The U.S. labor market has been weaker than initially reported over the past year, according to updated Bureau of Labor Statistics data released on Sept. 9.

The federal agency published preliminary annual revisions to its nonfarm payroll data after gathering more comprehensive employment information.

For the third consecutive year, annual job growth was cooler than first estimated.

Job Growth Overstated

For the year ending in March, the U.S. economy added 911,000 fewer jobs than the Bureau of Labor Statistics initially estimated, marking the largest annual revision to national employment data on record.

This represents a 37 percent decline from the bureau’s original estimate of approximately 2.4 million new jobs last year.

It also accounts for a 0.6 percent share of overall employment, which is higher than the 10-year average for annual revisions of 0.2 percent.

The private sector accounted for virtually all of the downward revisions, totaling 880,000.

This was led by leisure and hospitality (down 176,000), professional and business services (minus 158,000), retail (down 126,200), and wholesale trade (minus 110,300).

Transportation, warehousing, and utilities were the only two sectors to see upward changes: 6,600 and 3,700, respectively.

Government payrolls were adjusted lower by 31,000.

The bureau will publish the final annual benchmark revisions in February 2026.

3 Years of Downward Revisions

Before revisions, monthly payroll gains averaged 146,500 during this span. Following these updates, the per-month average will be approximately 70,500.

Similar changes were observed in the previous two years.

In last year’s report, the bureau revised job growth lower by 818,000, or 30 percent, in the 12 months through March 2024.

This reduced the final tally to around 2.1 million from 2.9 million and altered the average monthly employment gain to 174,000 from the initial estimate of 242,000.

Likewise, the preliminary benchmark payrolls revision for March 2022 to March 2023 highlighted 306,000 fewer jobs—a 7.5 percent reduction in reported job growth.

Still, the U.S. economy added about 3.7 million jobs in those 12 months, although many of the gains were recouped from the pandemic.

How We Got Here

Since 1935, the Bureau of Labor Statistics has performed annual benchmark revisions.

While the process and methodology have evolved from the Great Depression, officials continue to rely on comprehensive datasets to determine more accurate employment trends.

The bureau compares its monthly survey-based non-farm payroll estimates—Current Employment Statistics (CES)—to the more detailed but lagging Quarterly Census of Employment and Wages (QCEW), which provides quarterly unemployment insurance tax filings.

In the latest report, the federal agency acknowledged that the primary contributors to overestimated job growth were “response error and nonresponse error.”

“First, businesses reported less employment to the QCEW than they reported to the CES survey (response error),” the bureau stated.

“Second, businesses who were selected for the CES survey but did not respond reported less employment to the QCEW than those businesses who did respond to the CES survey (nonresponse error).”

