Commentary

Every city in California has a story—especially when it comes to its financial stability. And since there are 482 of them in the state, I’ve broken it down into nine regions, following Caltrans district boundaries as closely as possible, to provide a look into each city’s fiscal situation.

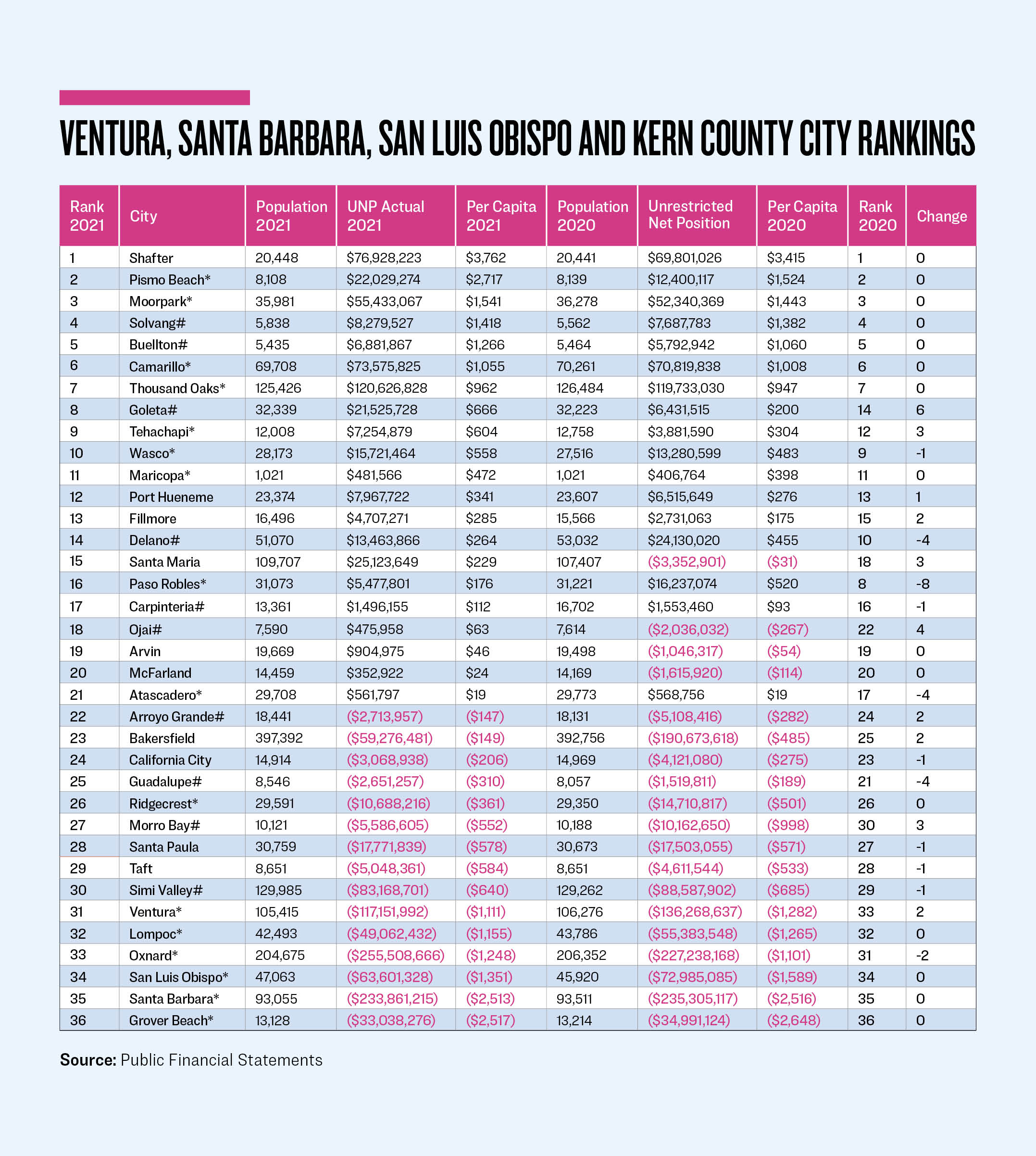

The region that includes Ventura, Santa Barbara, San Luis Obispo, and Kern Counties (Districts 5, 6, and 7) has 36 cities. Completing their required annual audit for the year ending June 30, 2021, was not a high priority for this part of the state. Less than half, 16, were able to have their independent certified public accounting firms complete their audits on or before Dec. 31, 2021. I have identified them with an asterisk. If you live in one of these cities, be sure to give your city council and the finance department an “atta boy.”

Ten cities completed their audits by March 31, 2022. I have identified them with the pound sign. The following 10 cities make up the last third of the zone: Santa Maria (April 6), Arvin (May 13), Bakersfield (May 17), Santa Paula (June 12), Port Hueneme (June 15), Fillmore (Aug. 2), California City (Sept. 20), McFarland (Sept. 30), Shafter (Nov. 28, 2022), and Taft (Oct. 29, 2024).

The city of Taft blames the pandemic, loss of staff members, and an inability to hire replacement staff in a timely manner for their extremely late completion of this critical annual responsibility. Officials say the city is also facing a financial crisis, which it partially blames on two prisons closing and the state’s “extreme regulations” on the oil and gas industry.

Most cities have websites that provide their annual comprehensive financial reports (ACFRs), including the annual audit. The city of Atascadero is not user-friendly, but former Mayor Heather Moreno provided me with a good link. She is now serving as the Fifth District county supervisor for San Luis Obispo.

Now that all the reports have been published for 2021, let’s take each city’s unrestricted net position for governmental activities, divide it by its population, and come up with a per capita dollar amount. With this simple metric, we can rank these 36 cities from the strongest balance sheet to the weakest. The graph providing the long-awaited results is provided below.

While most of the cities stayed in place, two cities moved up four or more positions, and four cities dropped four or more positions. What happened that improves cities or has them sliding in the wrong direction?

