Commentary

The U.S. economy is wheezing, and with it California’s. The numbers tell the story, from Chapman University’s Economic Forecast Update, given at the school on June 22 by President Emeritus Jim Doti and his colleagues. The video can be found on YouTube. I’ve been attending Doti’s presentations for 36 years now, and he always puts on a good show.

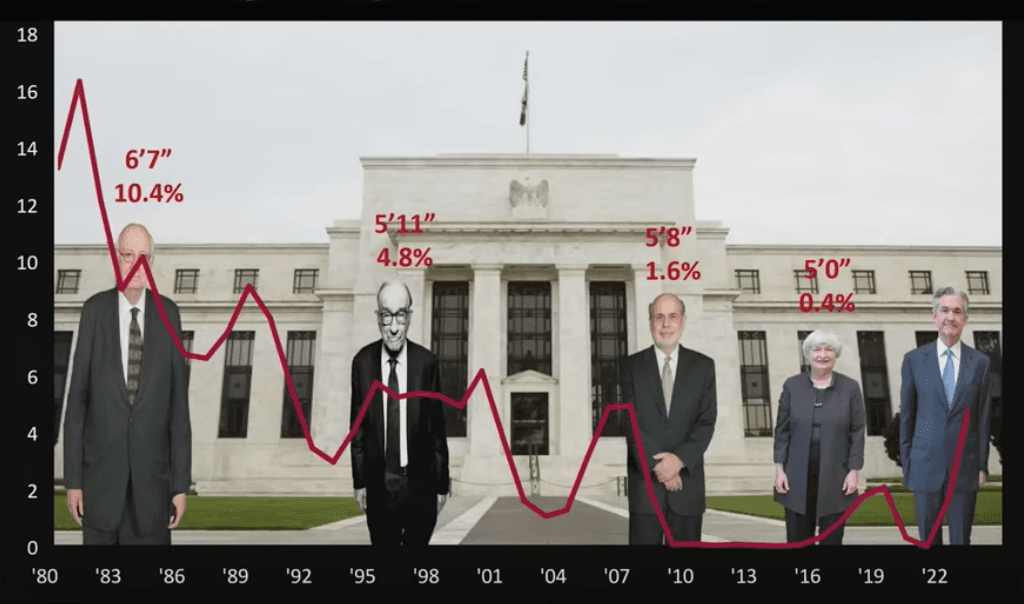

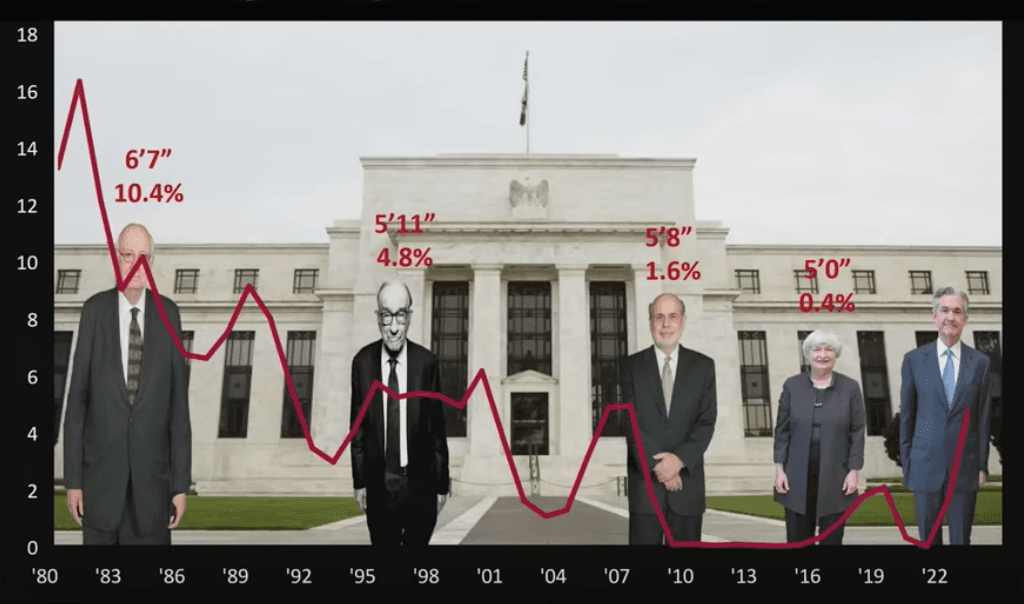

Economics may be the “dismal science,” but with him it’s entertaining. For example, he compares the height of the Federal Reserve Board chairmen of the last 45 years to the average Fed Funds Rate, the main interest rate you hear about, during each’s tenure. From left right are Paul Volcker, Alan Greenspan, Ben Bernanke, Janet Yellen, and Jerome Powell:

(Screenshot via YouTube/Chapman University)

“The relationship is absolutely uncanny,” Doti said. “The correlation coefficient is 0.9.” In statistics, a 1.0 coefficient is a 100 percent correlation, so it’s close to that. “You don’t get correlation coefficients that high. ... Every inch increase in height, leads to a 50 basis points increase in the federal funds rate.”

