Commentary

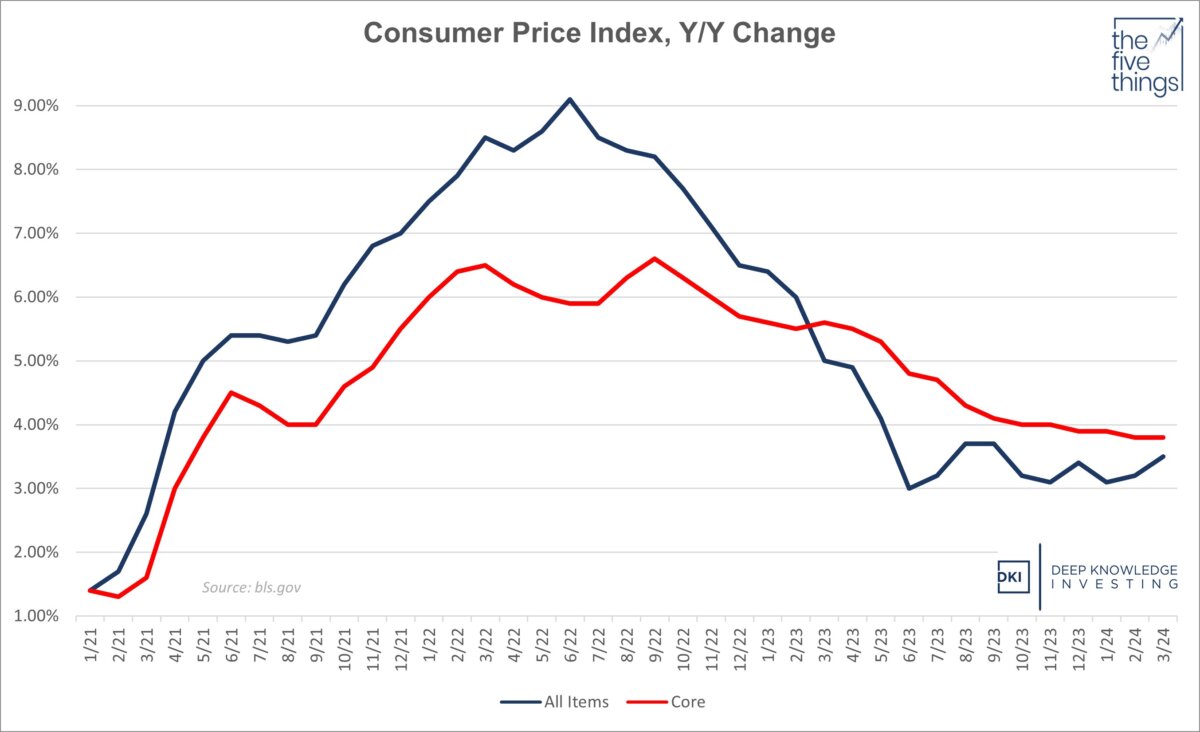

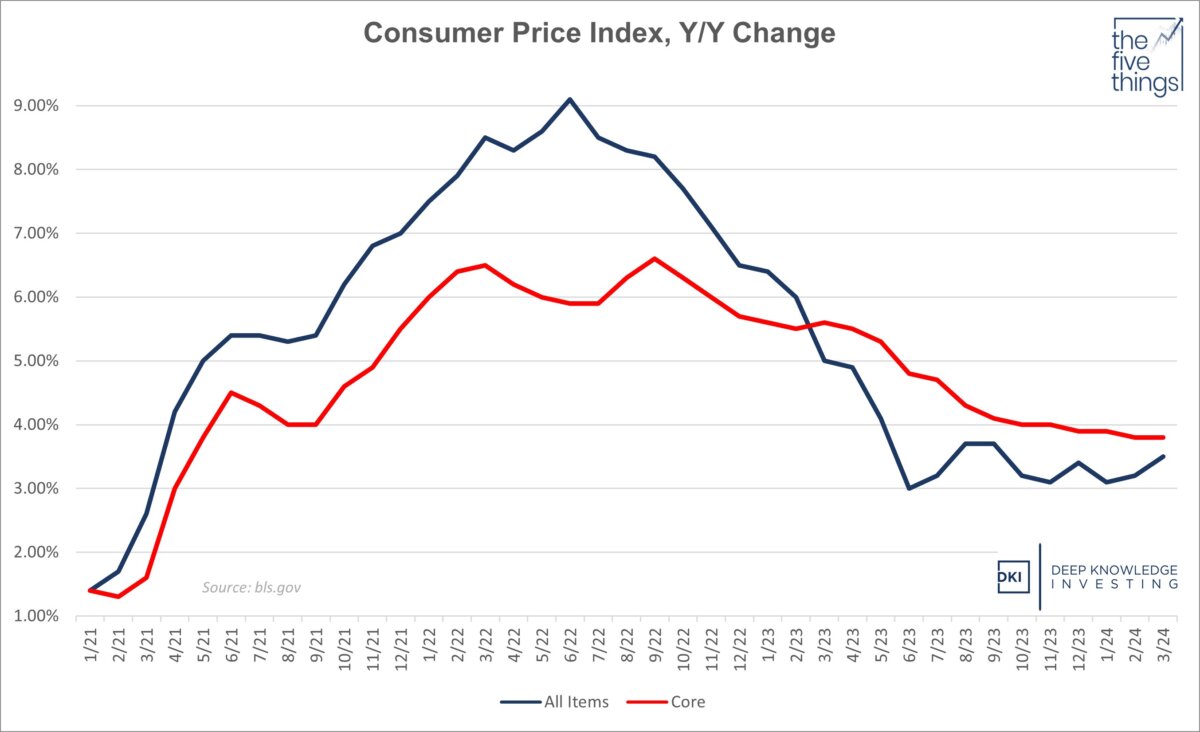

This week, we got the March Consumer Price Index (CPI) report which showed an overall increase of 3.5 percent unadjusted in the last year and 0.4 percent vs last month. That’s above last month’s 3.2 percent and expectations of 3.4 percent. The 0.4 percent monthly increase annualizes to 4.9 percent. The Core CPI which excludes food and energy was up 3.8 percent for the last year and up 0.4 percent from last month.

The annual number was above expectations of 3.7 percent, and flat vs last month. The annual number is still almost double the Fed’s 2.0 percent target. Let’s go through the details:

This is not the disinflation story many have been celebrating in recent months.

