It’s been three months since President Donald Trump introduced sweeping global tariff plans that upended international trade. During this period of uncertainty, businesses have proactively responded by reassessing prices and adjusting supply chains.

Shortly after announcing reciprocal tariff rates on U.S. trading partners, Trump issued a self-imposed 90-day deadline, implementing a baseline universal tariff rate of 10 percent, giving businesses a bit more time to acclimate to changes in global commerce.

All eyes were on July 9, but the president confirmed over the Fourth of July long weekend that he would extend the deadline to Aug. 1, allowing administration officials more time to reach trade agreements. Trump has made some trade deals—with the United Kingdom, China, and Vietnam—and has sent letters to more than a dozen nations, including Japan and South Korea, informing them of double-digit tariff rates.

Global financial markets are closely monitoring U.S. tariff developments, but businesses worldwide are still recovering from the rollercoaster ride that has taken place over the past few months. From diversifying their supply chains to accelerating imports, companies hoped for the best and prepared for the worst.

“There are many crosscurrents surrounding tariffs, immigration and deregulation, and everyone is sorting through what the tariff rates are going to be, how they will impact inflation for retail products and, importantly, how long they will be in place,” Jack Kleinhenz, the chief economist for the National Retail Federation, said in a statement.

In recent months, supply chains and pricing dynamics have been at the forefront of business operations.

The Price Is Right—or Wrong

Some companies were forthright about their plans to raise prices. Others stated that they intend to absorb tariff-related costs. Many smaller companies are balancing the risks between increasing their prices and eating the tariffs.

The Federal Reserve’s Beige Book—a periodic report of economic conditions across the U.S. central bank’s 12 districts—highlighted that tariff rates were applying “upward pressure on costs and prices.”

“However, contacts’ responses to these higher costs varied, including increasing prices on affected items, increasing prices on all items, reducing profit margins, and adding temporary fees or surcharges,” the report said. “Contacts that plan to pass along tariff-related costs expect to do so within three months.”

In June, New York Fed economists reported that most businesses were passing at least some of the tariff-related costs on to their customers.

Research by the Atlanta Fed determined that if firms pass all the costs of tariffs to their customers, retail prices would rise by as much as 1.6 percent.

This past spring, Walmart, the world’s largest retailer, said it was preparing to increase prices almost immediately.

“We will do our best to keep our prices as low as possible. But given the magnitude of the tariffs, even at the reduced levels announced this week, we aren’t able to absorb all the pressure given the reality of narrow retail margins,” Walmart CEO Douglas McMillon said in an earnings call.

In its first-quarter earnings report, Stanley Black & Decker announced that it would start raising prices on its tools, home, kitchen, and outdoor products, saying it notified its customers “that further price action is required.”

Toymaker Mattel confirmed that it would increase prices because of tariffs. Electronics retailer Best Buy expects vendors in all categories will pass some of the tariff costs to retailers, “making price increases for American consumers highly likely.”

Shopping carts outside a Home Depot in Philadelphia, Pa., on Sept. 21, 2022. (Matt Rourke/AP Photo)

Other retail giants have resisted price hikes over tariffs.

Home Depot Chief Financial Officer Richard McPhail told CNBC in May that the company will “generally maintain” its current pricing levels.

Solid relationships with suppliers and recalculating inventory order times have allowed Target to mitigate most tariff pressures.

“We have many levers to use in mitigating the impact of tariffs, and price is the very last resort,” Target CEO Brian Cornell noted on a May 21 earnings call. “Our strategy is to remain price competitive by leveraging the capabilities, long-standing relationships, and the scale that set us apart from many of our retail peers.”

Kimberly-Clark, a consumer goods titan that controls well-known brands like Scott and Kleenex, says a majority of its operations are based in the United States, and it is not facing significant tariff challenges.

So far, tariff-related inflation has not been reflected in the economic data, as consumer prices and wholesale inflation have remained low. Economists and monetary policymakers predict that tariff-driven sticker shock will begin to appear this summer, particularly as inventories become depleted and businesses purchase more from abroad to replenish their stocks.

Still, the public’s inflation outlook has stabilized and returned to pre-tariff levels. The New York Fed’s latest Survey of Consumer Expectations showed that the one-year inflation outlook declined to a five-month low of 3 percent in June from 3.2 percent in May.