National Recession

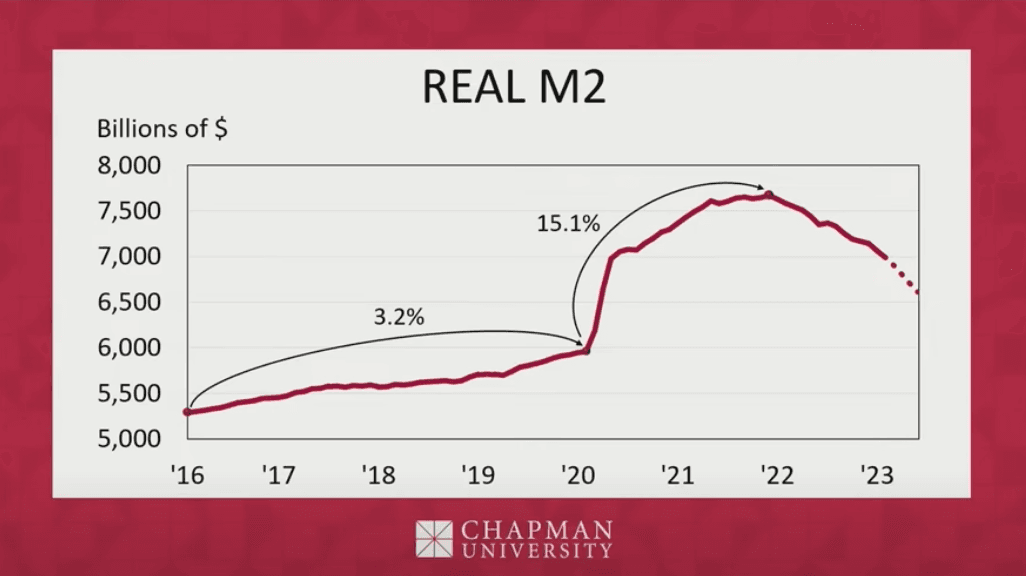

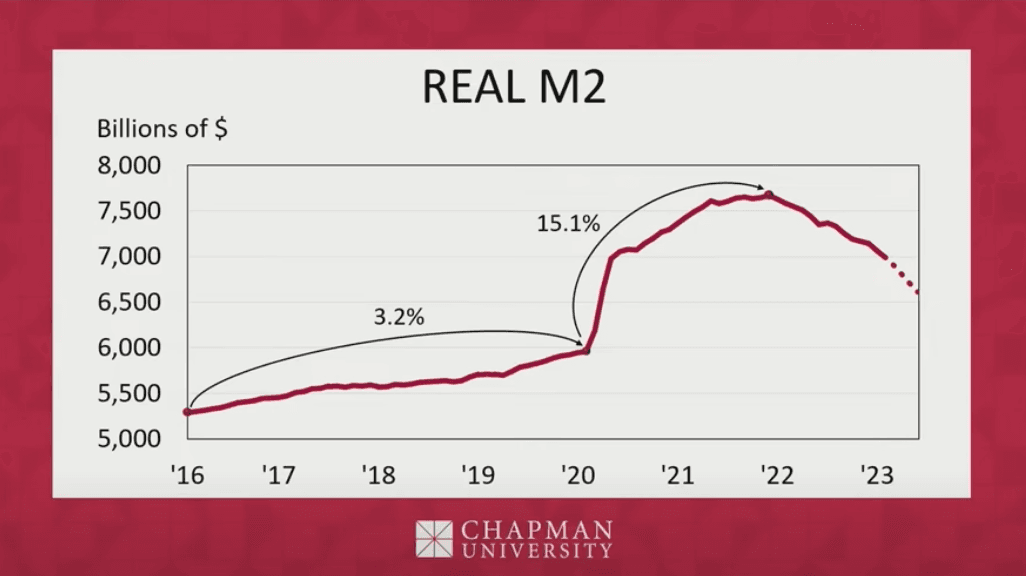

Briefly on the national picture, to fight inflation, the Federal Reserve Board has been increasing the Fed Funds rate from 0.0 percent in early 2022 to 5.25 percent today. And it is reducing the growth of M2, which mainly is the amount of money in checking accounts. In his graph, you can see how, during the COVID-19 pandemic, M2 shot up from a typical 3.2 percent annual rate to 15.1 percent. Doti said that’s unprecedented since World War II, and now is being cut back sharply.

(Screenshot via YouTube/Chapman University)

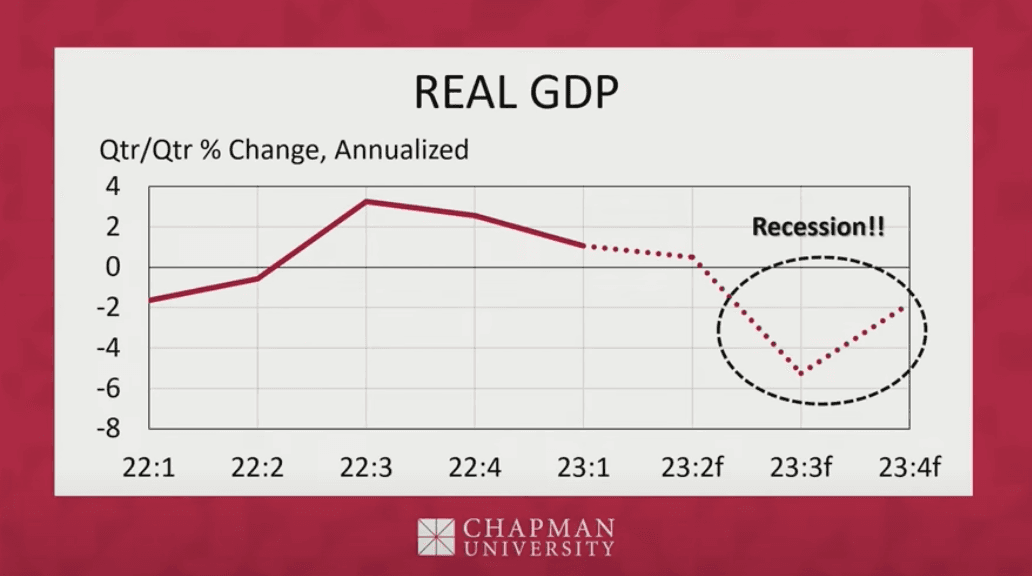

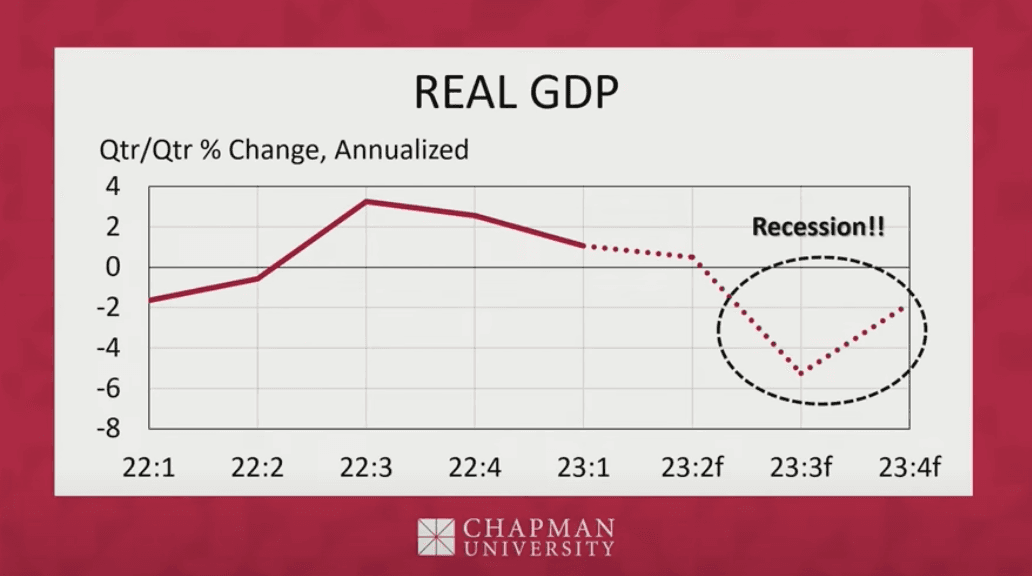

As a result, Real GDP will crash by 5 percent in the third quarter of 2023—that’s July-September.

(Screenshot via YouTube/Chapman University)

