Commentary

The stock market staged a historic Thanksgiving rally last week, with the S&P 500 and Dow hitting all-time highs on Nov. 29, NASDAQ approaching its high, and the Russell 2000 matching its 2021 highs. For November—the market’s best historical month—we saw a 5.7 percent monthly gain in the S&P 500, a 6.2 percent gain in NASDAQ, a 7.5 percent gain in the Dow, and a torrid 8.4 percent gain in the small-cap Russell 2000 index.

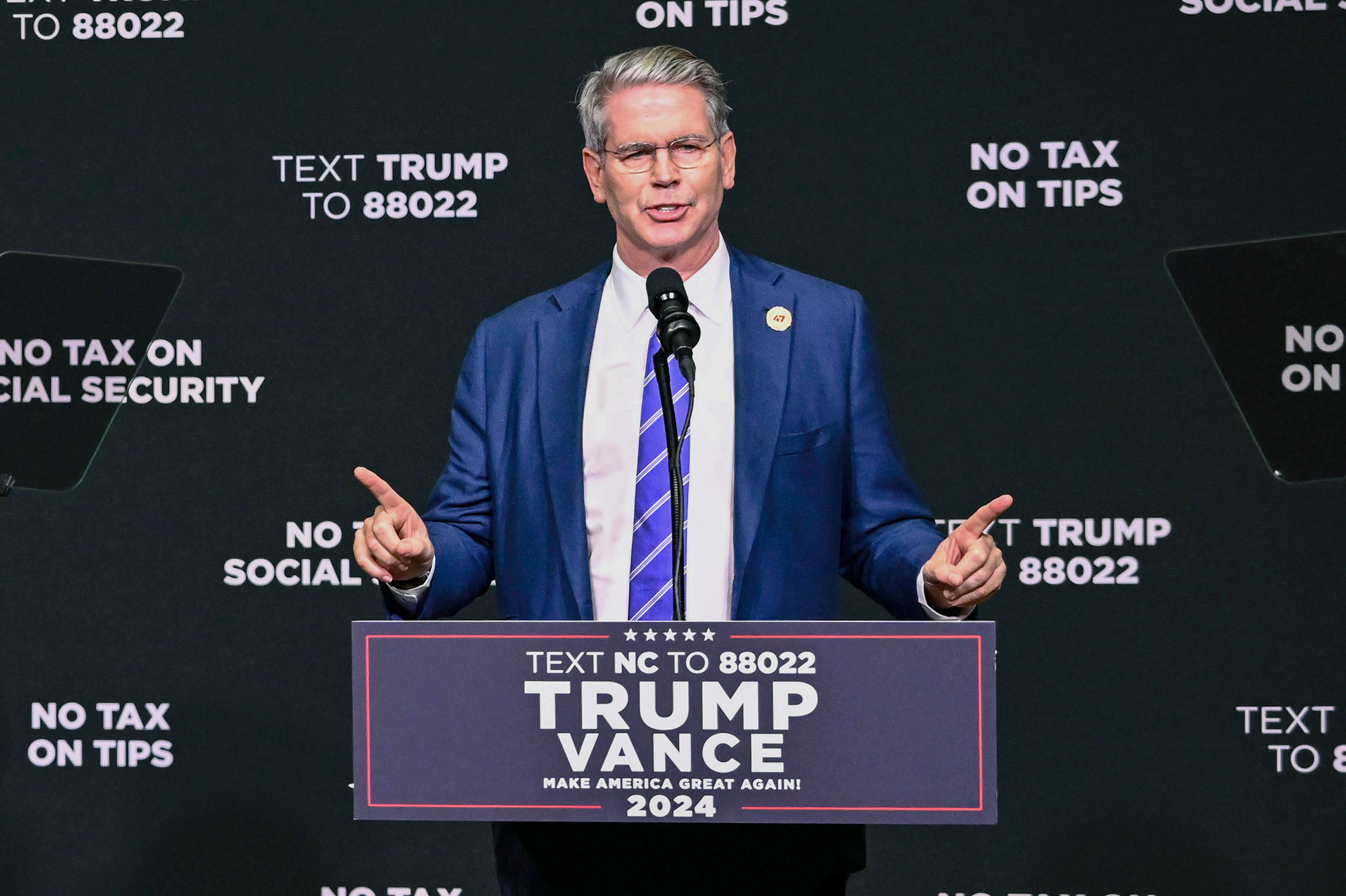

Adding further fuel to this November rally was the fact that yields on the benchmark 10-year Treasury bonds declined from 4.41 percent to 4.18 percent last week on the presumption that the treasury secretary nominee, Scott Bessent, will work with foreign investors to finance the fiscal deficits of the Trump 2.0 administration. The truth of the matter is that the current treasury secretary, Janet Yellen, has had some “issues” with managing the recent Treasury bond auctions, and so she has had to skew the Treasury auctions more to the short- and intermediate-term Treasurys, which is what really caused the Treasury’s inverted yield curve to widen. Under Bessent, Treasury auctions are expected to become more orderly.