The city of Goleta reflected revenues in excess of expenditures on its Statement of Activities of $13.6 million, explaining 90 percent of the growth in its unrestricted net position. The city increased its liabilities by $9.9 million from the financing lease related to the purchase of its city hall building during the prior fiscal year, and it was reflected in the cost of land and construction in progress of $9 million. This suburb of neighboring Santa Barbara moved up six positions.

The city of Ojai enjoyed revenues in excess of expenditures of $4.7 million, explaining the improvement to its unrestricted net position, and moving it up four positions.

The cities of Delano, Atascadero, and Guadalupe each dropped four positions. The city of Delano saw its unrestricted net position drop $10.7 million, thanks to expenditures in excess of revenues of $10.6 million. Atascadero dropped by sitting still, watching Ojai, Arvin, and McFarland improve just enough to move ahead of it.

The city of Guadalupe is one of the few that does not provide a page listing all of its ACFRs by year. It only has its June 30, 2021, ACFR available to link to. This city, although enjoying revenues in excess of expenditures, has been slowly increasing the size of its unrestricted net deficit over the last two years. But without providing its 2020 ACFR, the reasons will have to wait until it steps up to the level of neighboring cities when it comes to disclosure.

The city of Paso Robles dropped eight positions. Although it had revenues in excess of expenditures of $12 million, its unrestricted net position dropped by $10.8 million. Increasing restricted assets by $8.7 million explains part of it. Making investments in land and buildings may have also played a part.

The top seven cities maintained their positions, and for the most part, so did the bottom nine cities. The year July 1, 2020, to June 30, 2021, saw the bulk of the state’s pandemic lockdowns. To see most of the cities holding their own is encouraging news.

Now, if things could just get back to normal, perhaps the laggards can get back into the proper discipline and complete their audits within six months.

Taft’s finance director, Teresa Binkley, assured me, “We are still ... working [through] the process with our auditors to get the other fiscal years caught up.” Hang in there, Teresa. We’re rooting for you.