The IRS published its annual data book for fiscal year 2024, revealing higher tax collections and improved taxpayer service provided by the agency compared to the previous year, the agency said in a May 29 statement.

IRS’ revenue collection for the fiscal year 2024, which ran from Oct. 1, 2023, to Sept. 30, 2024, totaled more than $5.1 trillion, “an increase of almost 9 percent compared to the prior fiscal year total of $4.7 trillion,” the IRS said. This was the first time that revenues exceeded $5 trillion.

“The IRS processed more than 266 million returns and other forms from individuals, businesses and tax-exempt organizations; received almost 4.6 billion information returns; and issued close to $553 billion in refunds to individual and business taxpayers during FY 2024.”

The agency said revenue collected by the IRS accounts for about 96 percent of all government funding.

The IRS published fiscal year 2024 collection numbers in November. The recently published data book provides a more detailed look at collection figures and other information.

Regarding customer service, the IRS has provided “improved levels of service” over the last two filing seasons, the IRS said in Thursday’s statement.

For fiscal year 2024, the agency assisted taxpayers on 62.2 million occasions, an increase of 3.2 percent compared to the prior year, it said.

The IRS said it reduced call wait times for taxpayers. Each major category of taxpayer assistance—automated telephone assistance, live telephone assistance, and assistance offered at Taxpayer Assistance Centers—saw an improvement, according to the agency.

A survey conducted by the IRS among 1,500 taxpayers found that taxpayer satisfaction regarding their interactions with the agency “dropped significantly” in 2024, according to the data book.

The share of respondents saying they were very/somewhat satisfied dropped to about 75 percent, down from over 80 percent in 2017.

Lawmakers have taken action to improve the agency’s services.

In February, a group of bipartisan lawmakers reintroduced the Internal Revenue Service Math and Taxpayer Help (IRS MATH) Act that seeks to simplify error notices sent by the IRS to taxpayers, Sen. Elizabeth Warren’s (D-Mass.) office said in a Feb. 14 statement.

Millions of mathematical and clerical error notices are sent by the agency every year, with the “vague and confusing” documents posing a challenge to taxpayers, according to the statement.

The legislation asks the IRS to improve the notices by mentioning a “clear description of the error, including the type of error and the specific federal tax return line on which the error was made.”

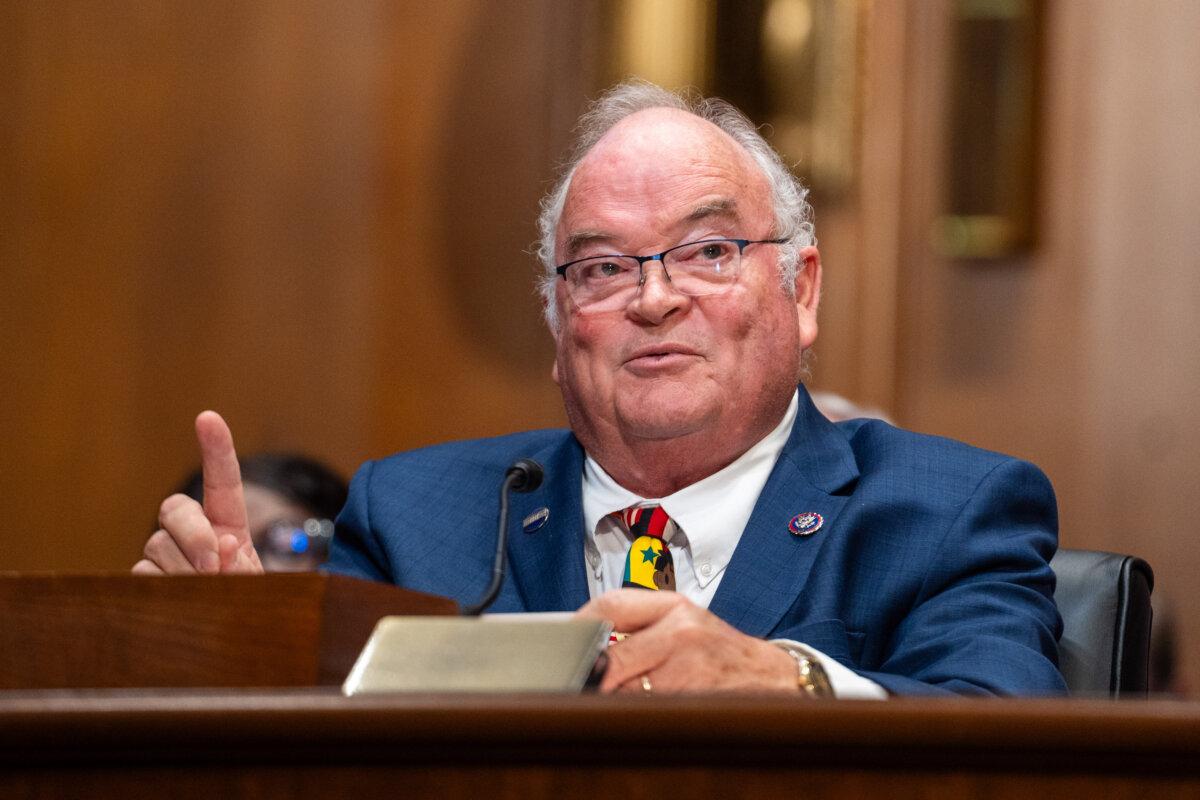

Internal Revenue Service commissioner nominee Billy Long testifies during a confirmation hearing before the Senate Committee on Finance on Capitol Hill on May 20, 2025. (Madalina Vasiliu/The Epoch Times)

During his May 20 confirmation hearing before the Senate, Billy Long, President Donald Trump’s nominee to lead the IRS, said taxpayers have consistently complained about poor customer service and delayed refunds, adding that these are among the several issues he intends to correct once confirmed to the post.

Direct File

According to the IRS data book, the agency’s Direct File program, which offers free online tax filing services to certain taxpayers, saw nearly half a million people use the service in fiscal year 2024.

“An estimated 423,450 taxpayers logged into Direct File and 140,803 of them submitted an accepted return,” the IRS said in the data book. “Of all Direct File users with an accepted return, 72 percent received a tax refund, with roughly $90.4 million issued.”

California had the highest number of taxpayers whose returns were accepted by Direct File at over 33,000 returns. This was followed by Texas, Florida, New York, and Washington.

During Long’s May 20 hearing, Direct File was a topic of discussion. Sen. Marsha Blackburn (R-Tenn.) said she and many other lawmakers are seeking to end the service.

“We’ve had lots of complaints about the Direct File program, and it is something that was put in place without explicit congressional approval,” she said, adding that many people feel the service is “overly intrusive into their personal information” compared to other free filing options.

Earlier in January, lawmakers from the Democratic Party wrote in a letter to Long and the treasury secretary that ending Direct File “would hurt everyday Americans.”

“This program is efficient and effective, providing a vital service for millions of Americans,” the lawmakers wrote.

In his testimony, Long called Direct File “one of the hottest topics at the IRS,” and said it was one of the first things he plans to look at once confirmed as agency head.

Long clarified he wants to talk to people with all kinds of views on Direct File before taking a position on the matter.

“I want to get to the bottom of it and see what is best for the hardworking employee partners that I will have at the IRS, if I’m confirmed, and the taxpayers,” he said.

The One Big Beautiful Bill Act, which recently passed in the House, carries a provision to repeal the Direct File program, opening the way for the introduction of a new service from the current administration.