The House Select Committee on the Chinese Communist Party stated on Oct. 7 that key semiconductor manufacturing equipment (SME) companies have sold China the tech it needs to fuel its military modernization on a “large-scale” basis.

The lawmakers released a report on Oct. 7 that highlights how China remains one of the biggest customers in the chips supply chain despite years of increasing restrictions.

“China is still buying vast quantities of highly sophisticated SME from the United States, Japan, and the Netherlands,” the report reads.

Chinese firms bought semiconductor manufacturing equipment worth more than $38 billion in 2024, according to the report, and did so legally. About $26.2 billion of these sales were to Chinese state-owned enterprises.

The report, a result of months of discussion with the toolmakers, does not focus on any illegal activity, such as export control evasion, but shows a gap between strategic goals and commercial activity.

The lawmakers recommend export controls that apply to China at large, rather than the current strategy of targeting specific companies.

Highly Specialized Equipment

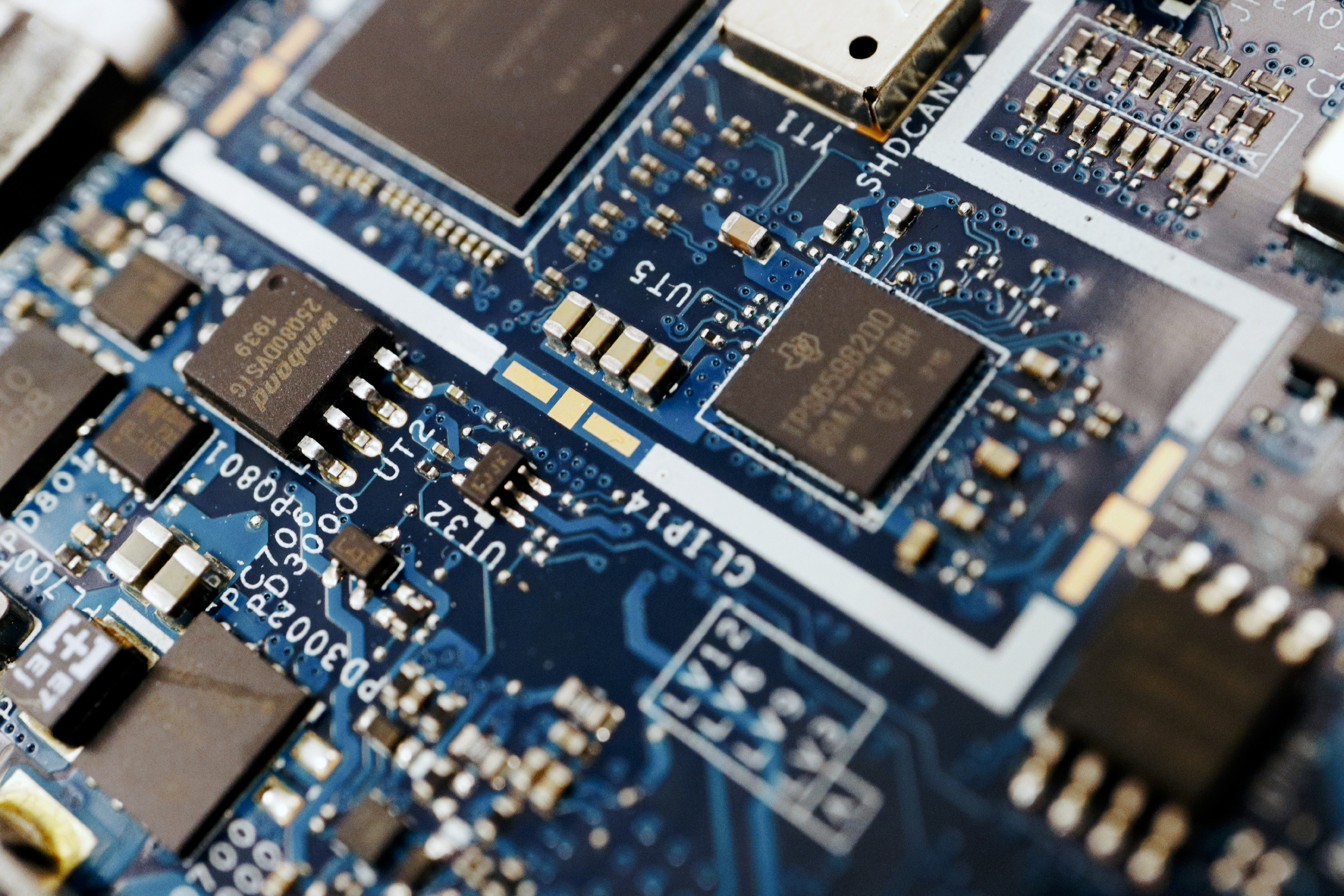

Chips are measured in nanometers, and the most advanced are the smallest. With layers the width of an atom, chip manufacturing requires highly specialized equipment made by a handful of companies around the world.

The report highlights five of these companies, which made 39 percent of their worldwide revenue from China in 2024. This represents a 56 percent increase in the share of revenue from China in 2022.

U.S.-based Applied Materials sells several SME tools, including ones for etching, deposition, and inspection. It received 36 percent of its 2024 revenue from China.

Dutch company Advanced Semiconductor Materials Lithography is the leading lithography toolmaker, known for its extreme ultraviolet lithography technology. It received 36 percent of its 2024 revenue from China.

U.S.-based KLA Corp. sells a variety of SME tools but specializes in process-control and process-enabling tools. It received 44 percent of its 2024 revenue from China.

U.S.-based Lam Research Corp. sells several tools, including those for etching, deposition, and cleaning. It received 42 percent of its 2024 revenue from China.

Japanese company Tokyo Electron makes tools for coating, developing, etching, deposition, and cleaning. It received 44 percent of its 2024 revenue from China.

“If [China] could get this equipment elsewhere or build it within [China], it would,” the report reads. “But it can’t—for now.”

The report notes that the customers include “restricted entities.” These are companies of concern. U.S. agencies may require businesses to obtain licenses in order to sell to these companies, but they do not denote illegal activity.

For example, each of the five SME companies has sold to Chinese state-owned Semiconductor Manufacturing International Corp. Other companies include Huawei subsidiaries and companies with close ties to the Chinese military.

The report notes that from 2022 to 2024, U.S.-based companies’ shares of revenue from restricted entities decreased, but non-U.S. companies’ sales to restricted entities grew by nearly 50 percent.

China’s Chipmaking Problem

The first Trump administration began the U.S. trend of restricting China’s access to the most advanced chip technologies—both the chips themselves and the specialized equipment needed to manufacture them—for national security reasons.

In 2024, China imported $385 billion in chips, up by 10 percent year-over-year, according to Chinese customs data, stockpiling the tech before new export controls kicked in.

Chinese companies have, over the years, also found illicit ways to get their hands on restricted chips, but Chinese authorities have come out more strongly recently in pushing Chinese companies to use domestically made chips.

To do that, Chinese companies need more advanced chips, and Chinese chipmakers need equipment that China cannot produce domestically.

The Chinese communist regime, as outlined in its Made in China 2025 plan, envisions a fully self-sufficient supply chain by 2030. To that end, Chinese chipmakers have raised and invested billions of dollars in the past few years.

“SME represents a crucial chokepoint that the U.S. and our allies currently have over China,” the report reads.

“As the U.S. government works with our allies and partners and plots the course ahead on export control policy and related actions, this crucial chokepoint must be preserved, not squandered.”