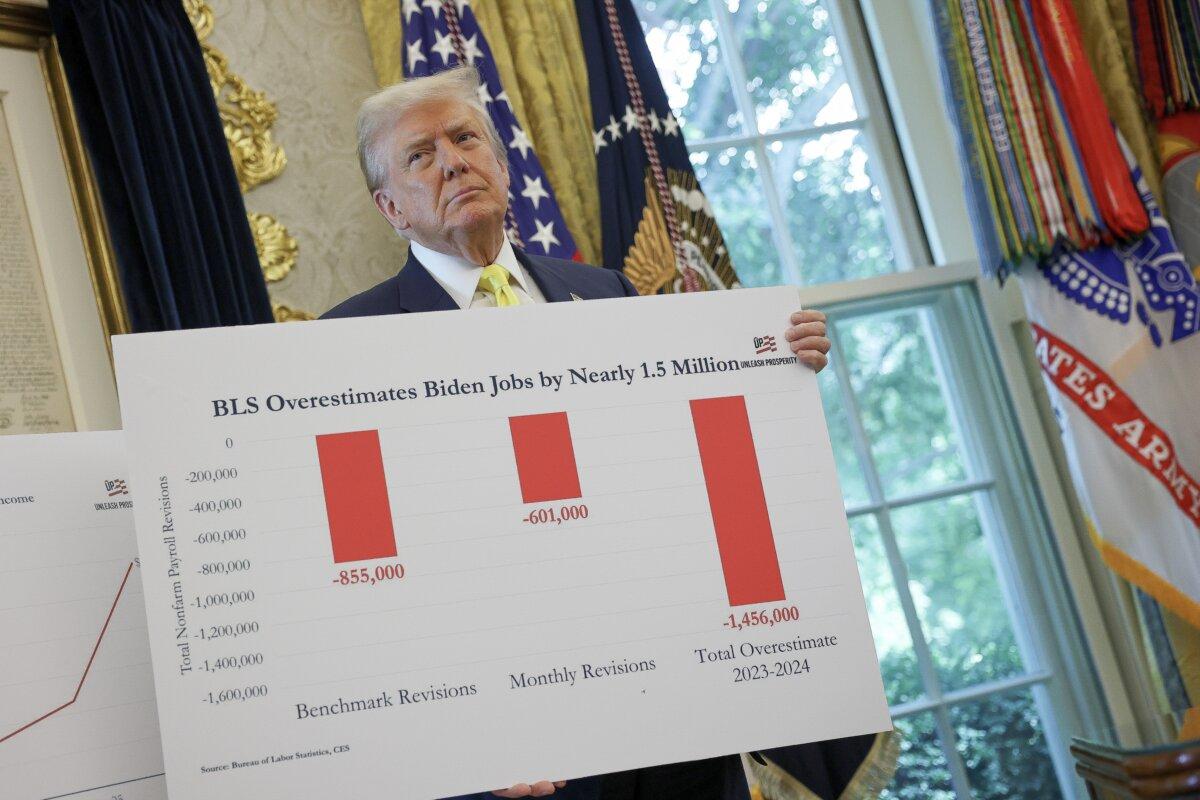

President Donald Trump holds a poster that reads "BLS Overestimates Biden Jobs by Nearly 1.5 Million" in the Oval Office in Washington on Aug. 7, 2025. (Win McNamee/Getty Images)

The net birth-death model—a statistical estimate of new business formation and closures—might have also influenced the data.

Since the bureau surveys existing companies, researchers might miss newly established businesses and potentially underrepresent shuttered firms.

In the 2024 report, for example, the model overestimated the number of jobs created by new firms and failed to account for an acceleration in business closures.

Ultimately, the Bureau of Labor Statistics (BLS) requires a change in its data-collecting practices, says Labor Secretary Lori Chavez-DeRemer.

“Leaders at the bureau failed to improve their practices during the Biden administration, utilizing outdated methods that rendered a once reliable system completely ineffective and calling into question the motivation behind their inaction,” Chavez-DeRemer said in a statement shortly after the benchmark revisions were released.

“We are committed to finding solutions to these problems, including by modernizing to improve transparency and deliver more accurate and timely data for American businesses and workers.”

Policy Implications

Federal Reserve Chair Jerome Powell and several of his colleagues have focused their attention on the U.S. labor market, warning that conditions could deteriorate rapidly.

Fed Governor Christopher Waller, who supported cutting interest rates at the July policy meeting, argued that data and the lag effect of monetary policy suggested restarting the central bank’s easing cycle that began in September 2024.

“My final reason to favor a cut now is that while the labor market looks fine on the surface, once we account for expected data revisions, private-sector payroll growth is near stall speed, and other data suggest that the downside risks to the labor market have increased,” Waller said in an Aug. 1 statement defending his view.

The bureau’s revisions reveal that the employment situation was already stalling before President Donald Trump’s global tariffs, and experts say the economy now requires a faster response by the Fed.

“These numbers are worse than expected, and they reinforce the call for bold and aggressive action by the Federal Reserve when they meet next week,” Dan Varroney, CEO of Potomac Core Consulting, said in a note emailed to The Epoch Times.

White House press secretary Karoline Leavitt says the central bank “has officially run out of excuses” and must lower the benchmark federal funds rate immediately.

“This is exactly why we need new leadership to restore trust and confidence in the BLS’s data on behalf of the financial markets, businesses, policymakers, and families that rely on this data to make major decisions,” Leavitt said in a statement.

“Much like the BLS has failed the American people, so has Jerome ‘Too Late’ Powell—who has officially run out of excuses and must cut the rates now.”

The Fed will meet later this month, and investors overwhelmingly anticipate policymakers will vote to reduce the key policy rate by a quarter point from the current target range of 4.25 percent to 4.5 percent, according to the CME FedWatch Tool.

While the odds of a super-sized half-point cut are low, Treasury Secretary Scott Bessent thinks it should be considered.

Last month, in an interview with Bloomberg Television, Bessent stated that interest rates should be as much as 175 basis points lower.

“There’s a very good chance of a 50 basis point rate cut. We could go into a series of rate cuts here, starting with a 50 basis point rate cut in September,” he said.

“If you look at any model, we should probably be 150, 175 basis points lower.”