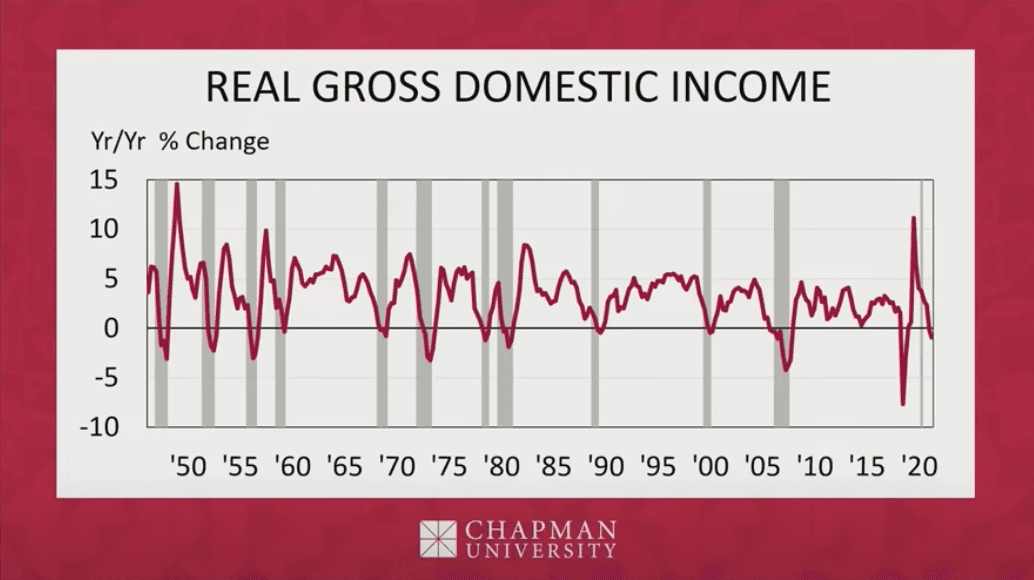

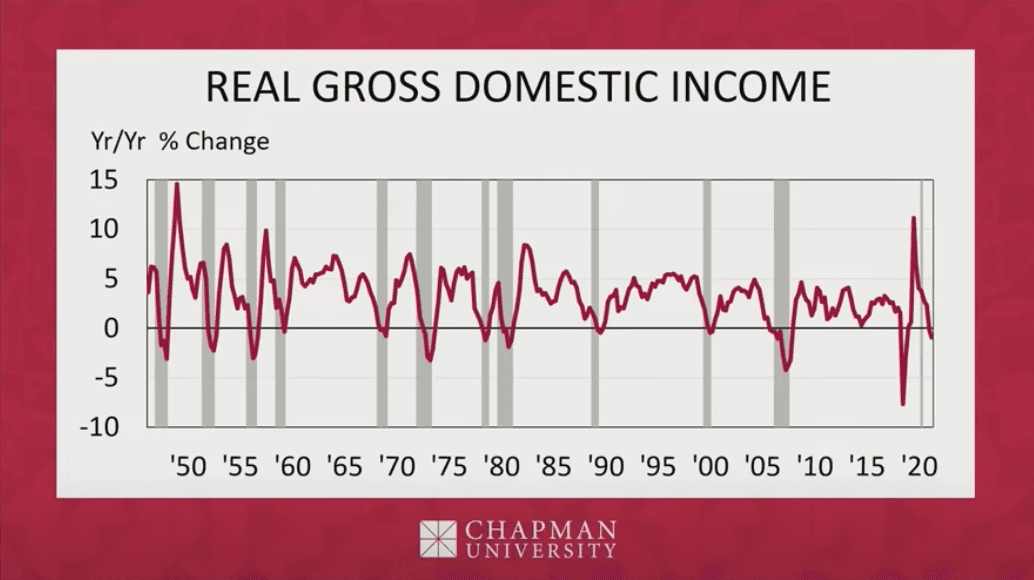

Real gross domestic income also will head into negative territory:

(Screenshot via YouTube/Chapman University)