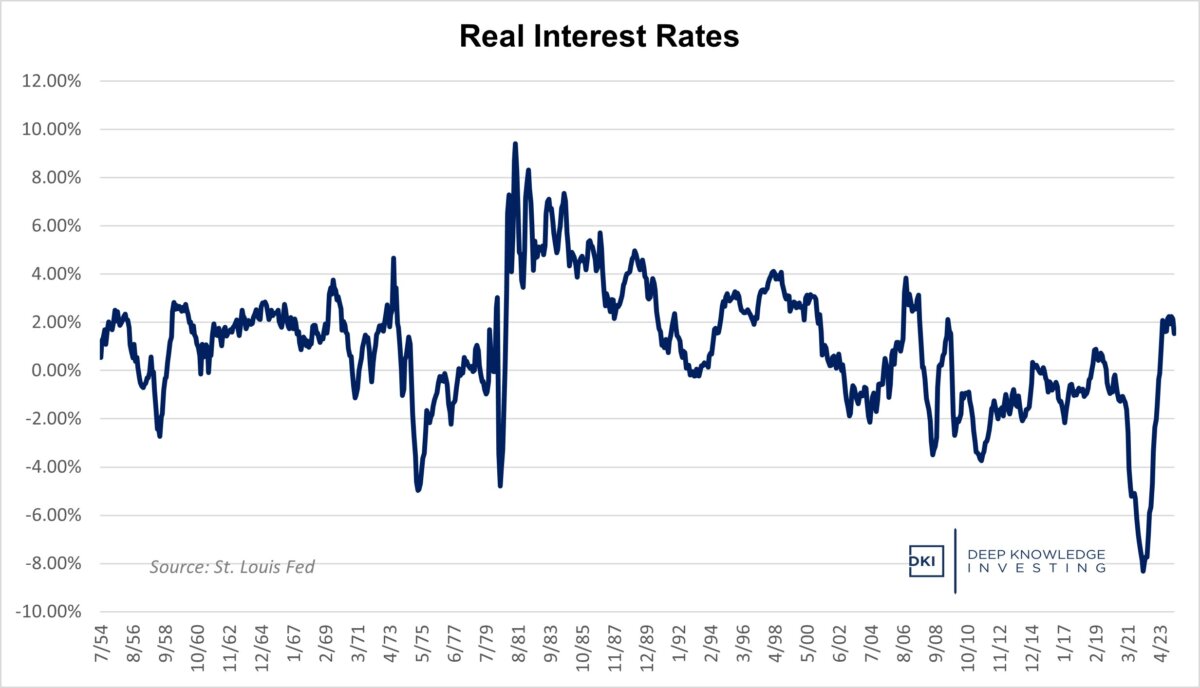

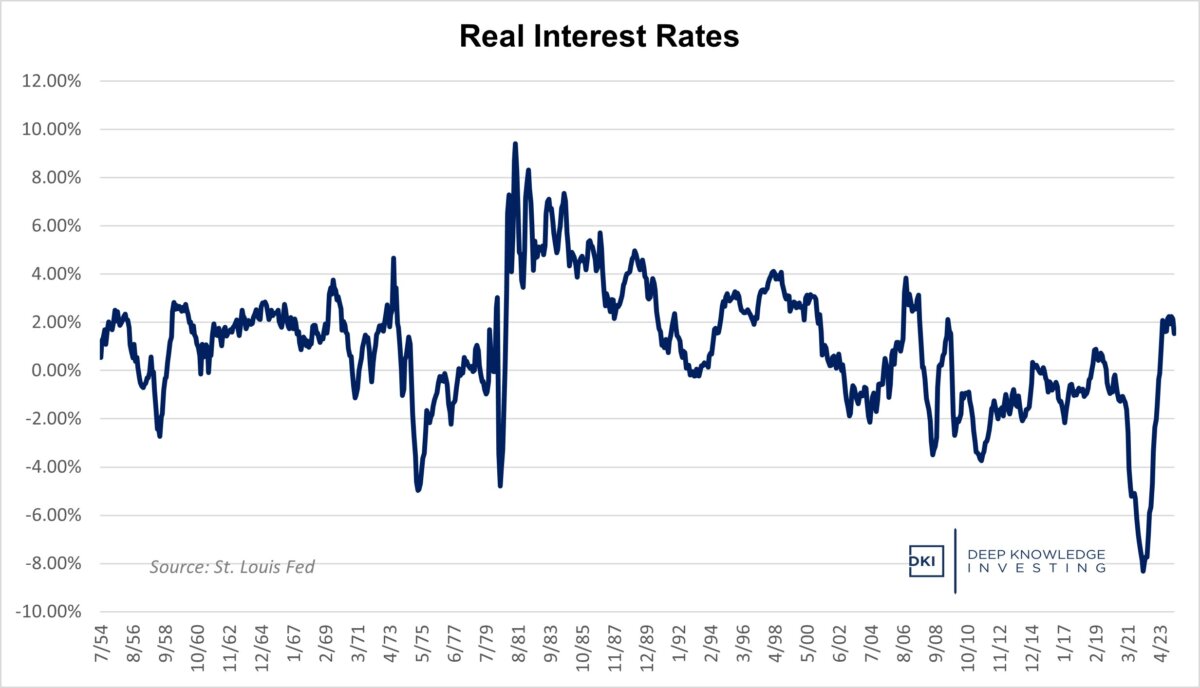

I don’t think current Fed policy is as restrictive as some believe. The real rate is back below 2 percent.

Food

Food inflation came in at 2.2 percent which was a significant decrease from last month’s 3.2 percent. Food at home was up 1.2 percent which was below last month’s 2.2 percent. I continue to insist that anyone who believes that food inflation is only 2 percent hasn’t been inside a grocery store in years. Food away from home is now up 4.2 percent which is slightly better than last month’s 4.5 percent. Anyone who’s seen the recent posts about bills of more than $20 for a burger, fries, and soft drink at fast food places won’t believe this number either. I continue to be skeptical of this part of the CPI, and have been for the past two years. It seems understated to me.

