Analysis

WASHINGTON—The Supreme Court released its long-anticipated decision on Feb. 20 over whether President Donald Trump’s tariffs exceeded the boundaries of congressional authority.

The Supreme Court’s ruling invalidates tariffs imposed using the 1977 International Emergency Economic Powers Act.

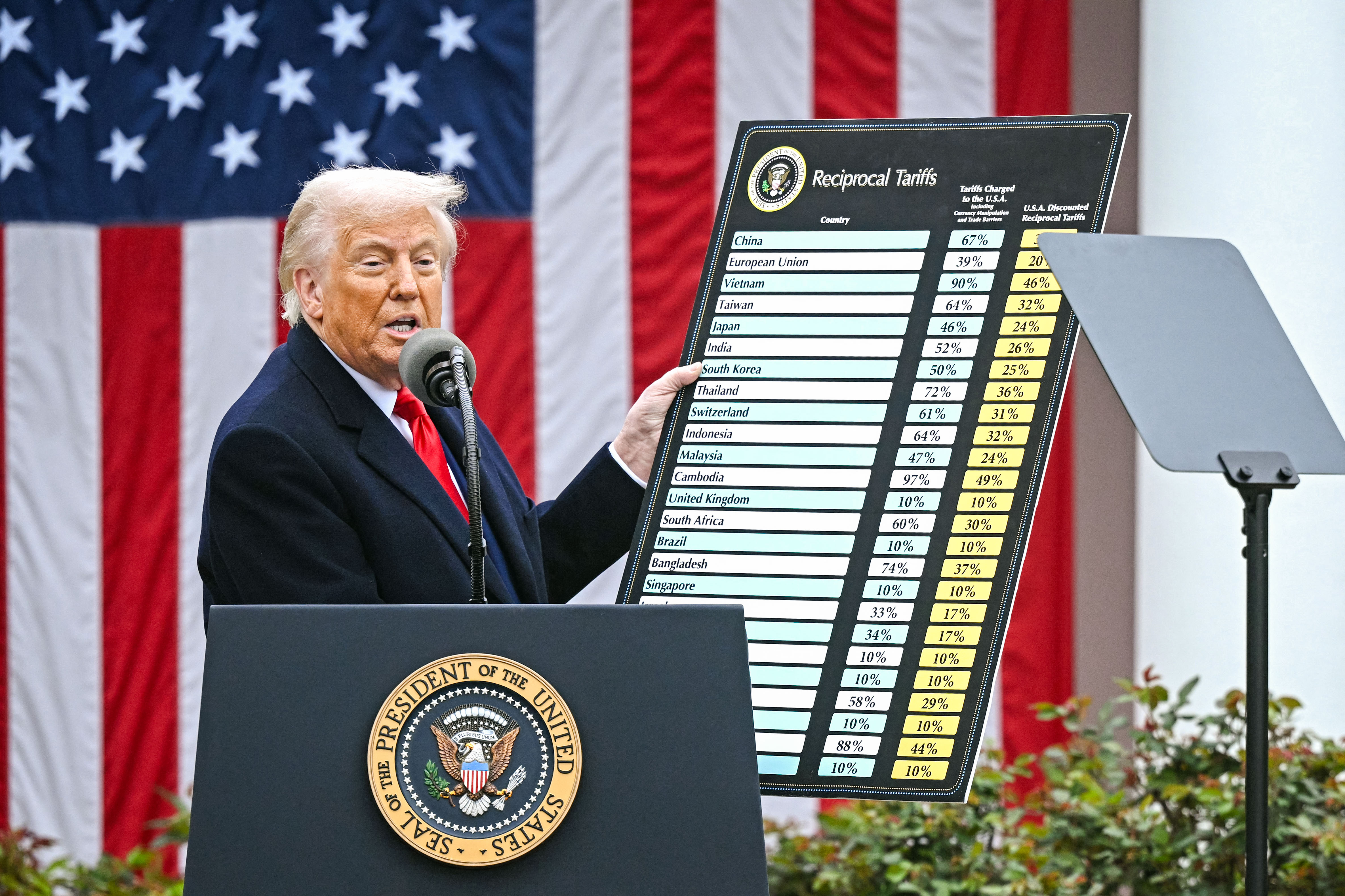

Specifically, this affects “Liberation Day” reciprocal tariffs on imports from most U.S. trading partners, with rates ranging from 10 to 50 percent.

It also impacts border security and fentanyl-related tariffs on China (10 percent), Mexico (25 percent), and Canada (35 percent). Tariffs on India for buying Russian oil and tariffs on Brazil will also be affected.

The high court’s ruling will not overturn various sectoral tariffs, including those on aluminum, copper, and steel, issued by other tariff authorities.

The pivotal decision is expected to shake up the United States’ foreign and economic policies. However, Trump said he will reimpose a significant portion of his tariffs using other legal authorities available to the executive branch.

Treasury Secretary Scott Bessent had said earlier that the administration could work around a negative ruling, but he said the potential fix wouldn’t be as efficient.

Although recent presidents have applied pressure through trade, Trump ushered in a paradigm shift in the country’s economic policy when he announced a sweeping set of tariffs beginning in April last year.

Here are the potential impacts of today’s decision.

1. Presidential Power

The decision may affect Trump’s future decisions to use emergency powers for many economic measures.

This decision is expected to set precedents for executive emergency powers in other policy areas.

Trump has previously called the decision potentially “life or death” for the United States.

However, during a press conference on Feb. 20, Trump announced that he would sign an order imposing a 10 percent global tariff under Section 122, in addition to the existing tariffs already in place.

He also said national security tariffs—Section 232 and Section 301 tariffs—will remain in place, and will be in full force and effect.

