WASHINGTON—The Senate on Dec. 11 rejected a pair of competing health care measures aimed at addressing expiring Affordable Care Act subsidies.

Both procedural votes ran largely along party lines, with neither proposal gaining the 60 votes needed to advance in the chamber.

The GOP plan, pitched as an alternative to the expiring subsidies, failed to advance in a 51–48 vote. Sen. Rand Paul (R-Ky.) was the lone Republican who voted against the measure.

Following the Senate votes, White House press secretary Karoline Leavitt said President Donald Trump would make an announcement concerning health care soon.

“The President is prepared to take action on health care, and he wants Republicans on the Hill to do the same,” Leavitt said.

The Democratic plan to extend the expiring subsidies for three years was similarly rejected in a 51–48 vote. Four Republicans—Sens. Susan Collins (R-Maine), Lisa Murkowski (R-Alaska), Dan Sullivan (R-Alaska), and Josh Hawley (R-Mo.)—voted for the Democratic bill.

The subsidies, officially known as enhanced premium tax credits, were created as a temporary measure in 2021 to blunt the economic impact of the COVID-19 pandemic national health emergency. They have been in place for five years.

Republicans proposed a plan to replace the enhanced subsidies with a cash payment to eligible enrollees, to be placed in a Health Savings Account. The original Affordable Care Act subsidies, distinct from the enhanced subsidies, would remain in place.

Democrats, fearing that allowing the subsidies to expire now would cause financial hardship and cause millions of Americans to drop their health coverage, have proposed another three-year extension.

Republicans, saying that the billions of dollars spent on these additional subsidies have contributed to rapidly rising insurance premiums and have given rise to opportunities for fraud, oppose an extension that does not address those issues.

Enhanced Subsidies

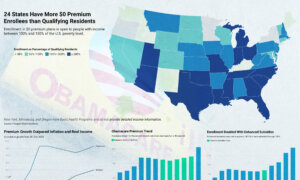

The enhanced subsidies enacted in 2021 expanded eligibility for the Affordable Care Act—former President Barack Obama’s health care law, known as Obamacare—offering subsidies for wage earners well into the middle class.

The original Obamacare subsidies are open to people making between 100 percent and 400 percent of the federal poverty level. That equates to a household income of between $32,150 and $128,600 for a family of four.

The enhanced subsidies increased the amount of the subsidies, removed the income limit, and capped out-of-pocket premium payments at 8.5 percent of household income. Some low-income enrollees are eligible for plans with no premium payment under the coverage expansion.

Obamacare enrollment more than doubled after the enhanced subsidies were introduced.