Last weekend, I saw some interesting analysis on Twitter/X where someone tracked the price of the 50 most commonly-bought items at supermarkets. They determined that this basket of items was up 8 percent annually for the past three years. I believe this number is much closer to the truth than the CPI. It explains why so many people are angry about inflation and refuse to celebrate the great economy narrative being pushed by many in the media. When your grocery bill is up almost 30 percent in three years, that’s going to create stress for most households.

The reason I keep repeating the same language about understated food inflation is because the Bureau of Labor Statistics keeps printing the same nonsense.

Energy

Energy has been the reason the CPI has come down so much in recent months (disinflation not deflation). That trend was never going to be sustainable especially given the desire of many western governments to limit hydrocarbon production. Energy prices have now reversed and are rising again. Geopolitical conflict combined with extended production cuts by Saudi Arabia and Russia have contributed to this trend. Total energy prices were up 2.1 percent with gasoline up 1.3 percent and fuel oil down 3.7 percent. These items had seen big decreases moderate to small decreases in recent months. Partly due to the production cuts referenced above, we’ve gone from energy being a tailwind for a lower CPI to a shift to a headwind.

In previous editions of this report, we’ve highlighted the White House strategy of draining the Strategic Petroleum Reserve (SPR) to get fuel prices down ahead of elections. With a contentious Presidential election on the way and a White House desperate to convince Americans the economy is in good shape, Deep Knowledge Investing (DKI) doesn’t expect any meaningful replenishment of the SPR.

Offsetting some of the new trend towards higher energy prices has been the success of the work from home/anywhere movement. Many workers are resisting the call to return to the office five days a week and are reducing commuter miles. This is also pressuring commercial real estate, and the banks that lend to commercial property owners, a trend DKI has been highlighting in recent editions of the weekly 5 Things to Know in Investing.

DKI hosted a webinar earlier this year with energy expert, Tracy Shuchart @chigrl, to discuss oil and gas, uranium, and geopolitics. For those of you who want to understand this important part of the economy better, please feel free to check out the full video here (not paywalled).

