UnitedHealth Group uses aggressive tactics to maximize federal payments by capturing high-paying, often discretionary, medical diagnoses, according to a report by the Senate Judiciary Committee.

The insurer uses high-tech scanners and a team of specialists to identify problems in enrollees—including minor ones—to ensure the insurer obtains the maximum funding possible, even if that money is not used to treat the added diagnoses, according to the Jan. 12 report.

Medicare Advantage is an alternative to traditional Medicare that is operated by commercial insurance companies, which are paid a fixed monthly fee per person based on the health condition of the enrollee. The provision of additional funds for enrollees diagnosed with more expensive health conditions is called risk adjustment.

Report Findings

The Senate’s inquiry began in February when Sen. Charles Grassley (R-Iowa) requested documents from the company’s CEO about its Medicare business.

UnitedHealth provided more than 50,000 pages of records, which included internal training materials, policies, software documentation, and audit tools.

After reviewing the records, Grassley’s Oversight and Investigations unit—part of the Judiciary Committee—revealed that “[UnitedHealth] has turned risk adjustment into a major profit-centered strategy,” which was not the original intent of the program.

The insurer utilizes a “robust workforce,” comprising a large team of doctors, nurse practitioners, and professional coders, to find as many diagnoses as possible, the report found. The company also uses advanced data analytics and artificial intelligence to scan billions of medical records, identifying patients who may have “untapped” illnesses that could lead to higher government payments.

The report lists specific medical conditions—such as certain types of heart disease, dementia, and malnutrition—that UnitedHealth encourages its staff to capture or document.

The company uses broader or more discretionary criteria than are typically used by doctors to label patients with these diseases, which increases the patient’s risk score and results in higher monthly payments from the government, the report stated.

In one example, UnitedHealth directed its providers to diagnose patients with “alcohol use, unspecified with unspecified alcohol-induced disorder” when an alcohol disorder is present but it cannot be determined that the patients meet definitive criteria for either “abuse” or “dependence.”

Software automatically applies these labels and requires providers to code any history as “in remission” every year. These potentially inaccurate, payment-boosting diagnoses can follow a patient permanently, according to the report.

The average risk score for Medicare Advantage patients at UnitedHealth was estimated to be 0.28 points higher than that of traditional fee-for-service Medicare, resulting in significantly higher government spending—approximately $643 more per member per year compared to the industry average.

The Senate inquiry found that UnitedHealth also sells its billing insights and services to other Medicare Advantage organizations, which suggests that the company’s aggressive methods are spreading across the entire Medicare Advantage industry.

UnitedHealth Statement

UnitedHealth Group did not respond directly to the Judiciary Committee’s report but issued a statement the same day, citing studies that it had commissioned to argue that Medicare Advantage saves money for both the government and beneficiaries.

The statement said that Medicare Advantage saved $1,400 per member per year compared to traditional Medicare, and that out-of-pocket costs are 53 percent lower than in traditional Medicare for a typical senior who has traditional Medicare along with private add-on insurance.

“UnitedHealth Group is proud to work with policymakers and other stakeholders to protect and strengthen the [Medicare Advantage] program, and research like this is one of many ways the company demonstrates its commitment to care and lives its mission of helping people live healthier lives and making the health system work better for everyone,” the statement reads.

UnitedHealth Group is by far the largest Medicare Advantage organization, covering 29 percent of program enrollees—nearly 10 million—in 2023, according to the report.

It is the third-largest company in America by revenue, with two distinct but complementary businesses—Optum and UnitedHealthcare.

Medicare Advantage

Medicare Advantage plans, formally known as Medicare Part C, provide enrollees with Medicare Part A (hospital) and Part B (medical) coverage. Some plans include Medicare Part D (prescription drug) coverage, as well as other benefits such as vision and dental coverage.

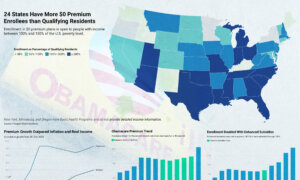

More than 33.6 million people—more than half of all eligible beneficiaries—were enrolled in Medicare Advantage in 2024.

Medicare enrollment is highly concentrated among a few major companies. UnitedHealth Group and Humana together account for nearly half of Medicare Advantage enrollees.

“Medicare Advantage is an important option for America’s seniors, but as the program adds more patients and spends billions in taxpayer dollars, Congress has a responsibility to conduct aggressive oversight,” Grassley said in a statement.

“Taxpayers and patients deserve accurate, clear-cut, and fair risk adjustment processes.”

Rep. Lloyd Doggett (D-Texas) cited data in a July hearing indicating that taxpayers would pay $84 billion more in 2025 to cover beneficiaries enrolled in Medicare Advantage compared to what they would have paid if they had chosen traditional Medicare.