California’s Recession

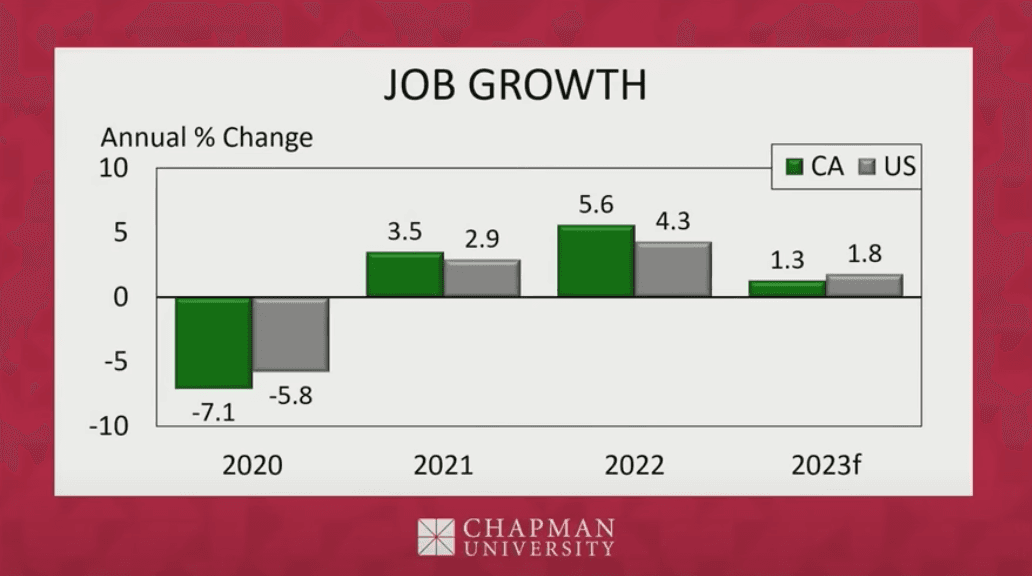

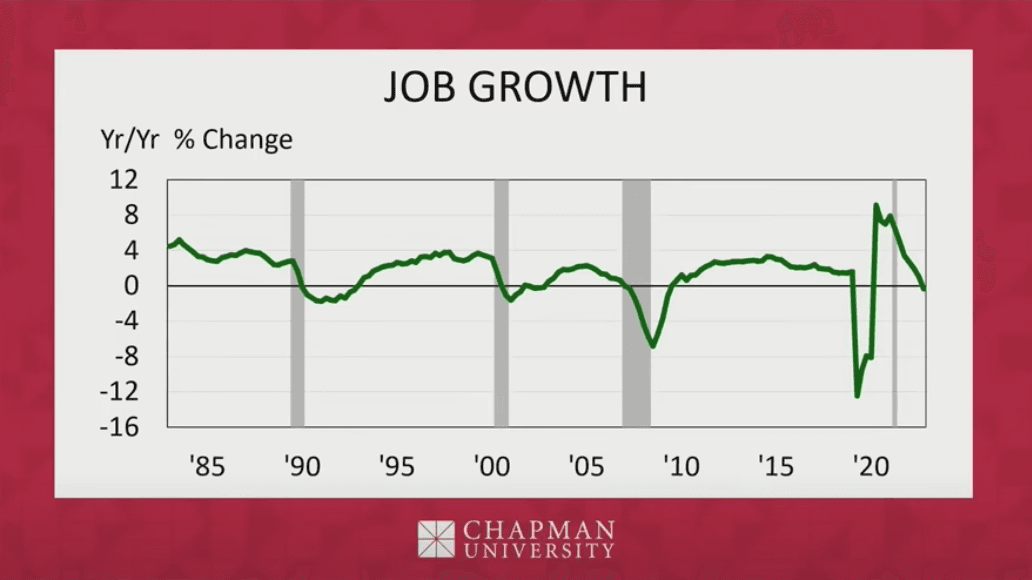

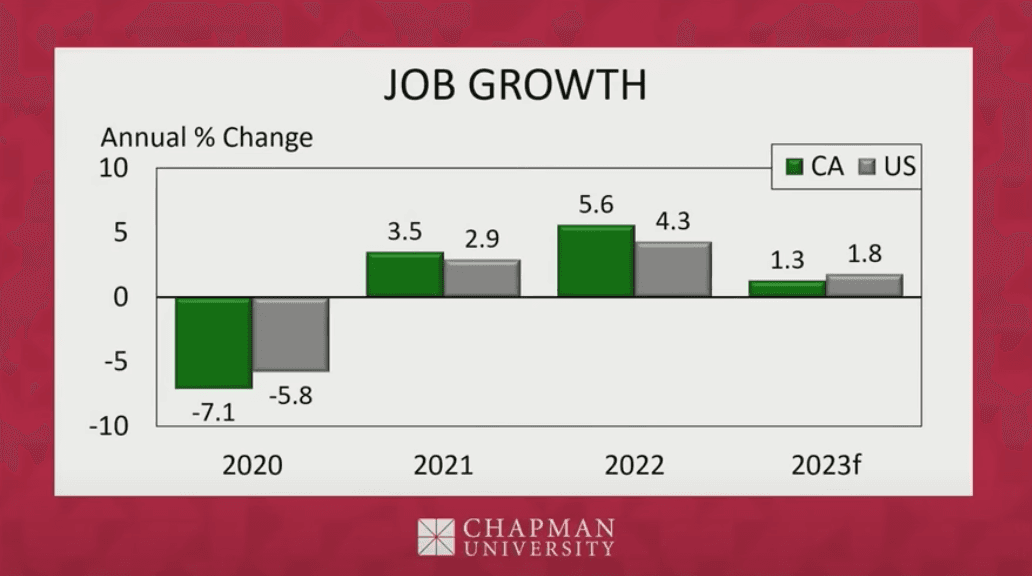

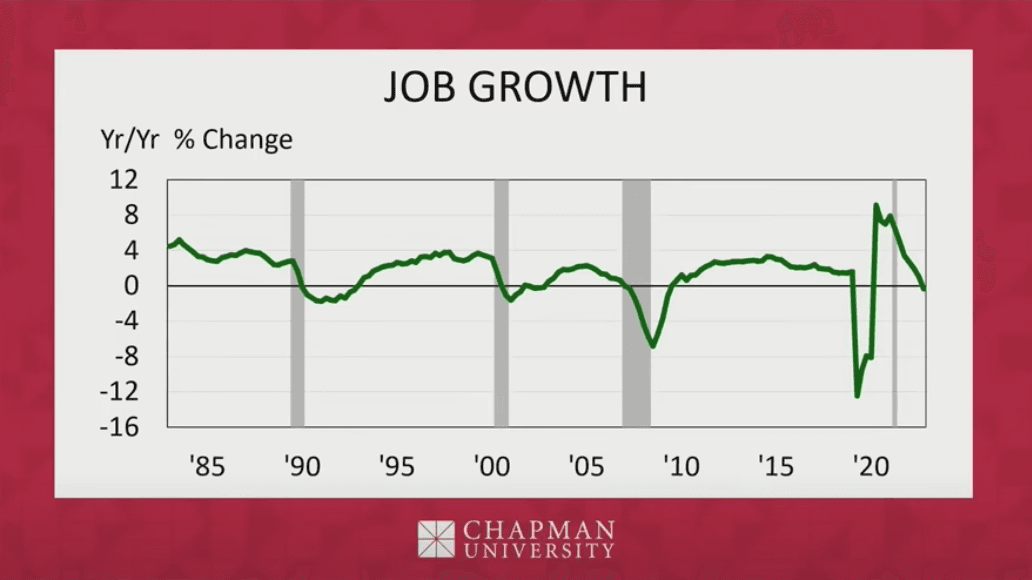

“Job growth is the lifeblood or pulse of what’s going on in our state,” Doti said. The graph shows how California was hit harder by the 2020 COVID-19 lockdowns, which were harsher here under Gov. Gavin Newsom than in other states. But the flip side was the jobs recovery of 2021-22 was more robust here as well, making up for lost employment.

In California, jobs growth will drop sharply, from 5.6 percent in 2022 to 1.3 percent in 2023. “California again will underperform the U.S. economy.”

(Screenshot via YouTube/Chapman University)

On a quarterly basis, job growth will actually dip into negative territory by the end of 2023.

(Screenshot via YouTube/Chapman University)

NorCal Leads SoCal in Advanced Industry

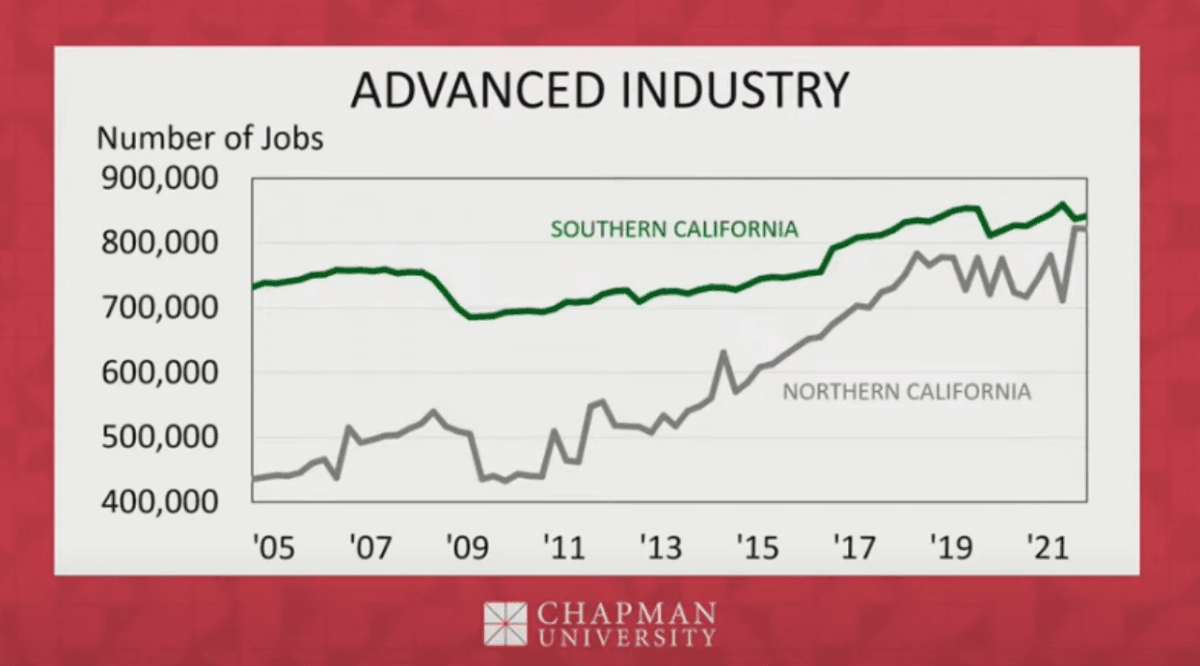

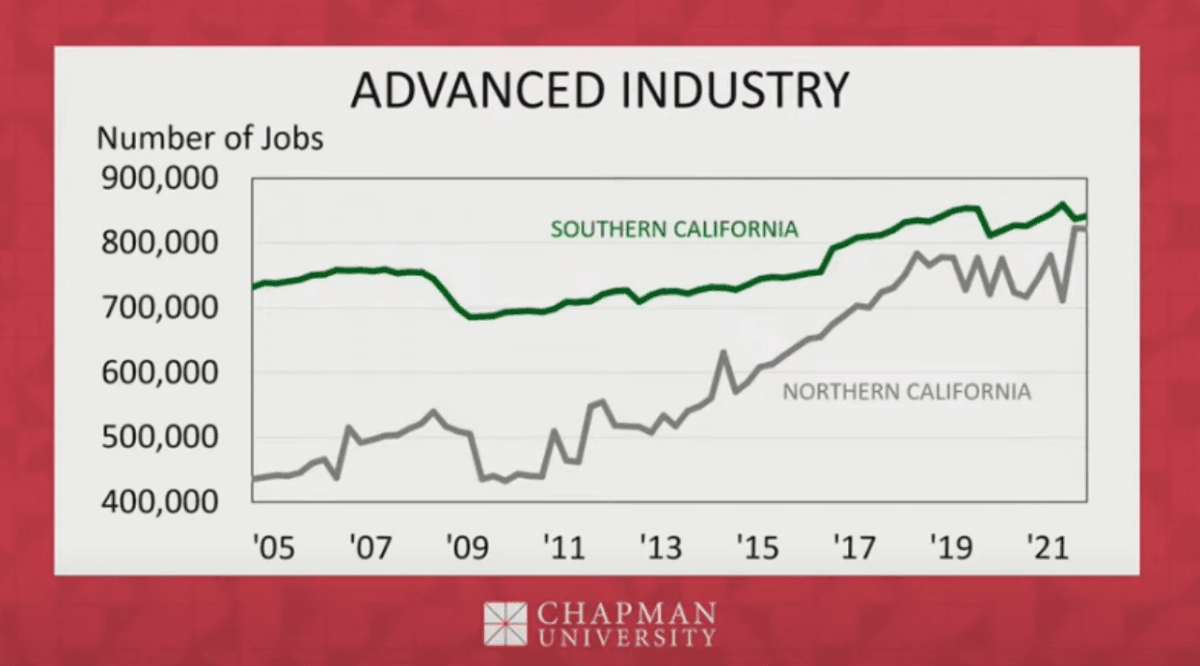

Chapman also has developed a measure of “advanced industry”—the highest-paying jobs, mainly design, aerospace, research and development, and computer software. He said a “dichotomy” has developed between Northern and Southern California in the past 20 years, with the Southland stagnating, while NorCal zoomed upward to “parity.”