Vehicles

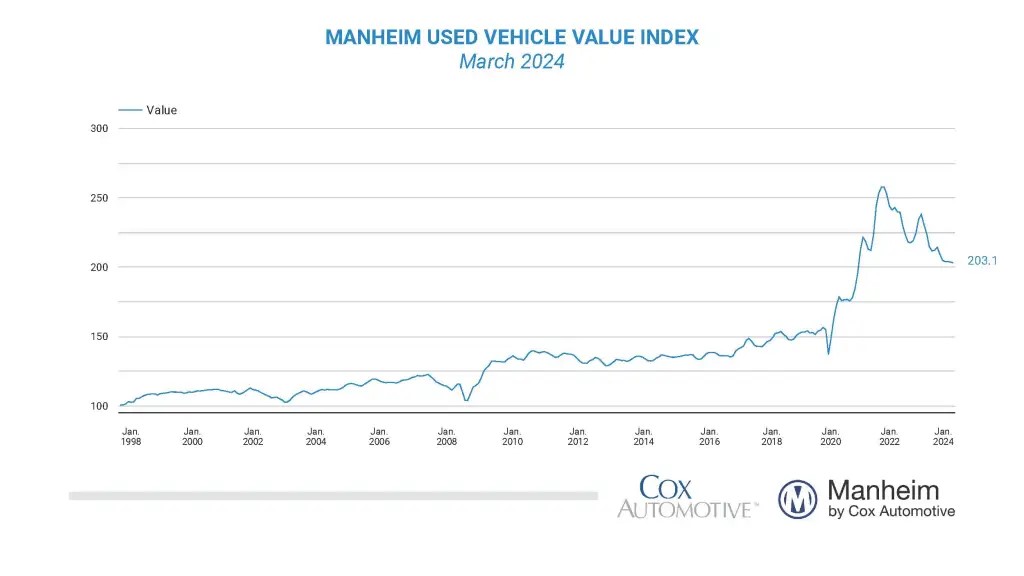

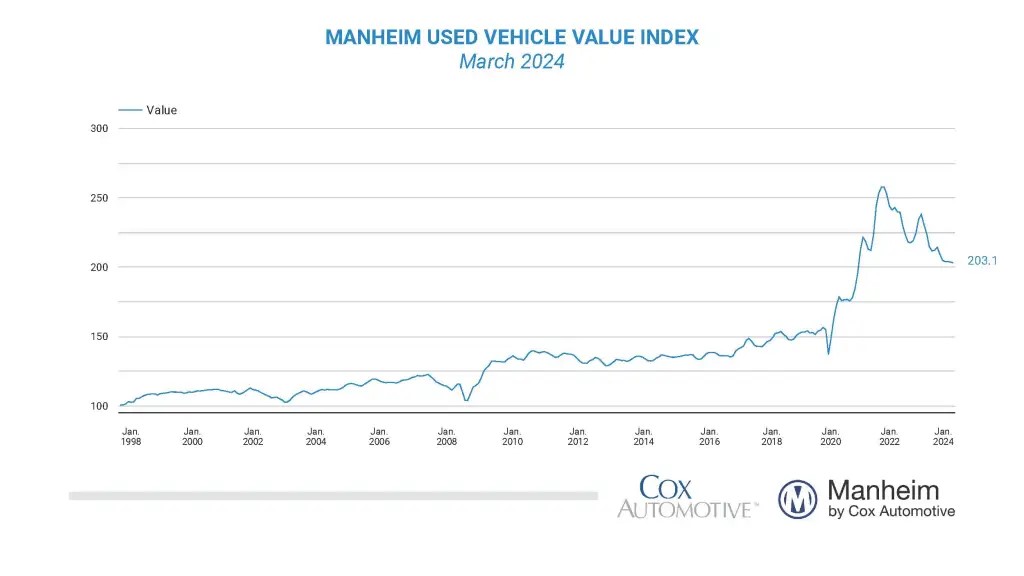

New vehicle pricing was down 0.1 percent and used vehicle pricing was down 2.2 percent. These have been volatile categories. We’d also note that the decrease in used car pricing is off of a huge increase.

Still, if you look at the chart below, you can see that about half of the COVID-related spike in used car prices has disappeared. Pricing is slowly returning towards the “normal” trend. It will be interesting to see the effect of more manufacturers slowing the emphasis on money-losing electric vehicles and returning their focus on profitable internal combustion cars and trucks.

We’re seeing continued reports of used vehicle loans going delinquent. New car pricing is still high enough that $1,000 per month auto payments are far too common for stretched consumers. It’s likely that this part of the CPI will continue to decline in upcoming months.

As you can see, used vehicles are still expensive but have had meaningful and continued improvement.

Services

Services prices were up 5.4 percent increasing from last month’s already-high 5.2 percent. This is an area where the Fed is struggling to bring down inflation. This is partly because much of the increase is caused by higher wages. The labor picture is difficult to analyze right now because the data being provided is inaccurate. Wages are up and the jobs reports show increases in employment.

However, all of the new jobs are part-time and almost all job growth is coming from government and health care which is largely funded by government. That’s telling you the public market is throwing money into the economy while private businesses aren’t doing as well. Finally, these figures are constantly revised downwards. We keep seeing positive initial reports while the historical numbers get adjusted by so much that the current month “beat” isn’t enough to show actual growth.

There are credible reports as well that the recent jobs reports have overstated employment by almost 1 million jobs. The headline numbers distort (or misrepresent) reality which is going to create a problem for the Federal Reserve. They will remain “data driven”, but what will that mean when the “data” is showing a better economy and better employment numbers than Americans are experiencing?

