Commentary

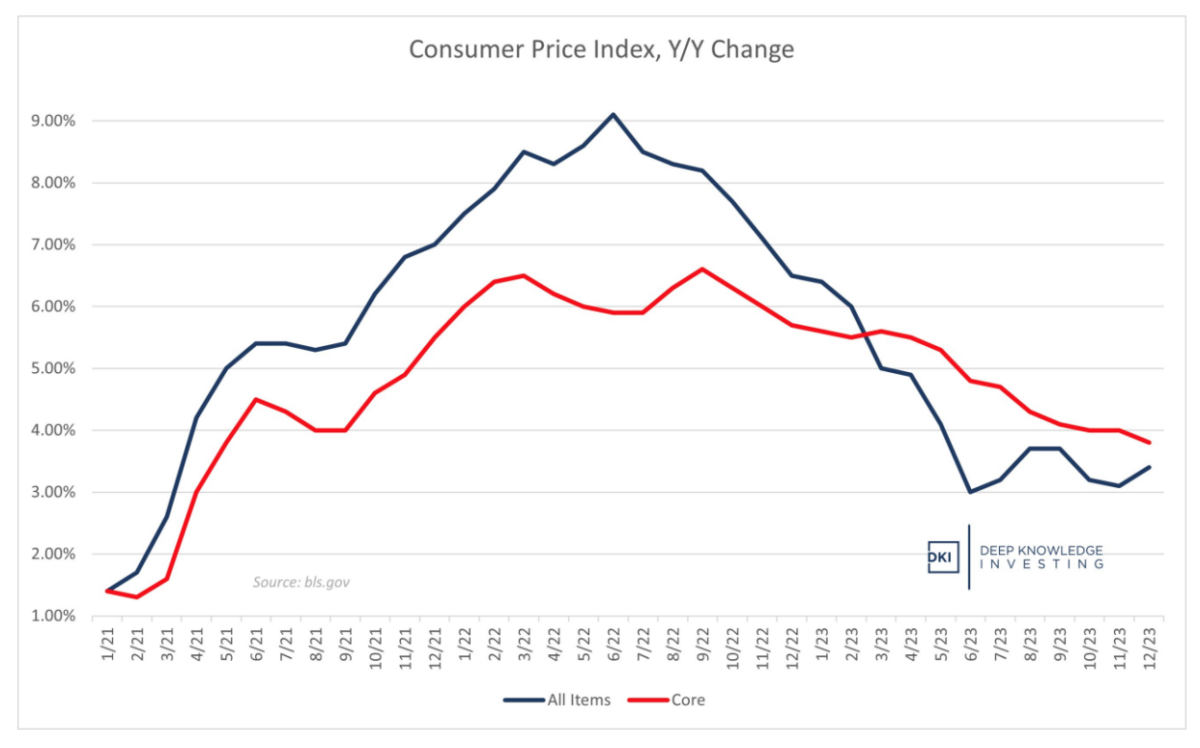

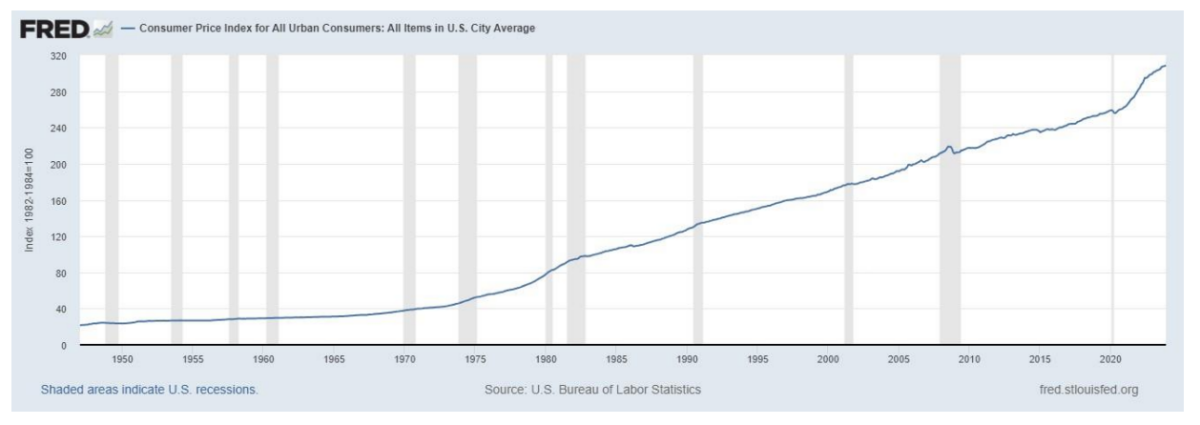

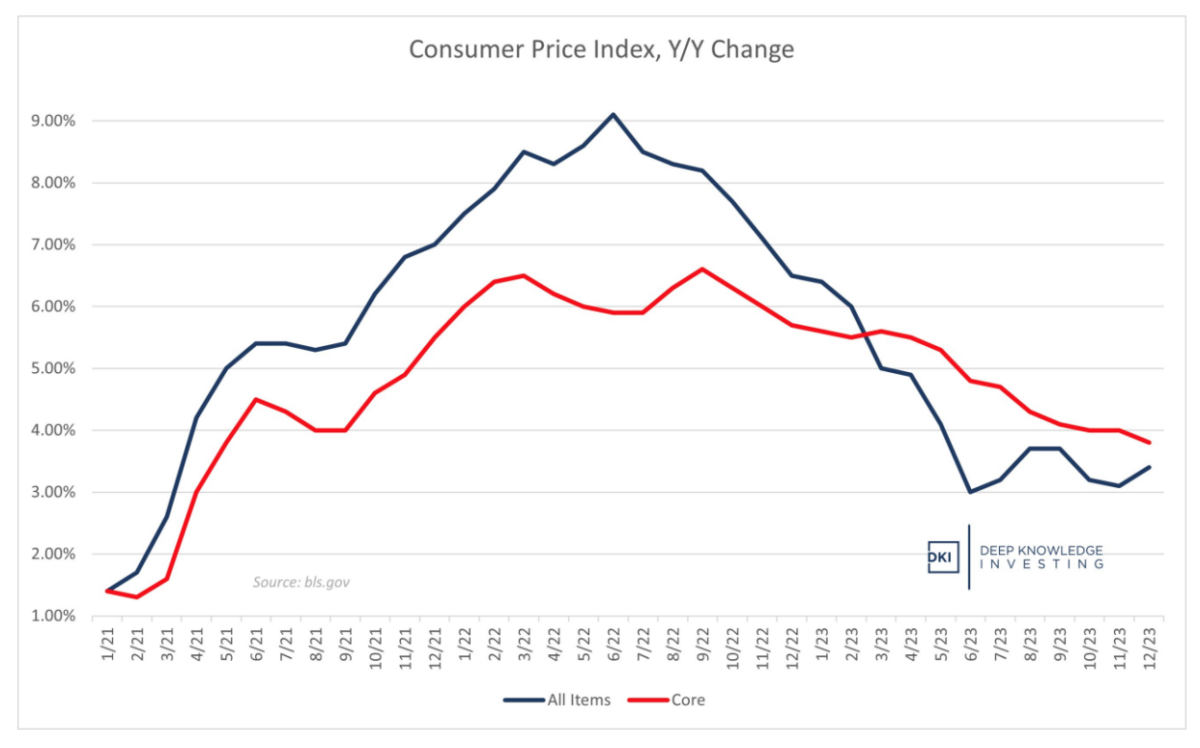

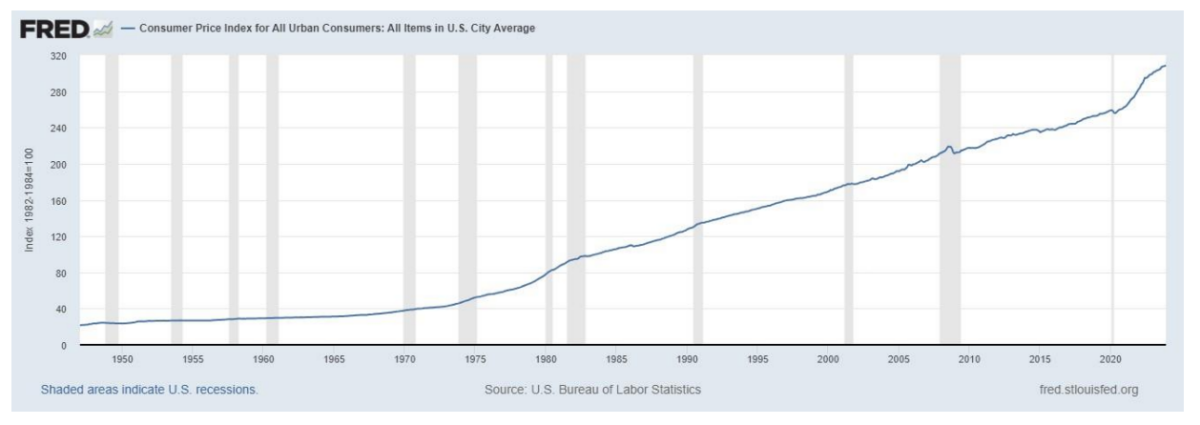

The December 2023 consumer price index (CPI) report shows an overall increase of 3.4 percent unadjusted over the past year and an increase of 0.3 percent from November 2023. This was above expectations of 3.2 percent for the year and above expectations of 0.2 percent for the month.

The core CPI, which excludes food and energy, was up by 3.9 percent for the year and up by 0.3 percent for the month. The annual number was above expectations of 3.8 percent, and the monthly increase was in line with expectations. The difference is due to rounding. The annual number is still almost double the Federal Reserve’s 2 percent target.

Let’s go through the details:

The CPI is ticking back up. The core is declining but still sticky.