(Screenshot via YouTube/Chapman University)

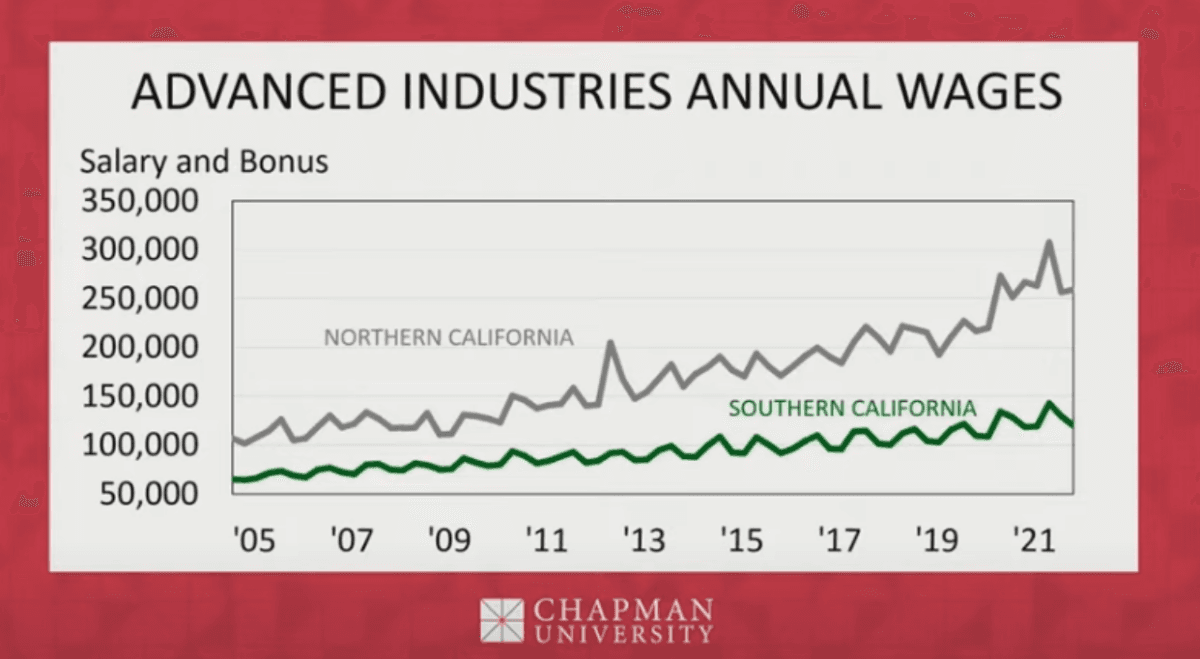

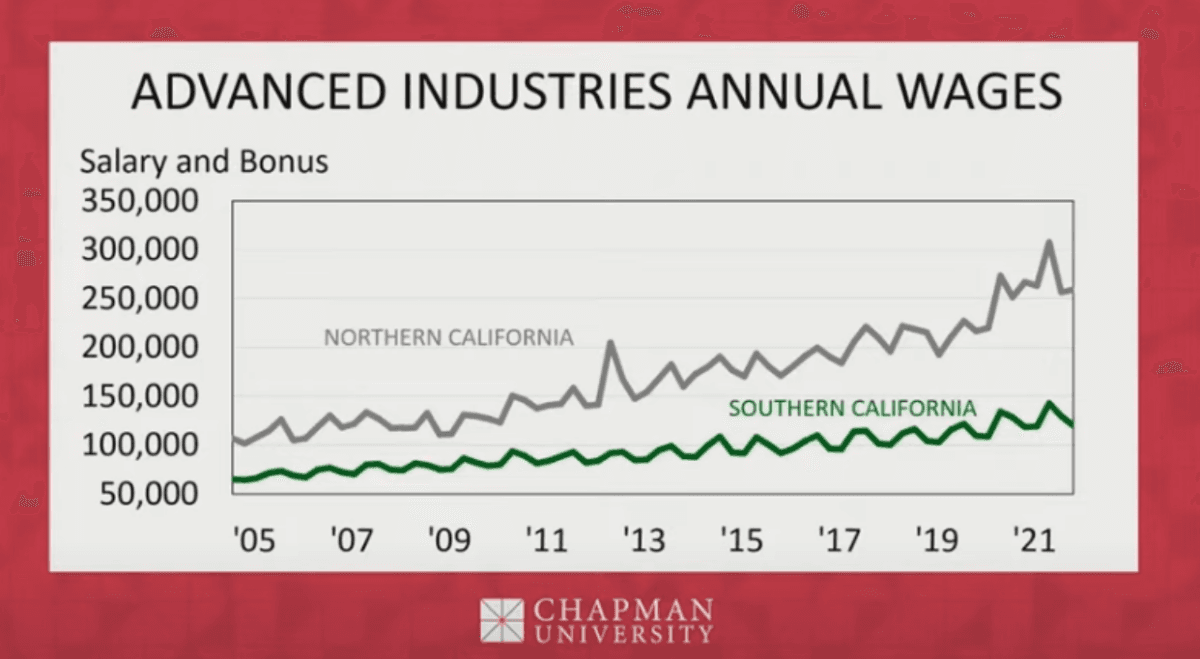

But the jobs in NorCal pay a whole lot more—$250,000 a year compared to half that, $125,000. For $250,000, one can almost afford to live in California.

(Screenshot via YouTube/Chapman University)

I would add that’s reflected in the vast valuations of Silicon Valley’s companies. Here’ are the top 7 U.S. market capitalizations on June 23:

- Apple $3 trillion

- Microsoft $2.5 trillion

- Alphabet/Google $1.6 trillion

- Amazon $1.3 trillion

- Nvidia $1.1 trillion

- Tesla $844 million

- Meta/Facebook $744 million

Microsoft and Amazon are located in Washington State. And Tesla recently moved from Silicon Valley to Texas. The other four are in Silicon Valley. None is in Southern California.

Basically, what’s happening is Silicon Valley, and to a lesser extent San Francisco, remain the global nexus of the internet economy—despite California’s high taxes and regulations. SoCal doesn’t enjoy that advantage.

I also would add SoCal once enjoyed the good middle-class jobs from the aerospace and defense industries. Both declined from two causes. First, the end of Cold War 30 years ago. Second, the shift of the origin of U.S. presidents from Californians Richard Nixon and Ronald Reagan, to Texans George H.W. Bush and George W. Bush. Defense industry jobs went with them, their staffs, and their major donors.

Both factors could change due to the hot war in Ukraine and increased tensions with China; and should Newsom become president. Northrup Grumman, Boeing, Raytheon, and Lockheed Martin still maintain large facilities here.

The California Budget

Doti turned to the just-passed California budget for fiscal year 2023-24, which begins on June 30. The general-fund surpluses of recent years, much from federal transfers to the state, are long gone, flipping into a deficit. Let me once again lament how the state missed a chance to use the nearly $100 billion surplus in the 2022-23 budget to reform its tax code.