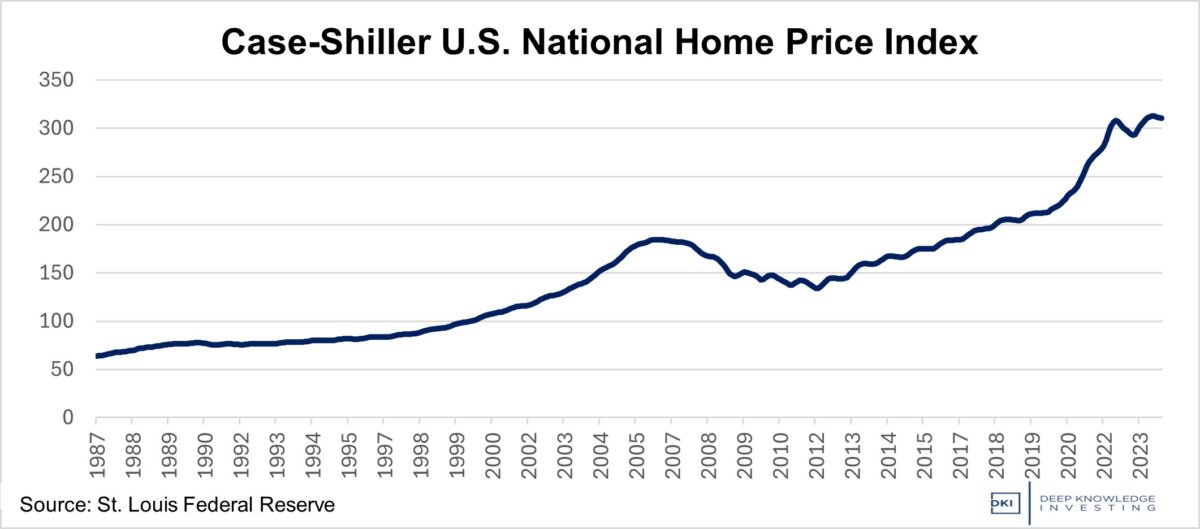

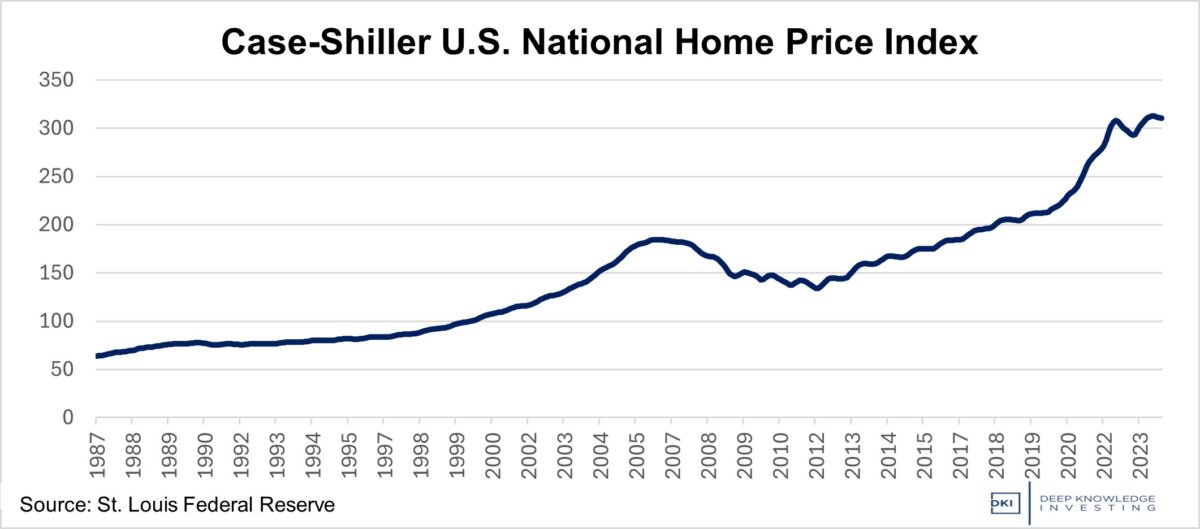

Shelter (a fancy word for housing) costs were up 5.7 percent and represents the largest category of the CPI. Much of the CPI increase is due to this category alone. Housing has remained strong as people are reluctant to sell their homes and move when higher mortgage rates mean a new smaller home might have higher monthly payments. This has kept supply off of the market and prices high.