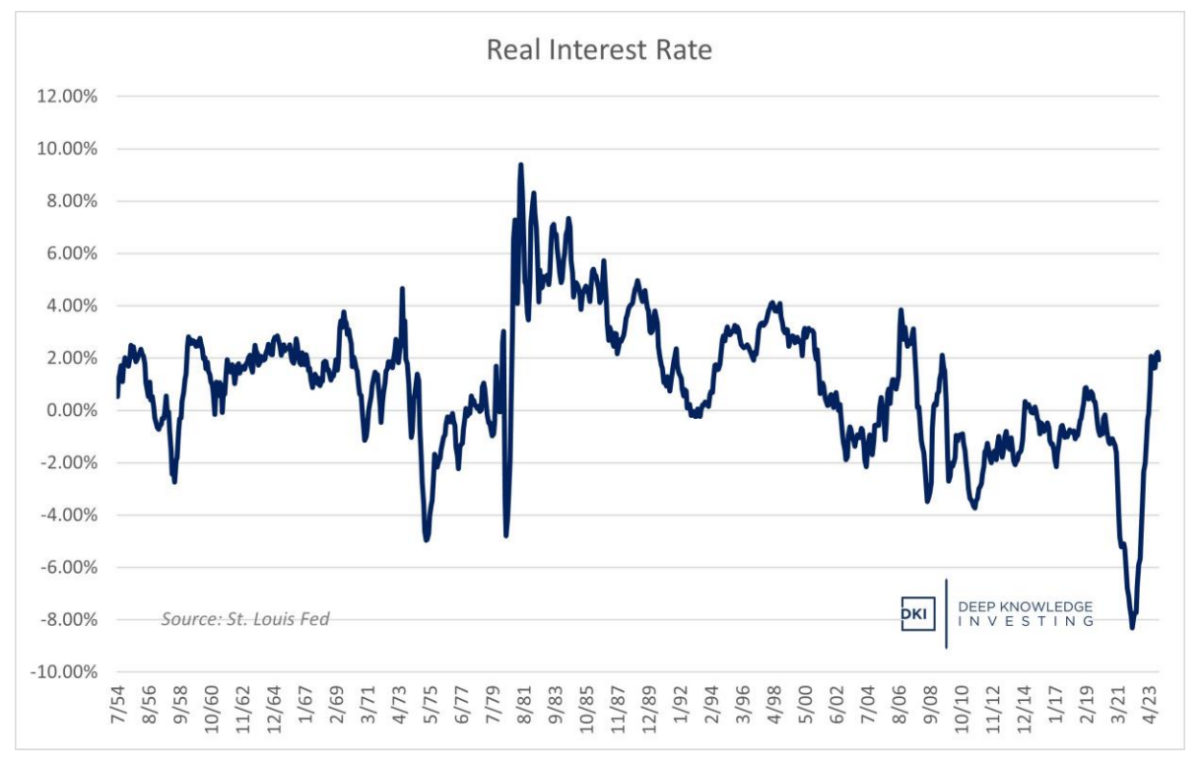

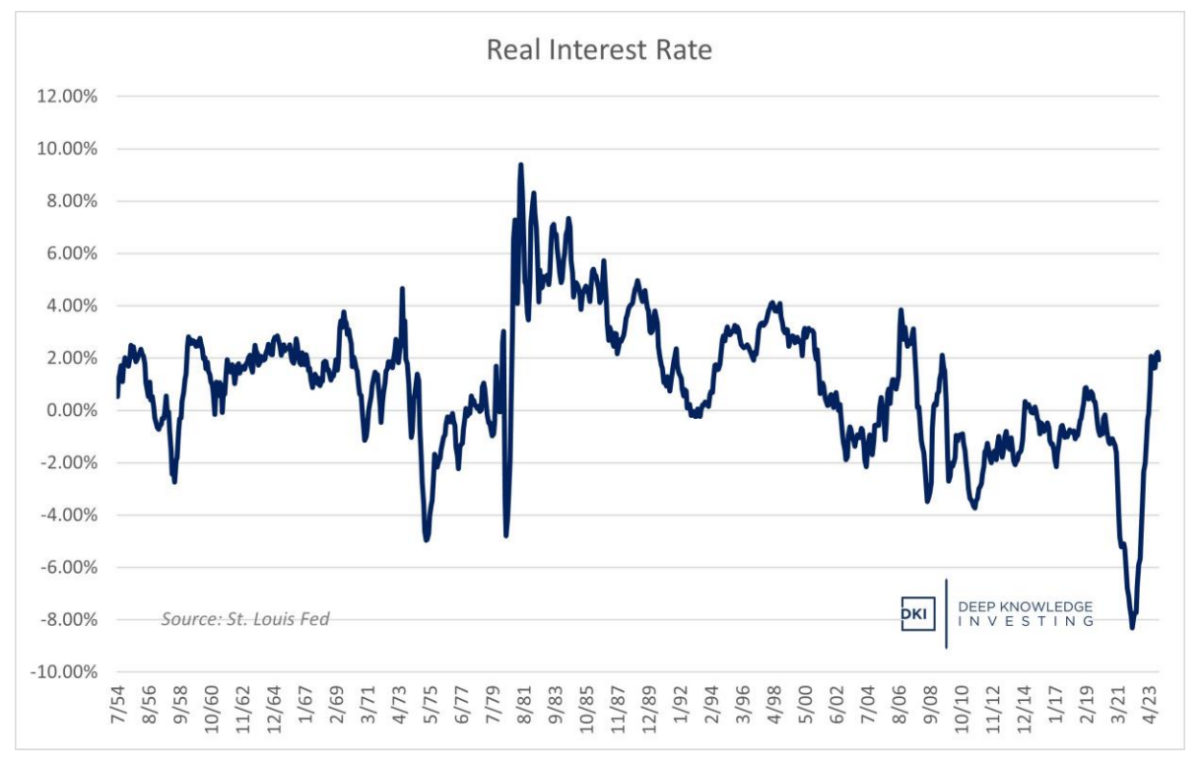

We’re back below 2 percent for the real interest rate.

Food

Food inflation came in at 2.7 percent. Food at home was up by 1.3 percent. These are both declines from recent months, and I continue to insist that anyone who believes these numbers hasn’t been inside a grocery store in years. Food away from home was up by 5.2 percent. That’s not great. I write this every month, but I continue to be skeptical of this part of the CPI and have been for the past two years. It seems understated to me.

My grocery bills are up more than 3 percent from last year, and many of the restaurants near me charge higher prices than you see on the menus because it’s too expensive to keep updating constantly. Every single person I talk to who does the grocery shopping for their household is telling me the same thing. Most of them think their food bills are up by more than 20 percent in the past year. The reason I often talk about this is because the Bureau of Labor Statistics keeps printing the same nonsense.