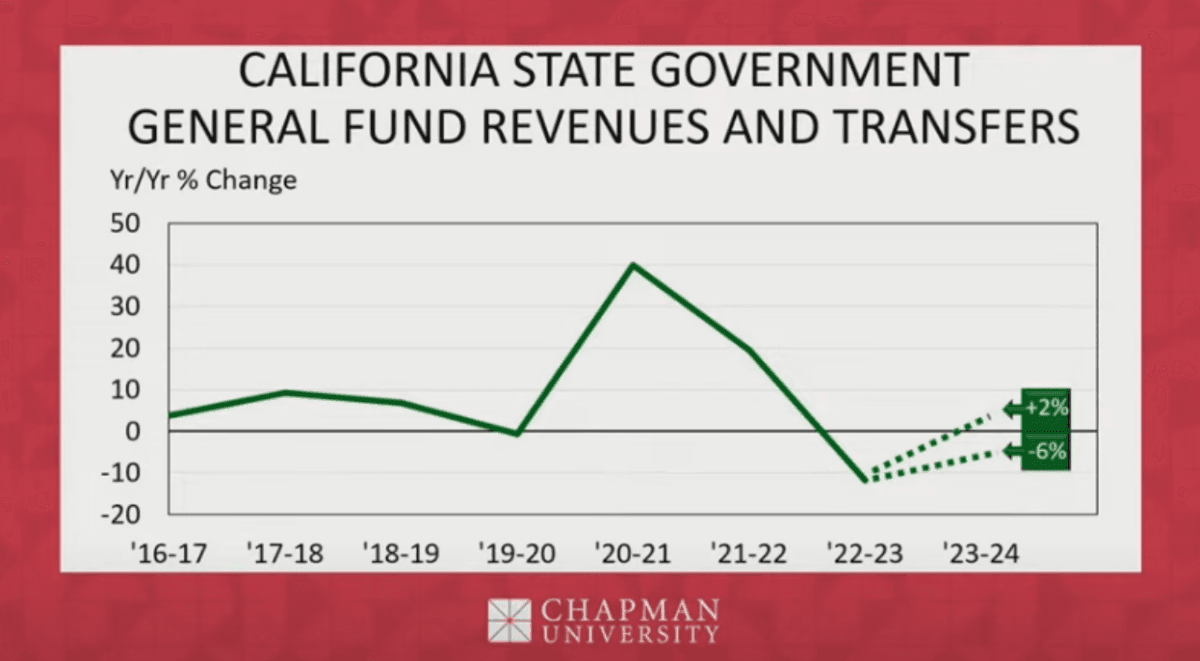

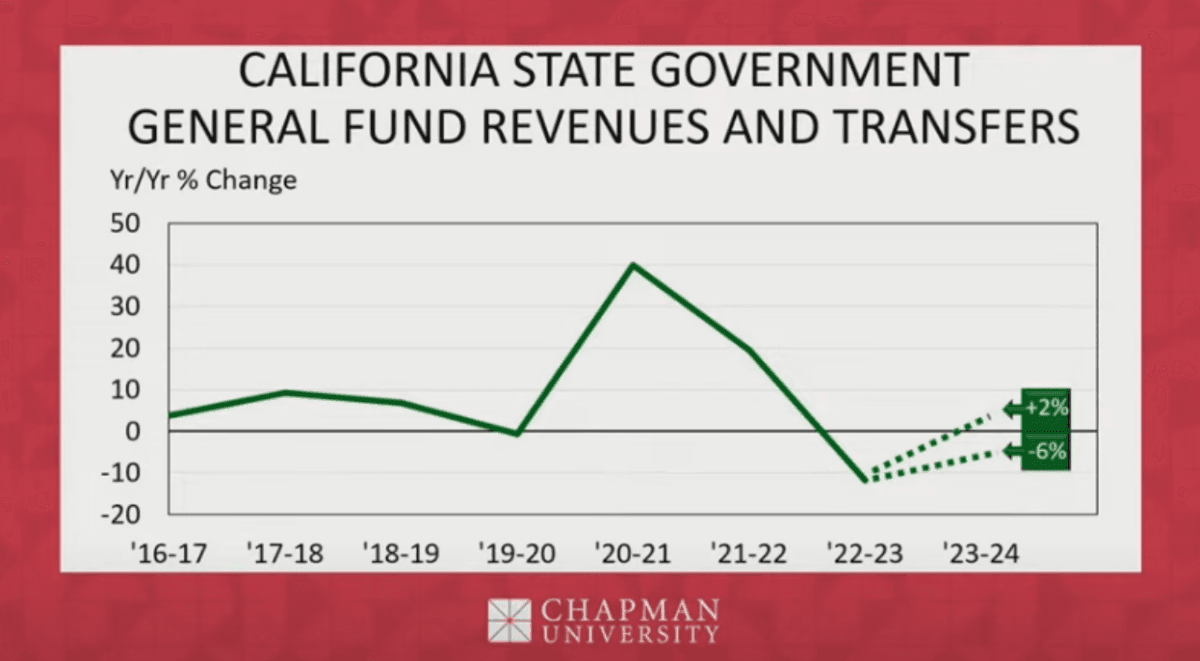

Doti also warned the budget is premised on a 2 percent increase in revenues and transfers, but instead will suffer a 6 percent drop, as shown in the chart below’s dotted line. If you’ve read my Epoch Times articles on the budget, that’s what I’ve been saying.

(Screenshot via YouTube/Chapman University)

In my May 15 article headlined, “Newsom’s Revised Budget Doesn’t Cut Enough,” I wrote, “If a recession digs in later this year, as most economists are expecting, revenues could fall even more. ... However, the governor’s new document does not concede this possibility, anticipating, ‘The May Revision forecast projects the U.S. economy to grow slowly through the third quarter of 2023, with U.S. real GDP growth averaging 0.5 percent in the second and third quarters amidst tighter financial conditions.’”

And although a “budget” was passed by the June 15 constitutional deadline, final numbers won’t be available until the “trailer bills” modifying it are passed later this summer.

Doti said Newsom’s projected $9 billion surplus actually will become a $6 billion deficit, “That’s a swing of $15 billion—a serious problem that I believe will emerge as we go through the year. But we believe it is even worse than that. Because something else is going on that is very serious.”

