Commentary

Several economic indicators are flashing warning lights for a recession in California. Unlike the 2020 recession, which ended as quickly as the COVID-19 restrictions were lifted, this one would be more structural. Some indicators:

1. Allen Buchanan, a principal with Lee & Associates Commercial Real Estate Services in Orange, is warning of price reductions for logistics buildings. These are distribution hubs for retailers. The most visible such warehouses are for Amazon and other online retailers. The lower demand indicates slackening sales to consumers.

He wrote on June 8, “Before June 2022, these boxes were devoured by hungry occupants even before construction was completed. Now, they sit. In some cases, for months. Those deals that have transacted are much less than the halcyon days of two years ago. Now, a creditworthy tenant can expect to pay $1.75-$1.85 triple net for the same address that not too long ago commanded a 17 percent higher rent.”

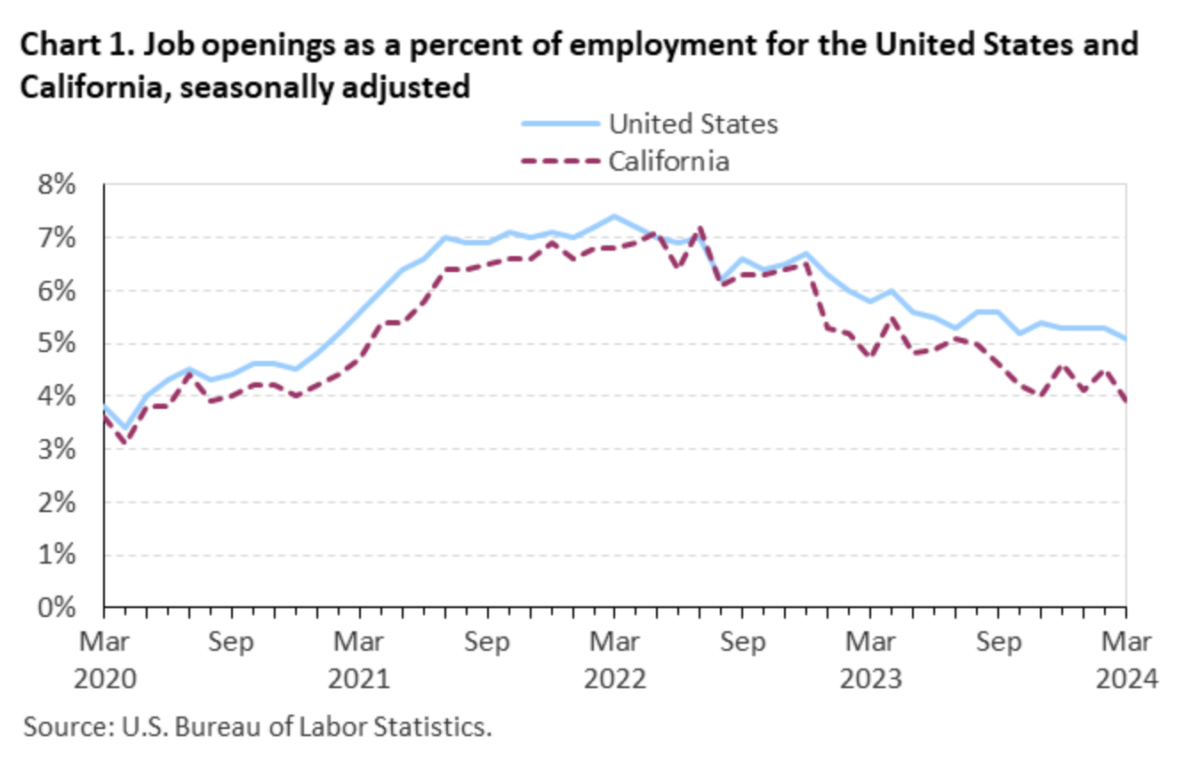

2. The U.S. Bureau of Labor Statistics reported on May 24 that job openings dropped to 734,000 in March from 853,000 in February. According to the Bureau’s regional commissioner, Chris Rosenlund, job openings as a percent of employment dropped to 3.9 percent in March from 4.5 percent in February. (Higher is better.) Below is the Bureau’s chart comparing California’s rate to the national rate.