Here are the most important market news items and what this news means:

• President-elect Donald Trump’s latest tariff threat is a potential 100 percent tariff against the BRICS nations (Brazil, Russia, India, China, and South Africa) that are bypassing the U.S. dollar in transactions. Currently, the U.S. dollar accounts for about 60 percent of international transactions, and commodities are priced in U.S. dollars. However, China has been encouraging countries such as Brazil to trade in Chinese yuan instead of the U.S. dollar. Brazilian President Luiz Inácio Lula da Silva and Chinese leader Xi Jinping both have been striving to undermine the U.S. dollar. Other countries, such as India and Russia, often trade directly and bypass the U.S. dollar, which helps Russia avoid international sanctions.

• The U.S. dollar remains very strong because Europe is in a recession and the European Central Bank (ECB) is anticipated to cut key interest rates in the upcoming months. ECB President Christine Lagarde warned that the eurozone economy remains fragile, with uncertainty and downside risks clouding the outlook. Specifically, Lagarde said on Dec. 4 that “survey-based data suggest that growth will be weaker in the short term.” Clearly, the political chaos in France and Germany, plus the fact that the two largest economies in the eurozone are in a recession, is dragging down the entire eurozone.

• The Biden administration banned the sale of high-bandwidth memory chips made by U.S. and foreign companies to China. Apparently, the Biden administration’s goal is to slow China’s development of advanced semiconductors and artificial intelligence (AI) systems that may help its military. In a tit-for-tat response, China banned the export to the United States of some rare earth materials, namely gallium, germanium, and antimony. I suspect that the incoming Trump administration will review this policy in conjunction with broader tariff negotiations with China.

• The Biden ban on liquefied natural gas (LNG) expansion has ended, and Trump 2.0 is expected to boost LNG exports and use natural gas to double utility output to fuel AI data center power demand. Natural gas futures in Europe have soared on the fear of a lack of storage and because Russian LNG is increasingly being blocked by new sanctions. Although natural gas prices are hypersensitive to cold winter weather, the United States still has excess supply and will have more supply to export under Trump 2.0’s “drill, baby, drill” policy. In fact, Trump has appointed a fracking expert, Chris Wright, to lead the Department of Energy. Furthermore, North Dakota Gov. Doug Burgum has been nominated for Interior Secretary so he can open up more federal land for crude oil and natural gas production.

• BlackRock paid $12 billion for HPS, which is a private credit firm with $148 billion under management. The 11 percent yield that the private credit industry offers investors is tempting, but private credit firms are increasingly leveraging debt to achieve such high yields. Leverage debt in structured investment vehicles (yield curve arbitrage) and leveraged municipal bond products eventually collapsed and caused a “Black Swan” event in 2008 that froze credit markets. If the leverage behind the increasingly competitive private credit market comes unwound, then the $2 trillion private credit market could freeze credit markets and create a new Black Swan event.

• The ISM manufacturing index rose to 48.4 in November, up from 46.5 in October. Although this improvement is welcome, any reading below 50 signals a contraction. Fully 11 of the 14 manufacturing industries surveyed contracted in November, so a manufacturing contraction persists. Then, on Dec. 4, ISM announced that its ISM nonmanufacturing service index declined to 52.1 in November, down from a robust 56 in October. Although any reading over 50 signals an expansion, the deceleration in the ISM service index in November was shocking and bodes poorly for fourth-quarter GDP growth. The supplier delivery component plunged to 49.5 in November, down from 56.4 in October, which partially explains the abrupt deceleration. Fully 14 of the 17 service industries surveyed reported an expansion in November, so the service sector continues to expand, just at a slower pace.

• ADP announced on Dec. 4 that 146,000 private payroll jobs were created in November, which was essentially in line with economists’ consensus forecast of 150,000. The October private payroll report was revised down to 184,000 from the 233,000 previously reported. ADP reported that 26,000 manufacturing jobs were lost in November, so the manufacturing recession persists. Also disturbing is that small businesses lost 17,000 jobs in November.

Overall, amid the chaos in the world, the United States remains an economic oasis. The United States remains food- and energy-independent, which other countries cannot claim. Furthermore, our 50 states act as economic laboratories and compete with each other. Finally, the United States has better demographics, creates new households, and better assimilates immigrants. The truth of the matter is that the United States has a big economic advantage compared with other nations. It is clear that under Trump 2.0, the president-elect intends to exploit the U.S. advantage to negotiate better trade deals and impose more tariffs on uncooperative countries.

*Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times.