Chasing Out Producers

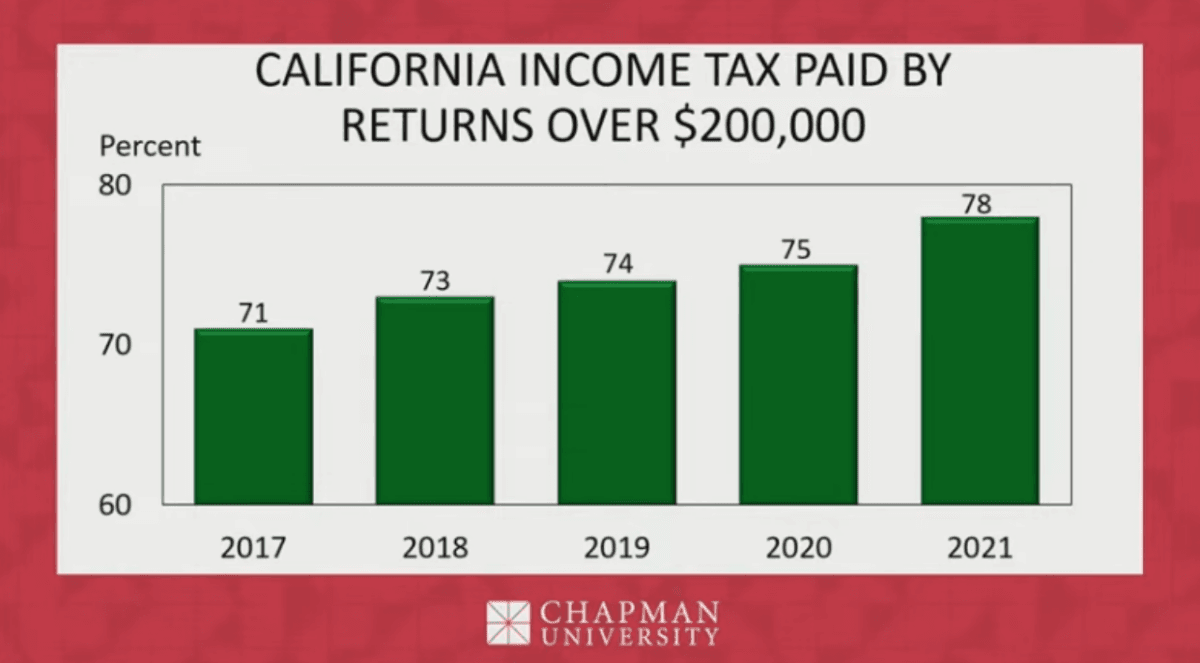

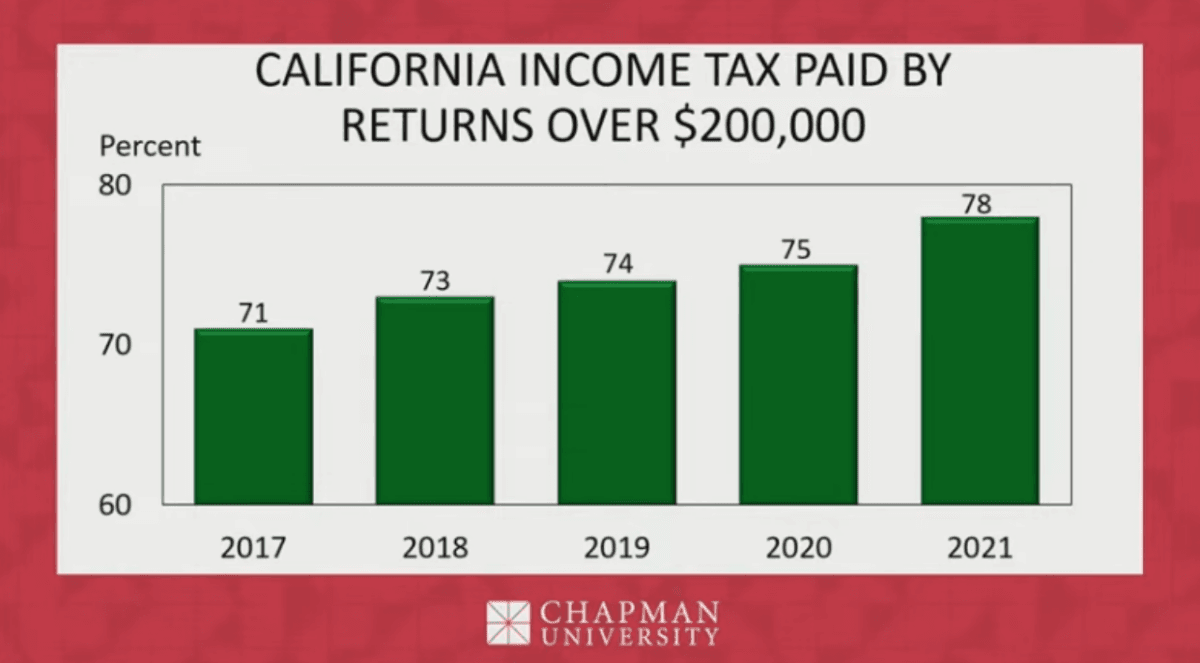

Doti said his Chapman economics team has been digging into IRS data. Newsom has been touting how the top 1 percent of taxpayers pay half the income taxes in the state, something he expects to continue. But Doti warned, “You can’t use static analysis to project tax revenue, because a lot of those people are leaving the state.”

Doti showed a chart of income taxes paid by those making more than $200,000. Those folks have risen from 71 percent of the income tax paid in California in 2017 to 78 percent in 2021.

(Screenshot via YouTube/Chapman University)

