Commentary

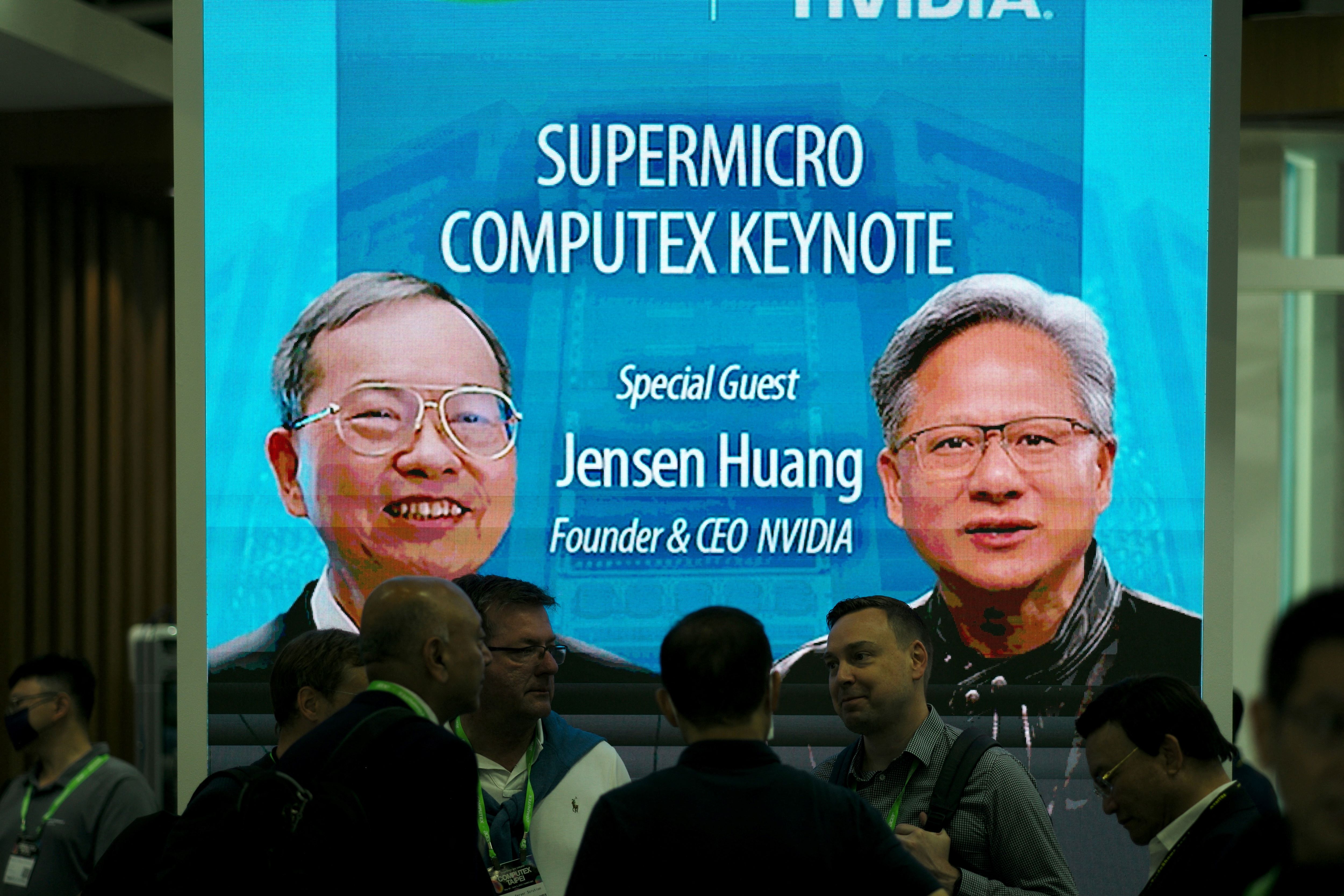

Last week was monumental for two of the leading AI stocks, Super Micro Computer (SMCI) and Nvidia (NVDA). On Tuesday, SMCI announced preliminary sales estimates of $5.6 billion to $5.7 billion, which would represent at least 54% annual sales growth. The company also estimated operating earnings of 58 cents to 60 cents per share, which represents at least 5% annual earnings growth. Super Micro Computer also provided upbeat sales guidance that got Wall Street analysts excited and the stock rose powerfully.

While some of the Magnificent 7 stocks are sputtering, new market leaders have emerged in this earnings announcement season, like Netflix (NFLX), Palantir Technologies (PLNT), and Spotify Technologies (SPOT), all of which utilize AI to boost efficiency, so AI enablers are breaking out as new market leaders.

In our podcast, Navellier Market Buzz, we discussed how the original narrative from three weeks ago – that DeepSeek would revolutionize AI and curtail the demand for Nvidia’s Blackwell chip, as well as data centers – turned out to be false. The fact that the DeepSeek founder used to run a hedge fund has raised suspicions that the DeepSeek announcement was just part of an orchestrated short-selling opportunity.

Here are the most important market news items and what this news means:

- Economists following the European Central Bank (ECB) now expect that the ECB will slash key interest rates to 1.75% no later than by 2026. So, that essentially means the economists are now expecting another four 0.25% key interest rate cuts due to the fact that the eurozone is in a recession due to France and Germany’s economic woes.

- The Bank of England is also expected to cut key interest rates due to the fact that Britain is also in a recession, plus the governors cannot seem to agree with the doves that calling for up to 100 basis points in future interest rate cuts. This collapse in global yields will cause our Fed to react to falling Treasury bond yields, so, I stand by my statement that I am expecting up to four key interest rates this year due to the global collapse in interest rates.

- As an example of the economic duress in Europe, auto parts supplier, Continental announced that it would cut 3,000 jobs due to a challenging market environment. Less than half of the Continental job cuts will be in Germany. Furthermore, Germany’s Commerzbank announced 3,900 layoffs. Since these are just the latest major layoffs being announced, I suspect these layoff announcements will influence the German election on February 23rd. A recent poll said 28% of German voters were undecided, so I am expecting many of these undecided voters will vote for the AfD Party, since it will represent the most pro-business change.

- Our allies in Europe have not been too happy. The fact that President Trump wants to onshore a lot of the manufacturing from our allies if they do not lower their tariffs to U.S. levels is making many countries that erected these trade barriers extremely nervous. Frankly, all the complaints from the European Union (EU) will likely be ignored by the Trump Administration and potentially result in the eventual demise of the EU.

- The problem Europe has is that it is changing fast. As an example, in Britain, the Labor Party and Prime Minister Keir Starmer is plunging in popularity, while Nigel Farage’s Reform UK party is surging and is increasingly replacing the Conservative Party. The AfD Party’s momentum in Germany will likely force an entirely new ruling coalition after the February 23rd election. Even though all the other political parties in Germany have said they will not work with AfD, I suspect that they will be more pragmatic after the election.

Overall, the stock market does not mind all the political drama now underway. The political uncertainty in Germany will hopefully be resolved after the elections on February 23rd. Britain and France are expected to continue to suffer until they can elect new leaders. In the meantime, the fact that Ukraine peace negotiations are now underway between Russia and the U.S. in Saudi Arabia is causing the stock market to have a “relief rally,” which is a sign that the stock market wants to eliminate uncertainty.

*Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times.