Mortgage rates have declined off the peak, but not enough to encourage meaningful increases in supply. In the past, I’ve added the obvious caveat that the decision to market a house and the sale process takes months so it will be a while before we see the impact of lower mortgage rates. While true, the housing market has remained expensive much longer than most people expected (including me).

Technically down from the high, but not a cause for celebration. Housing is around all-time highs despite/because of lower mortgage rates.

Analysis

In the fourth quarter of 2023, the market expected six rate cuts for a total of 1.5 percent with the first cut coming in January or March. DKI disagreed strongly and said we’d get fewer cuts coming much later. In recent weeks, market expectations had been reduced from six cuts to three (.75 percent) with a 50/50 probability of the first cut coming in June. Again, DKI said those predictions were too optimistic. Within minutes of Wednesday’s higher-than-expected CPI report, the market erased predictions for the first rate cut coming in June and pushed that back to September.

While Fed Chairman, Jerome Powell, has on occasion indicated a willingness to consider cutting rates before inflation comes down to 2 percent, other Fed Governors have been more hawkish and talked openly about not cutting the fed funds rate at all this year. Barring a massive market crash, bank failures, or economic downturn in the next few weeks, it’s now clear to everyone that there will be no rate cut at the June meeting.

For those of you who are inclined towards political analysis, we remind you that changes in the fed funds rate act on a lag. That means that a potential September cut won’t be soon enough for the stimulative effect to be felt in the economy before the November election. The White House was hoping for help from the Fed. Instead, they’re going to get that help from a Congress that stimulates the economy through overspending and a Treasury Department that’s monetizing that extra debt. As has been the case for years, we’re all going to be paying for our “stimmies,” government benefits, and other programs through future inflation. Mr. Powell knows this even though he’s an experienced enough political operator to avoid saying so in public.

