitive advantages by benefiting some restaurant chains while others are forced to raise wages to comply with new state law.

“Panera couldn’t afford Democrat lawmakers’ $20 minimum wage requirement for fast food restaurants,” Senate Minority Leader Brian W. Jones said in a Feb. 28 press release. “Lucky for them, their franchise owner donated ... to Governor Newsom, who got them an exemption.”

The governor and the franchise operator both graduated from Redwood High School in Marin County north of San Francisco and attended at the same time for one academic year covering the fall of 1981 and spring of 1982—the governor as a freshman and Mr. Flynn as a senior.

A view of Redwood High School where actor and comedian Robin Williams attended high school in Larkspur, Calif., on Aug. 11, 2014. (Justin Sullivan/Getty Images)

Mr. Flynn told The Epoch Times that he never met Mr. Newsom at the school, and the two became acquainted decades after graduation.

“It is true that I opposed AB1228, as did thousands of other California restaurant owners,” Mr. Flynn told The Epoch Times by email Feb. 29. “I also never met with Governor Newsom about this bill, though I did meet with his staff in a group meeting with other restaurant owners.”

He said that he never asked for special treatment and expressed his surprise at finding language exempting restaurants with bakeries in the final version of the bill, implying that Panera Bread and other similar restaurants would indeed benefit from the bill.

“To be clear, at no time did I ask for an exemption or special considerations,” Mr. Flynn said. “In fact, the idea never even occurred to me, and I was surprised when the exemption appeared in the final legislation.”

Owner of 2,355 restaurants worldwide, bringing in more than $4.5 billion in annual sales, according to the company’s website, Mr. Flynn controls 24 Panera Bread locations in California that may benefit from the unique wording in Assembly Bill 1228 exempting restaurants that operate a bakery and offer bread for sale as a stand-alone item.

Mr. Newsom previously told reporters the bakery exception was part of the “sausage making” of crafting legislation.

But the Republican leader in the state Senate suggested the combination of contributions and narrow exclusions that some perceive to benefit the donor by exempting Panera Bread are problematic and need to be further investigated.

“This isn’t ‘sausage making’ as the governor suggests, it’s crony capitalism,” Mr. Jones said. “Corrupt and unacceptable.”

Arguing that Panera Bread was excluded because of the donations, he said other businesses will pay the price for not being able to afford such expenditures.

“Unfortunately, other restaurants lacked such substantial donations and now must comply with the new minimum wage by all means necessary, including layoffs and replacing workers with automation,” Mr. Jones said. “Campaign contributions should not buy you carve-outs in legislation.”

A fellow Republican Senate colleague urged the governor to veto the bill last year raising concerns that some had influence over it, while others affected weren’t included in deliberations.

“This bill is the product of an exclusionary backroom deal between national and state big business interests and powerful California labor unions,” state Sen. Brian Dahle wrote the governor in September 2023. “Excluded from the negotiation table for this secret backroom deal were the very people most negatively affected by it: the small independent franchisee.”

Such exclusion was intentional and detrimental to the future of small businesses in the state, he said.

“The voices of these small business owners appear to have been purposefully left out,” Mr. Dahle said. “It’s shameful that these business owners were not included in the negotiations and were not given time to voice their opposition to the deal.”

Wary of how the bill’s language was crafted and arguing that such sets a “dangerous precedent,” one group petitioned lawmakers to vote against the measure last year.

“This development [is] a prime example of behind-the-scenes political maneuvering, raising concerns about transparency and fairness,” the American Association of Franchises and Dealers wrote to lawmakers in opposition before the bill was passed last year. “Given these circumstances, [we] cannot endorse legislation crafted behind closed doors, which disproportionately affects its members and lacks transparency in its decision-making process.”

The bill was signed into law last year after union representatives from four organizations lobbied for its approval while it received opposition from more than 150 groups.

“Ensuring a level playing field for all California businesses is paramount,” the opposition wrote in legislative analyses last year. “Dismantling a business model that provides upward mobility and entrepreneurial opportunities to thousands of Californians is misguided public policy and will only serve to hamper job growth and opportunities across the state.”