“We’re also initiating several Section 301 and other investigations to protect our country from unfair trading practices of other countries and companies,” Trump said.

The president stated that, with the new levies, tariff levels for each country would remain largely unchanged despite the Supreme Court’s decision.

A Maersk cargo ship loaded with shipping containers navigates through New York Bay, on Jan. 23, 2026. (Charly Triballeau/AFP via Getty Images)

2. Government Revenue

The country has seen record tariff revenues and trade renegotiations that have affected billions of dollars in commerce.

Tariffs generated record revenue of more than $215 billion in fiscal year 2025.

As of Feb. 17, the federal government had collected more than $130 billion in tariff revenue so far this fiscal year, according to the Treasury Department.

Data from the Bureau of Economic Analysis has shown the monthly trade deficit narrowing since the president’s tariffs.

But the annual deficit totaled $901 billion—a tepid decline from the previous year—making it the third-largest on record.

The decision may force the federal government to refund importers, straining the federal budget and complicating deficit-reduction efforts.

A new Penn Wharton Budget Model estimated that more than $175 billion in U.S. tariff revenue could be returned to importers in the aftermath of the Supreme Court’s decision.

The White House and the U.S. Department of the Treasury in Washington on March 10, 2025. (Madalina Vasiliu/The Epoch Times)

In a dissenting opinion, Justice Brett Kavanaugh said providing refunds to those affected by the tariffs would probably be a “mess.”

The federal government may be forced to refund billions of dollars to importers who paid tariffs under the International Emergency Economic Powers Act, “even though some importers may have already passed on costs to consumers or others,” Kavanaugh said.

Trump raised a similar concern and said that the issue may have to be resolved in the courts.

“Well, what happens to all the money that we took in?” Trump asked during the press conference, criticizing the court decision for not providing guidance on that.

“I guess it has to get litigated for the next two years,” he said.

3. Impact on Markets

Financial markets have been preparing for volatility.

The recent ruling against the tariffs has been good news for investors, offering some relief from higher company costs.

Still, the stock market rally may not last, as uncertainty could return.

New tariffs proposed by Trump will be implemented, which may increase uncertainty for investors.

“Foreign countries that have been ripping us off for years are ecstatic,” Trump said during the press conference. “They’re so happy and dancing in the streets—but they won’t be dancing for long.”

“I’m going to go in a different direction, probably the direction that I should have gone the first time,” he said, referring to the authorities he will use to impose new tariffs.

A trader works on the floor of the New York Stock Exchange at the opening bell in New York, on Feb. 20, 2026. (Timothy A. Alary /AFP via Getty Images)

Before the announcement, predictive markets such as Kalshi and Polymarket had shown that the odds of the high court ruling in favor of the Trump administration were about 25 percent.

The financial markets also expected the Supreme Court to invalidate the IEEPA tariffs.

U.S. stocks initially popped following the high court’s ruling, with the blue-chip Dow Jones Industrial Average rising more than 200 points. But the leading benchmark averages later pared their gains.

Fiscal worries that federal revenues will fall short of earlier projections pushed government bond yields higher.

The benchmark 10-year Treasury yield topped 4.1 percent, while the 30-year jumped above 4.75 percent.

4. Importers and Businesses

More than 1,000 companies, including Costco, have sued the government over tariffs.

U.S. importers have applied for electronic refunds, pending a Supreme Court decision on the legality of Trump’s IEEPA tariffs.

The deadline for importers to register for electronic refunds through the Automated Clearing House network with Customs was Feb. 6.

It remains unclear how these companies will receive their refunds, which is a significant problem for the administration at this time.

Costco wholesale store in Elkridge, Md., on Oct. 24, 2025. (Madalina Kilroy/The Epoch Times)

5. ‘America First’ Trade Policy

In his second term, Trump has been using tariffs as leverage to reduce tariffs and nontariff barriers on U.S. goods.

Shortly after his inauguration, the 47th president described “tariff” as the most beautiful word in the dictionary.

He drew inspiration from William McKinley, the 25th president, who championed steep tariffs to protect American industries in the late 19th century.

On April 2, Trump imposed levies of at least 10 percent on more than 80 countries.

This was a significant shift from the trade policy of his first term, when tariffs targeted a few specific countries, such as China.

Trump has frequently praised tariffs for attracting $18 trillion in new investment commitments this year.

He also floated the idea of sending American taxpayers $2,000 tariff rebate checks directly, using funds from the tariff revenue.

After April 2, 2025, which he dubbed “Liberation Day,” Trump launched trade talks with key trading partners to revise long-standing agreements.

President Donald Trump shakes hands with European Commission President Ursula von der Leyen after agreeing on a trade deal between the two economies following their meeting, in Turnberry, Scotland on July 27, 2025. (Brendan Smialowski /AFP via Getty Images)

He has announced new trade deals with dozens of trading partners, including Argentina, the European Union, Japan, South Korea, Switzerland, Thailand, the UK, and Vietnam.

Since taking office, Trump has also increased pressure on China by significantly raising tariff rates on Chinese goods.

Although some were reduced in a November truce, current tariffs remain high, at 47.5 percent.

This was expected to lead to long-term economic decoupling between the United States and China.

Trump’s trade agenda faced legal challenges from businesses and from states in 2025.

Although some economists warned that tariffs would increase inflation, the Bureau of Labor Statistics recently reported that inflation cooled to 2.4 percent in January, below expectations.

It’s unclear how trade agreements will change after the Supreme Court decision.

However, Trump stated he would immediately impose a 10 percent tariff on all trading partners.

Following that, he said that over the next five months, his administration will conduct “various investigations” needed to implement fair tariffs on each country.

“And in the end, I think we’re [going to be] taking more money than we’ve taken in before,” Trump said.