The Road Ahead

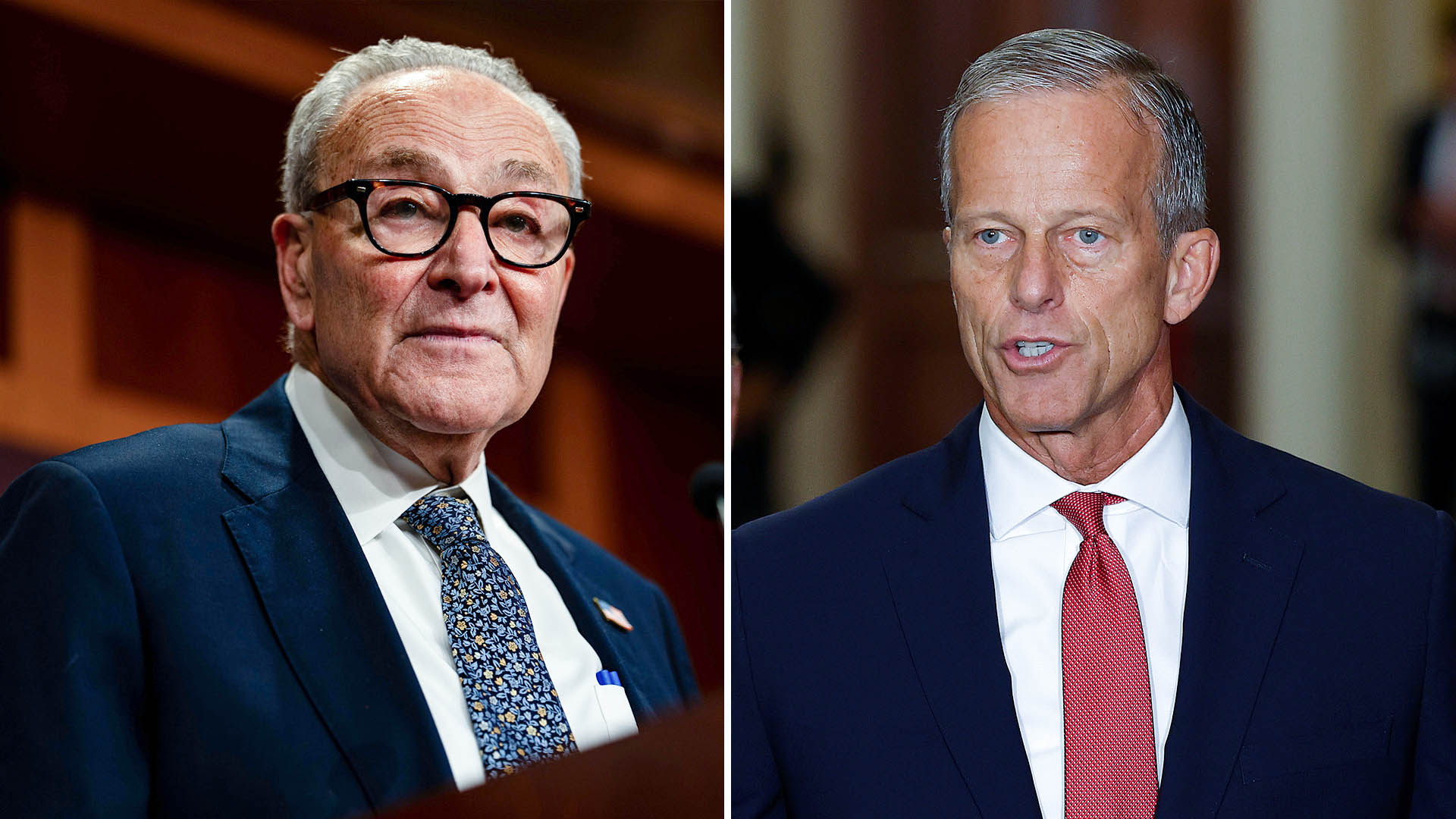

After the votes, Senate Majority Leader Chuck Schumer (D-N.Y.) said the failure of the Democratic proposal virtually ensures the enhanced subsidies will expire at the end of the month.

He predicted that many people would suffer the loss of health coverage and that Republicans would bear the responsibility.

“We put real legislation on the floor to ensure these tax credits do not expire, and Republicans blocked it, not once, not twice, but 13 times,” Schumer said, referring to a series of failed attempts to extend the enhanced subsidies.

Sen. John Kennedy (R-La.) told reporters that a budget reconciliation bill, which requires a simple majority vote in the Senate rather than the 60 votes usually needed to end debate, might be the only way for Republicans to pass health care reform.

Some senators were more optimistic about reaching a compromise.

Sen. Gary Peters (D-Mich.) said he believed the parties shared some common ground, but said extending the enhanced tax credits would get “exponentially more difficult” as the year winds down.

Sen. Mike Rounds (R-S.D.) said both parties would begin talking about their points of agreement and try to find common ground.

“Negotiations will start based upon the two positions we’ve got right now,” Rounds said.

Bipartisan Plans

The latest compromise proposal has been put forward by Rep. Brian Fitzpatrick (R-Pa.), joined by a bipartisan group of House members.

Fitzpatrick introduced a discharge petition that, if successful, could force the House to vote on his proposal. A discharge petition requires support from 218 House members.

The Fitzpatrick plan would extend the enhanced premium tax credits through 2027 to insulate consumers from sudden rate increases. It includes some measures to check fraud by unscrupulous insurance brokers and rein in some practices of pharmacy benefit managers, the middlemen in the prescription drug supply chain.

The measure has the support of several moderate House members, including Reps. Jared Golden (D-Maine), Michael Lawler (R-N.Y.), Don Bacon (R-Neb.), Thomas Suozzi (D-N.Y.), and Robert Bresnahan (R-Pa.).

The subsidies have taken on a sense of urgency as the Jan. 1 premium increases draw nearer.

“This is personal to a lot of us because these are our friends and our neighbors that are losing sleep over this,” Fitzpatrick said.

Sen. Thom Tillis (R-N.C.) applauded the effort, saying that it seemed similar to a three-year ramp-down of the subsidies that he suggested.

Tillis told The Epoch Times on Dec. 10 that any measure would need roughly equal support from both parties because hardliners on both sides would be likely to reject a compromise.

Reps. Jen Kiggans (R-Va.) and Josh Gottheimer (D-N.J.) introduced bipartisan legislation supported by 35 members that would extend the enhanced subsidies for one year with modifications to prevent fraud. It would also extend the open enrollment period and reform pharmacy benefit manager practices. The group calls for more comprehensive health care reform within one year.

Gottheimer began a discharge petition to compel a vote on this legislation as well.

When asked whether Senate Democrats would consider either proposal, Schumer said, “I’m not going to prejudge what the House does. Let’s see if they can pass anything.”