3. Rubio’s abruptly announced it was closing 48 California restaurants. Too bad, because it has been one of my favorites for decades.

“According to several reports from employees on Reddit, the closures came as a surprise,” Nation’s Restaurant News reported on June 3. “The Carlsbad-based company said in a statement that the decision to close these restaurants came in part because of the current business climate in the state, while also citing the locations’ underperformance.

“Though not cited directly, ‘current business climate in the state’ could in part be referencing California’s AB 1228 law, which went into effect April 1. The law raised the minimum wage to $20 an hour, equating to a 25 percent increase from the previous minimum wage. Since then, several chains have raised their menu prices, while some operators have vowed not to consider the state for expansion. In January, two California-based Pizza Hut franchisees laid off delivery workers ahead of the hike.”

4. The California Business and Industrial Alliance estimated that nearly 10,000 fast-food workers have been fired due to AB 1228, the fast-food minimum wage law passed last year.

5. Blaze Pizza announced it was moving its headquarters to Atlanta from Pasadena.

“This strategic move is expected to reduce the company’s state corporate tax rate substantially, a decisive factor that underscores the broader trend of business migrating for more favorable economic climates,” MSN reported on June 9. The company has been “a cornerstone in the region with about a third of its over 300 locations based there. Despite its deep roots, the decision to move reflects a strategic pivot toward markets that support growth and economic viability.”

The Tax Foundation lists California’s top marginal corporate income tax rate in 2024 at 8.84 percent, sixth highest among the 50 states, while Georgia’s is 5.75 percent, 31st highest.

The marginal top income tax rate is even more dramatic. The Tax Foundation lists California’s as 13.3 percent. However, a tax increase this year actually raised that to a 14.4 percent top rate, plus a shockingly high 10.4 percent for the middle class.

Meanwhile, Georgia levies only a 5.49 percent flat tax. That’s scheduled to drop to 4.99 percent in 2029.

‘There’s Always a Bottom Line’

I have a saying: “There’s always a bottom line.” In a family, a business, or a government, when costs rise above income, there’s a problem. The state of California itself is dealing with a “budget problem”—Sacramento parlance for a deficit—for the fiscal year 2024-25, which begins on July 1. Years of overspending, with tax-paying businesses continuing to leave, has caught up with the state.

Meanwhile, other states are improving their competitive business environment by cutting taxes and regulations. In addition to Georgia’s tax reduction, mentioned above, the Tax Foundation lists recent income tax cuts by Arizona (to a 2.5 percent rate), Idaho (5.8 percent), Iowa (3.9 percent), and Mississippi (4 percent). All are flat taxes, meaning everyone pays the same low percentage.

As to the budget, one of the final battles was reported by the Sacramento Bee on June 11: “In a tough budget year with the administration and lawmakers grappling with a $45 billion deficit, after years of increasing investments in child care for the Golden State’s low-wage earners, Newsom wants to hit pause for an indefinite period toward achieving an agreed-upon 200,000 subsidized child care slots by 2026. The proposal would freeze the number of available slots at 119,000 and also claw back funding for some 11,000 additional slots already authorized, saving $1.4 billion over two years.”

But the thing is, if this state weren’t so expensive, it would be easier for parents to take care of their kids themselves. If the recession warnings listed above continue, and more start flashing, then more lower-income people will start losing their jobs. It’s even harder taking care of children while standing in an unemployment line.

California’s unemployment rate for April was 5.3 percent, above the national 4.0 percent rate. However, a recession usually pushes California’s rate much higher than the national rate. For example, in the recession year 2010, California’s average rate was 12.4 percent, sharply higher than the national rate of 9.6 percent. That also came after a large tax increase, a record $13 billion signed into law in 2009 by Gov. Arnold Schwarzenegger.

A new recession later this year could hit just as hard.