Energy

Energy continues to be the primary reason the CPI has come down so much this year. It’s not that energy prices are cheap; but rather, that those prices are being compared with last year’s spikes. Energy prices are also down on fears of a coming recession in multiple parts of the world. Total energy prices were down 2.0 percent with gasoline down 1.9 percent and fuel oil down 14.7 percent. These decreases are large, and still substantially less than what we saw last month.

The White House has gotten away with its political strategy of draining the Strategic Petroleum Reserve (SPR) for the second straight year. Russia and Saudi Arabia have continued their large production cuts. Between encouraging more production in Iran and Venezuela, and reduced demand for gasoline, energy prices have remained lower than many expected. Stock market bears are saying that’s because we’re entering a recession. Others point out that with work-from-home continuing for many workers (for at least a few days a week), Americans are commuting less leading to lower demand for gasoline. Either or both are possibilities, and there’s credible talk that the White House will get more serious about starting to refill the SPR. I think that would be the right move.

Vehicles

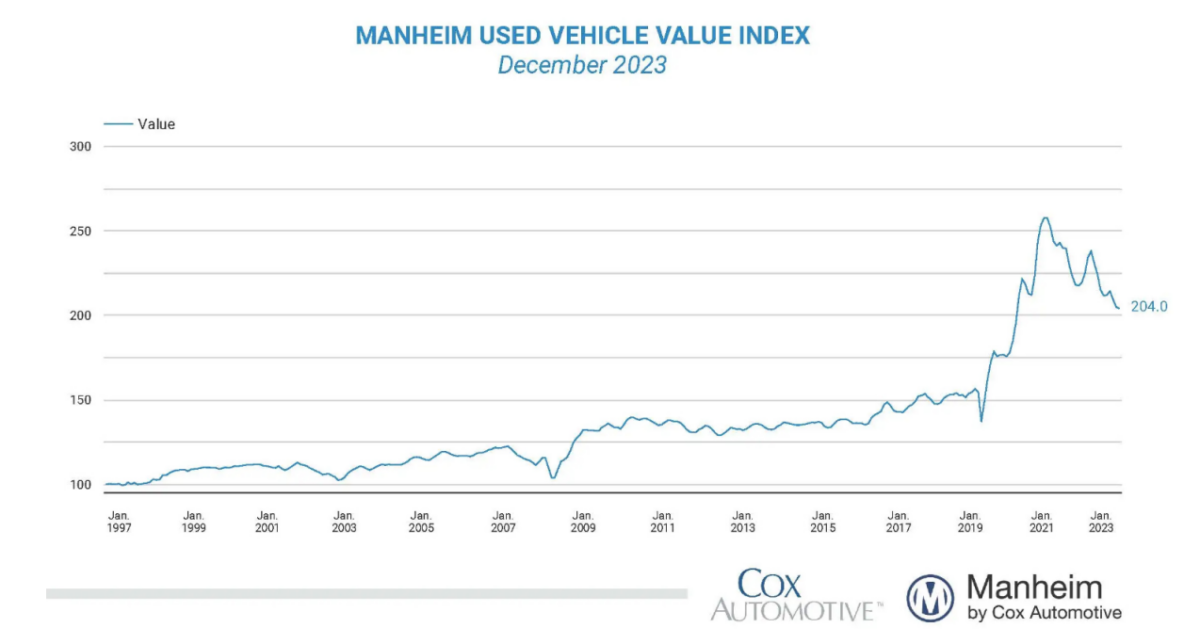

