President Donald Trump signed a key piece of cryptocurrency legislation on July 18, establishing the first significant U.S. regulatory framework for stablecoins.

After a rocky beginning to “Crypto Week,” House Republicans successfully passed a trio of key crypto bills, including landmark stablecoin legislation.

The Genius Act—fully named the Guiding and Establishing National Innovation for U.S. Stablecoins Act—passed 308–222 with bipartisan support.

“The Genius Act creates a clear and simple regulatory framework to establish and unleash the immense promise of dollar-backed stablecoins,” Trump said at a White House event.

“This could be perhaps the greatest revolution in financial technology since the birth of the internet.”

Trump had been a vocal supporter of the Genius Act, which establishes a regulatory framework for stablecoins by installing consumer safeguards, reserve requirement ratios, and audit and anti-money laundering standards.

When the Genius Act encountered hurdles in Congress, the president intervened and urged a dozen dissenting GOP lawmakers to move ahead with a key procedural vote to advance the bill to the House floor.

Crypto czar David Sacks, meanwhile, called it a “historical legislative achievement” that will serve as a “monumental step” to ensuring U.S. dominance in the industry.

Sacks also estimated that stablecoins will create trillions of dollars in demand for U.S. Treasury securities, echoing the sentiment expressed by Treasury Secretary Scott Bessent.

Stablecoins are backed by safe and liquid assets, such as the U.S. dollar and government bonds, and hold these assets in reserve for their coins.

In addition to strengthening demand for U.S. Treasury securities, stablecoins will also lower interest rates and secure the dollar’s status as the world’s reserve currency, Trump said.

“This revolution has the potential to supercharge American economic growth and empower billions of people to save and transfer U.S. dollars,” the president said.

Securities and Exchange Commission chief Paul Atkins, who was also in attendance for the signing ceremony, lauded the president and his administration for helping the United States “embrace crypto asset innovation.”

“The SEC will work diligently to consider any changes needed to achieve regulatory clarity,” Atkins said in a statement. “Together we will make America the center of crypto asset innovation and strengthen the financial markets for the benefit of all Americans.”

Finding Clarity and Banning CBDCs

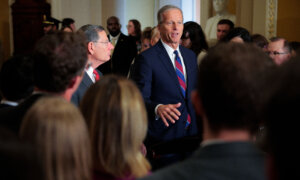

According to House Financial Services Committee Chairman French Hill (R-Ark.), the Genius Act and other bills will bolster American leadership in digital assets.

“President Trump gets to sign into law his first of several bills to come that will help make America an incredible leader globally in digital assets,” Hill said at a press conference on July 17.

All eyes will now be focused on two other bills.

The Digital Asset Market Clarity Act of 2025 was another vital piece of cryptocurrency legislation designed to provide greater clarity for the cryptocurrency sector.

Also known as the Clarity Act, this bill provides a comprehensive market structure that defines digital assets as commodities, securities, or stablecoins. Additionally, it will split oversight between the Commodity Futures Trading Commission and the Securities and Exchange Commission.

The Clarity Act passed 294–134 and will head to the Senate.

The lower chamber also approved the Anti-Central Bank Digital Currency Surveillance State Act in a narrow 219–210 vote.

Chairman of the House Financial Services Committee Rep. French Hill (R-Ark.) presides over a hearing on Capitol Hill in Washington on June 24, 2025. (Madalina Kilroy/The Epoch Times)

This legislation was introduced to prohibit the Federal Reserve from creating a central bank digital currency, or CBDC. It also ensures the Fed is restricted from testing, studying, or developing a digital dollar without authorization from Congress.

It is unclear whether Republicans have enough votes in the Senate to pass the anti-CBDC bill.

“At the Senate, it’s impossible to pass a ban on the CBDC. They don’t have the votes. They can’t get a 60,” Rep. Marjorie Taylor Greene (R-Ga.) told reporters.

But the president is optimistic that the anti-CBDC bill will reach his desk.

“I look forward to signing legislation banning it and make it a permanent law,” he stated.

During the 2024 election campaign, Trump called CBDCs a “dangerous threat to freedom” and vowed to “never allow the creation of a central bank digital currency.”

“Such a currency would give a federal government absolute control over your money. They could take your money, and you wouldn’t even know it was gone,” Trump said in January 2024.

Ultimately, these three bills will allow the United States to remain at the forefront of crypto, says Rep. Brian Steil (R-Wisc.).

“The Clarity Act, along with Genius and Anti-CBDC, gives us those regulatory rules of the road that are necessary for us to unlock this new watershed victory for America, so that we can capture the kind of innovation and consumer protection, and investment that all of my colleagues have been talking about,” Steil told reporters.

Despite Congress passing the three crypto bills, bitcoin prices struggled to sustain their momentum at the end of the trading week.

Bitcoin, which controls the majority of the global cryptocurrency market, fell by approximately 1 percent to around $118,000. It recently reached an all-time high of $123,615.