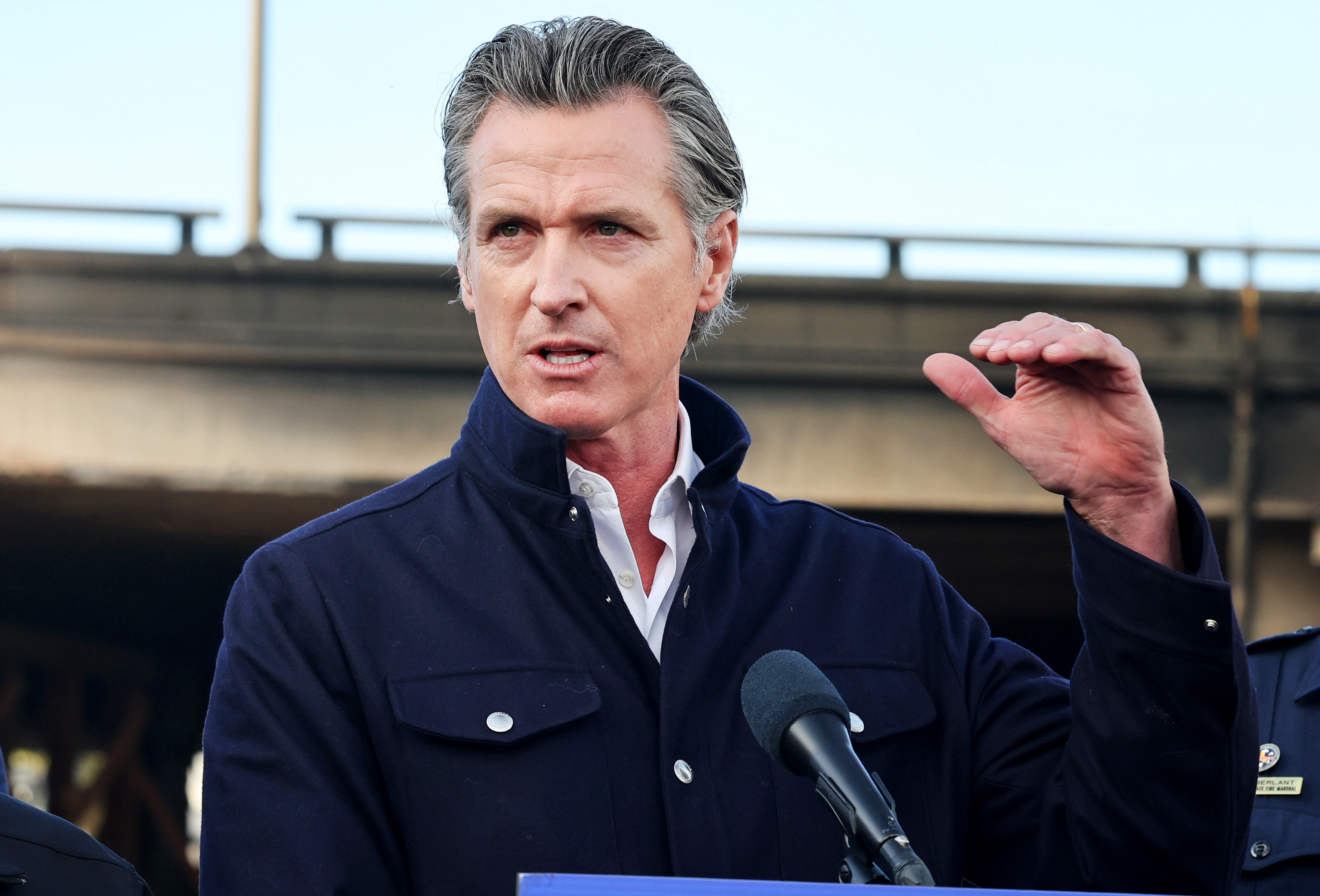

California Gov. Gavin Newsom signs the fast food bill surrounded by fast food workers at the SEIU Local 721 in Los Angeles, on Sept. 28, 2023. (AP Photo/Damian Dovarganes)

Other critics said the situation demonstrates how the political system is influenced by lobbying and money flowing from special interests to fund campaigns.

“The governor just stated today that it’s the way sausage is made,” Mr. Dahle said on the Senate floor Feb. 29. “Well, there’s a lot of pork in sausage, and a lot of his friends are getting some pork out of it.”

Republicans raised concerns about the issue on the floor of the state Senate Feb. 29 when contesting another measure, Assembly Bill 610, aimed at expanding exemptions to the fast-food law. The Caucus voted against the proposal and reiterated complaints about perceptions of impropriety.

“We need to send a message that the Senate will not condone any ‘pay to play’ actions or perceptions, period,” Mr. Jones said in a Feb. 29 press release. “At this point, the cleanest path forward is to scrap AB 1228 entirely and start from scratch.”

Requests for comment from the bill’s author, Assemblyman Chris Holden, were not returned on deadline.