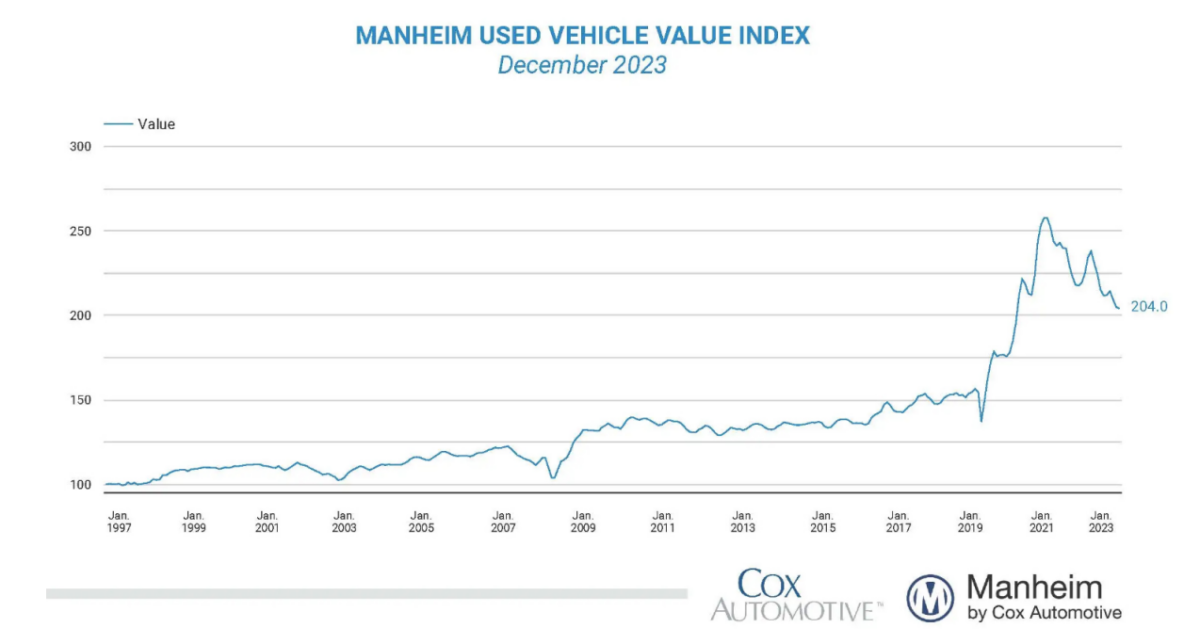

New vehicle pricing was up 1.0 percent and used vehicle pricing was down 1.3 percent. These have been volatile categories. I’d also note that the decrease in used car pricing is off of a huge increase. I’m surprised by these numbers. The Manheim Used Vehicle Index is down 7.0 percent from a year ago, and I’m reading reports of dealerships loaded with inventory. This discrepancy could be due to delays in reporting and/or to different data collection methodologies.

I’m still reading reports of skyrocketing numbers of auto loans going delinquent which will lead to more supply of used cars and lower prices in the future. The now-common $1,000 monthly auto payments aren’t an option for most. There’s clear improvement in pricing for now, but prices are still well above the pre-pandemic levels:

Still expensive and still improving.

Services

Services prices were up 5.3 percent—slightly below last month, and still very high. This category is an issue for the Fed, because much of the increase is caused by higher wages. Labor is still in demand. Unemployment remains 3.7 percent, and there are still millions of unfilled jobs. The Fed is actively trying to restrict wage growth and raise the unemployment rate to take pressure off of this part of the CPI.