Supply Chain Diversification

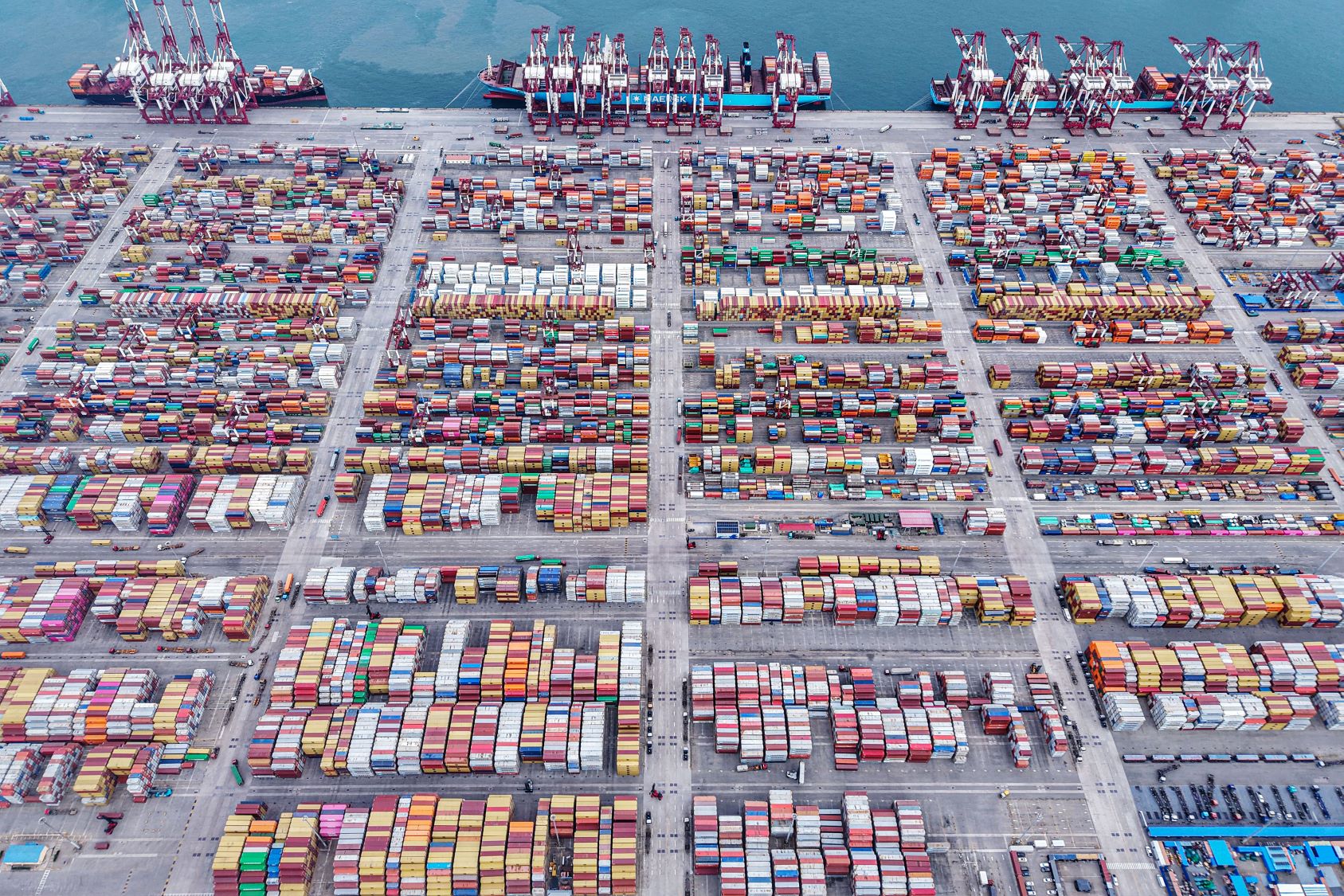

Leading up to the April 2 trade announcement, shipping data revealed companies were front-loading their imports to avoid punitive tariffs. However, firms have done more than accelerate their foreign purchases to beat the tariff deadline.

One significant decision was rerouting supply chains from China to avoid tariffs.

A recent study by global credit insurer Allianz Trade found that 60 percent of exporting firms in the United States, Europe, and Asia were transitioning their supply chains to Latin America and Western Europe.

“Latin America is emerging as a winner, with firms continuing to seek access to the US at lower cost,” the report said.

Meanwhile, an April survey by B2B software firm Zilliant found that 42 percent of U.S. businesses were shifting suppliers or sourcing regions because of the president’s trade policy changes.

Companies have been open about these adjustments.

During a May 5 earnings call, Clorox Chief Financial Officer Luc Bellet stated that the company is considering implementing changes to sourcing and product formulation to mitigate the impact of hefty tariff charges.

“Now, obviously, we already started working on mitigations and working at a broad set of levels,” Bellet said. “We’re looking at changing sourcing. We’re looking at potential reformulations.”

Apple projects a $900 million tariff-related hit in the current quarter. This has prompted the tech behemoth to shift U.S.-bound iPhone production from China to India and Vietnam, marking a significant shift in its supply chain.

Trump warned Apple in May that it would have to pay a tariff of 25 percent or more for iPhones manufactured outside the United States. He also said he told Apple CEO Tim Cook, “I don’t want you building in India.”

The iPhone 14, iPhone 14 Pro, and iPhone 14 Pro Max displayed at the Apple Fifth Avenue store in New York on Sept. 16, 2022. (Yuki Iwamura/AP Photo)

Scores of U.S. and foreign companies have announced plans to invest more in domestic manufacturing to avoid levies, ranging from overseas automakers to multinational tech giants.

If the coronavirus pandemic were not enough, the tariffs forced companies to enhance their supply chain resilience, ING economists said.

“Alongside ongoing reliability challenges, companies are increasingly prioritising diversification and resilience strategies,” they wrote in a May research note. “Many are exploring multi-sourcing, maintaining security stocks, and considering alternative transport solutions such as air cargo—though cost constraints make this more viable for larger firms than smaller ones.”

Made in America

The current administration’s goal has been to resurrect products made in America. Although corporations worldwide have signaled their plans to manufacture more in the world’s largest economy, reshoring all operations might be easier said than done after 30 years of outsourcing and globalization.

An April CNBC supply chain survey found that nearly 400 companies believe tariffs are unlikely to bolster supply chains in the United States, primarily because of higher costs and labor challenges. Even if reshoring trends persist, it will be a multi-year initiative rather than a short-term fix.

ING economists said the “frenetic pace of U.S. trade policy” will likely persist, leaving global commerce in limbo.

“This situation could drag on for most of the year and will only increase the need for resilience.”