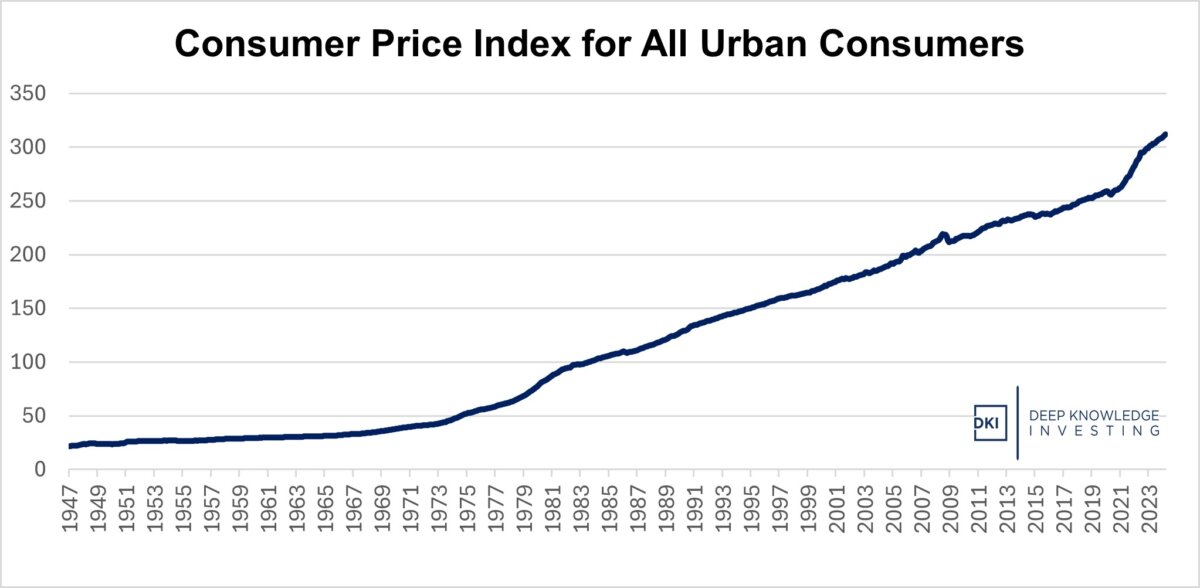

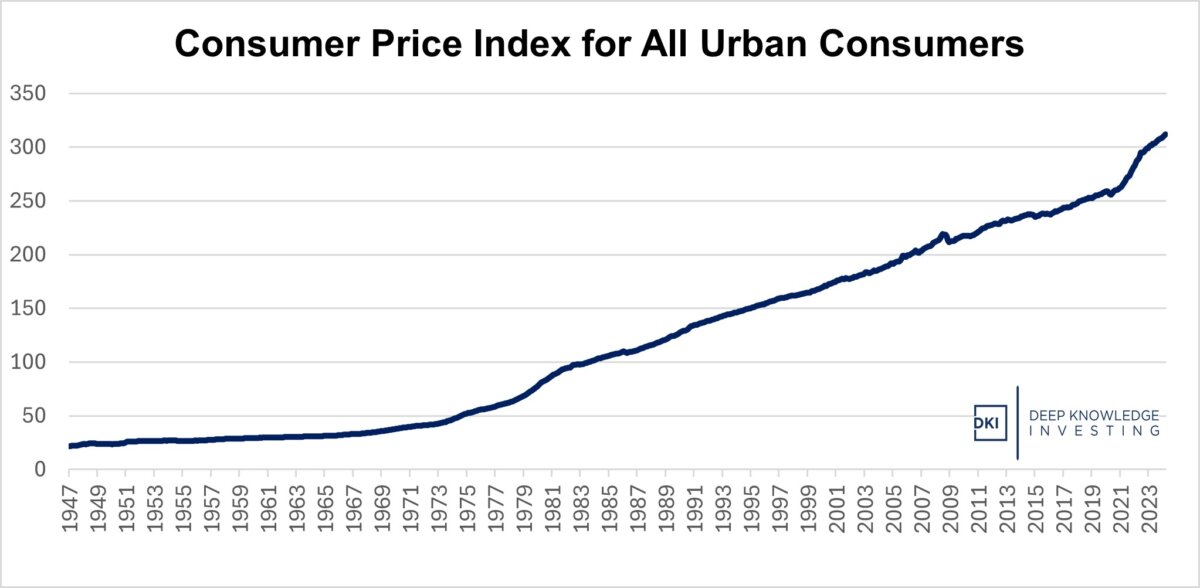

Washington has tried to get people focused on disinflation (a reduction in the rate of inflation). This chart is why most Americans are experiencing more financial distress.

Conclusion

The Fed had been succeeding in lowering the rate of inflation, but 0.4 percent for the month annualizes to almost 5 percent. That’s not great and means it’s almost certain the Fed won’t reduce the fed funds rate at the next meeting. DKI has been saying for more than a year that Congressional overspending and monetization of that new debt will lead to a second round of inflation and future Fed rate hikes. Expectations of a rate cut have been pushed back to September based on recent high inflation data. We’ll see “higher for longer” unless Mr. Powell decides to panic and follow the lead of former Chairman Arthur Burns, who authored the high inflation of the 1970s by reducing the fed funds rate too early.

One other point of interest: At the market open Wednesday morning, Bitcoin, gold, and silver were all trading down after their recent huge increases in price. I believe the reason for the reduction in price is the market is starting to understand the Fed isn’t going to cut interest rates soon. Higher yields on the U.S. dollar makes it more attractive relative to zero yield instruments like Bitcoin or precious metals.

DKI notes that this is true in the short-term. However, if the reason for higher rates is high inflation/currency debasement, then that makes the long-term prospects for alternatives like Bitcoin, gold, and silver much better. If the dollar loses purchasing power each year, and harder currency alternatives maintain purchasing power, then the dollar price of those alternatives will increase. Even as I was in the process of writing this piece, silver and gold went from down on the day to up, and Bitcoin has recovered most of its morning drop. I don’t think the hourly chart of these instruments is predictive, but it is interesting to watch during high-impact events like the monthly CPI announcement.

Originally published on Deep Knowledge Investing on April 10, 2024.