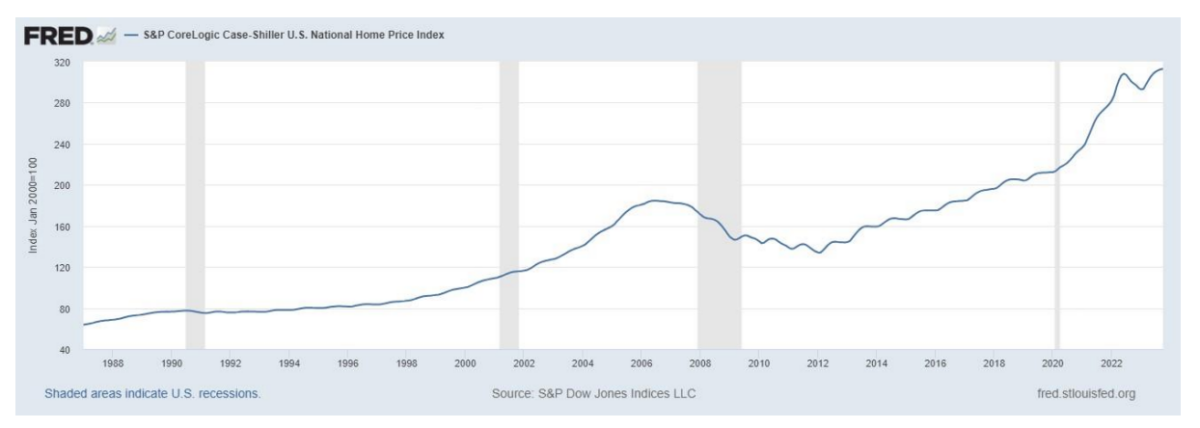

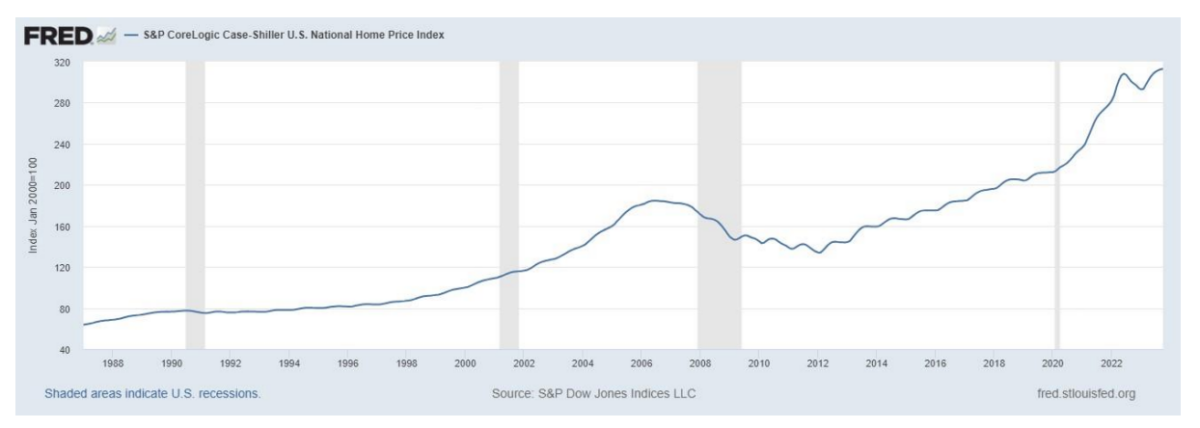

Shelter (a fancy word for housing) costs were up 6.2 percent and represents the largest category of the CPI. Much of today’s CPI increase is due to this category alone. Housing has remained strong as people are reluctant to sell their homes and move when higher mortgage rates mean a new smaller home might have higher monthly payments. This has kept supply off the market and prices high.

Mortgage rates have declined off the peak, but not enough to encourage meaningful increases in supply. I add the obvious caveat that the decision to market a house and the sale process takes months so it will be a while before we see the impact of lower mortgage rates.

This data is reported on a multi-month lag, and housing hasn’t gotten more affordable since the last update despite/because of lower mortgage rates.

Analysis

The market now thinks we’re at the Fed “pivot,” or at least the “pause.” The common belief is we’re at the high end of Fed rate hikes for this cycle, and the next move will be a rate reduction. Despite this week’s higher than expected CPI, I agree with this conclusion. We’ll see a lot of volatility in energy prices given the current geopolitical environment. We’ll see higher goods prices due to massive increases in shipping costs also due to the current geopolitical environment. Housing prices have stayed high despite both higher and lower mortgage rates. And auto prices should continue to fall in the near-term.

The CPI is increasing at a faster rate, and most consumers are experiencing higher prices. The Core is still sticky.

Energy prices have been volatile all year, and the multi-month decrease could be normal fluctuation or a sign of an imminent recession. If there’s a recession, that’s not going to be a positive for stock prices. If there’s a pickup in economic activity, we’ll likely see fuel prices rise again.

Conclusion

The Fed is succeeding in reducing the rate of increase in the CPI, but the big services inflation number remains elevated. We’ll see an increase in energy prices and shipping costs. Wages remain high. Long term, Congressional overspending and monetization of that new debt will lead to a second round of inflation and future Fed rate hikes. For now, expectations of a rate cut will be pushed back, but I do not expect the Fed to hike again in the coming months.

This article was originally published on Deep Knowledge Investing on Jan. 11, 2024.