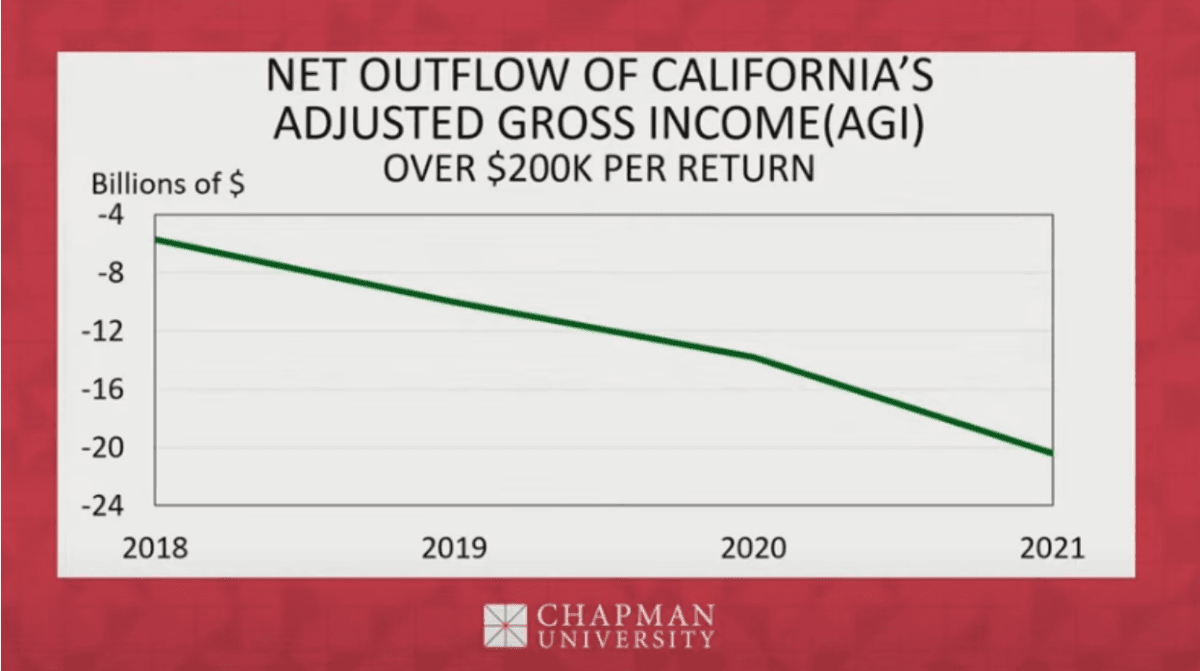

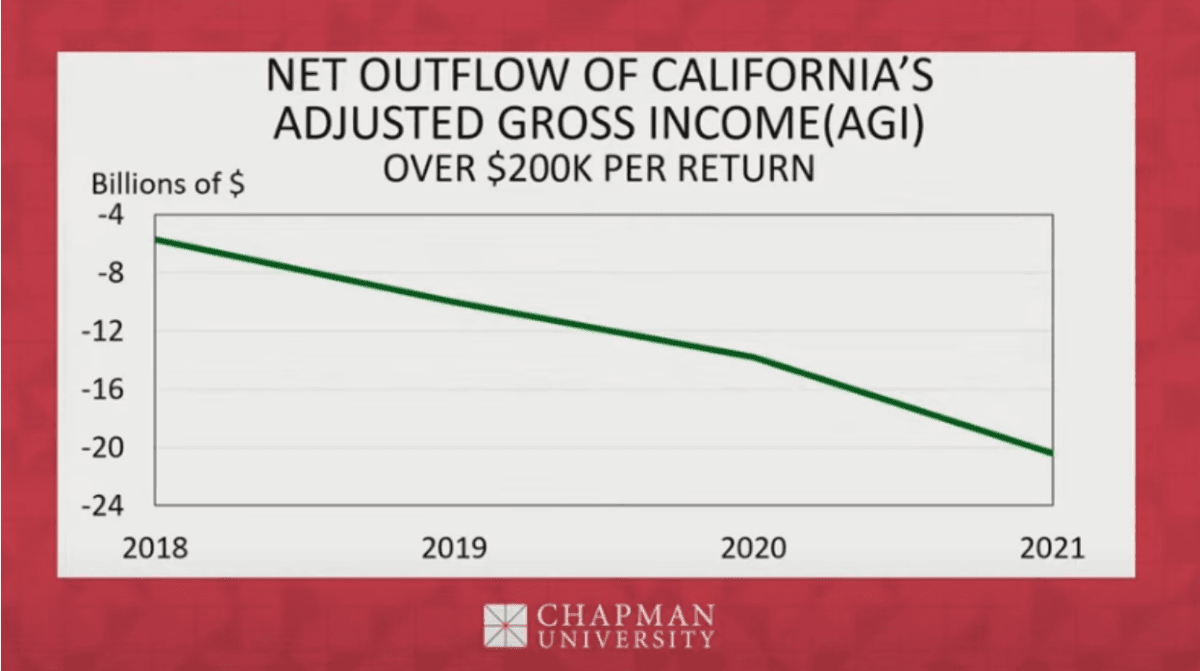

This next chart is shocking. It shows the outflow of those making $200,000 or more, compared to the inflow. Notice the huge gap of $20 billion, rising from $5 billion as recently as 2018. There’s no indication this is stopping, or even slowing.

(Screenshot via YouTube/Chapman University)

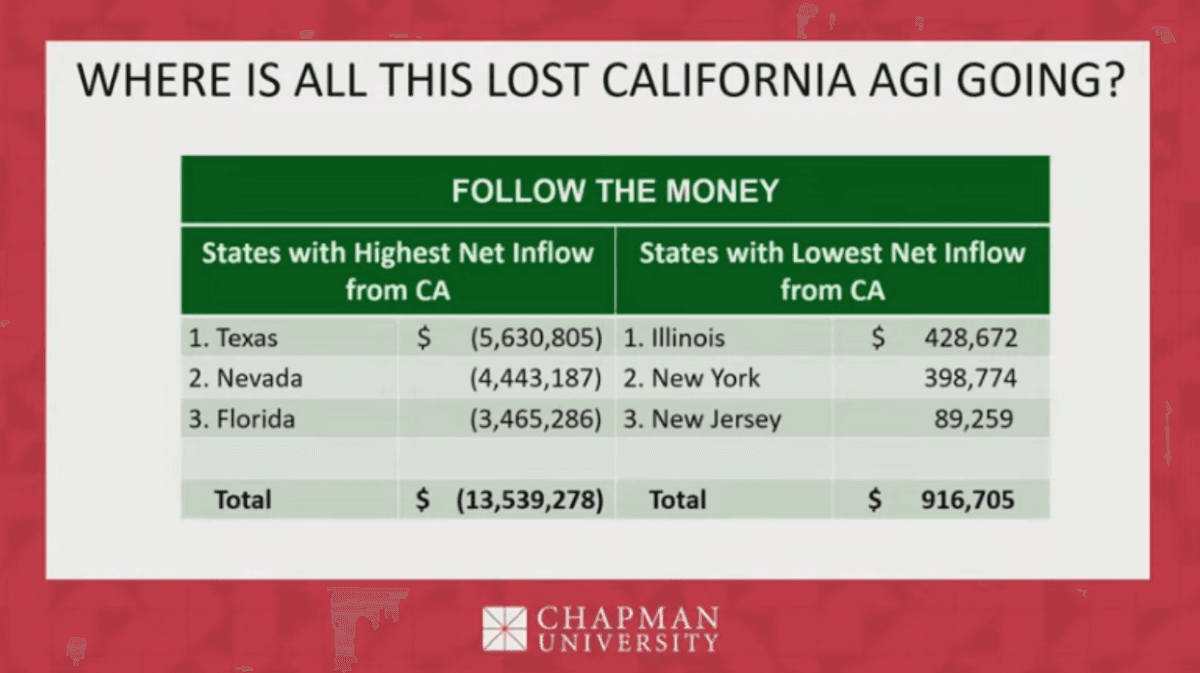

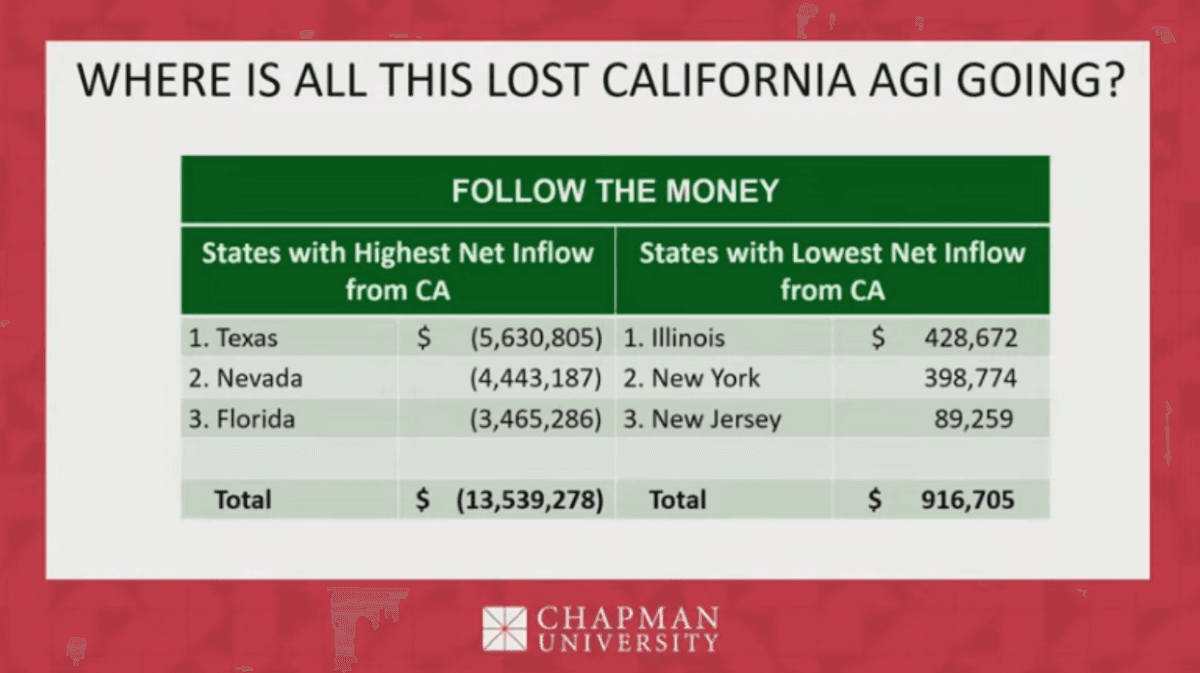

Doti asked, “Where are all those people going?” Here’s where:

(Screenshot via YouTube/Chapman University)

He pointed out the three top states to which Californians fleeing each has a 0.0 percent state income tax rate. Compared to a top rate of 13.3 percent in California—where even the middle class pays 9.3 percent.

Doti also pointed out the three states to which Californians are least likely to flee—Illinois, New York, and New Jersey—are the only three with higher taxes than California.

Conclusion: Be Prepared

Recessions come and go. If you can figure them out, you can become a billionaire.

But the prudent family, business, or government prepares for them by paying down debt, making sensible investments, reducing spending, and trying to make income secure and steady.

California has done none of those things. Although the state economy might seem stable and prosperous now, it looks like that soon will change, and the state again will get hammered by high deficits and above-average unemployment.

John Seiler’s email: writejohnseiler@gmail.com