Commentary

It’s Christmas season, a time when retailers enjoy a peak season as they meet the holiday demand. As California has the highest base sales tax rate in the nation, it would be interesting to look at one of its most populated counties and then focus on some of its 34 cities.

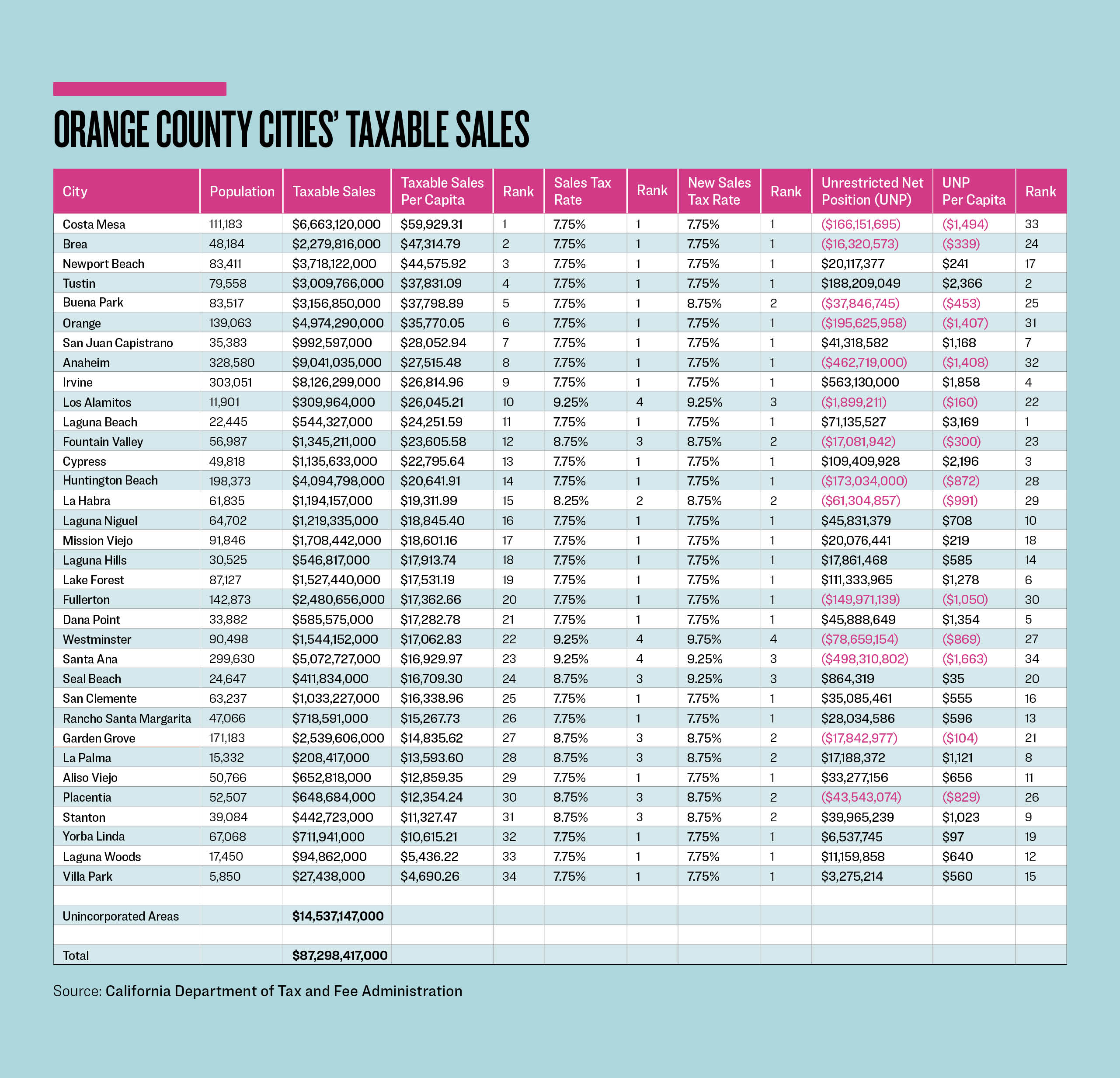

In 2023, Orange County saw $87.3 billion in taxable sales. The sales taxes generated helped partially fund its cities and its transportation authority, which operates its bus services and a good portion of the major road construction projects.

The chart below provides the county’s 34 cities, the taxable sales generated within their borders for the year 2023, and their financial status rankings for the same year.

Costa Mesa dominates as the taxable sales powerhouse on a per capita basis. This is thanks to South Coast Plaza, Harbor Boulevard new and used car dealerships, and other retail venues that this city between Newport Beach and Huntington Beach offers.

The city of Anaheim, with Disneyland, the Convention Center, Angel Stadium and the Ducks hockey stadium produces the largest amount of taxable sales, some 10.4 percent of the total for the county.

Although Costa Mesa pulls down three times the average ($26,526) and mean ($19,977), it finds itself at the bottom of the fiscal health rankings (see “Most OC Cities Financially Stable, While One Seeks Sales Tax Increase,” July 8, 2024). While cities with minimal retail activities, like Laguna Woods, which is gated, and Villa Park, which is mainly residential and surrounded by the city of Orange, have balance sheets that are in the top half of the 34 cities.

Costa Mesa has a debt problem, but thanks to its high sales tax revenue, it marches on as if all is well. And currently, it is. South Coast Plaza (SCP) reportedly generates one third of its taxable sales, generating more than $2 billion per year, and this may be a conservative amount, since it was mentioned during its 55th anniversary in 2022. It enjoys more than 20 million visitors from around the world every year as one of California’s major tourist destinations and competes aggressively with Rodeo Drive in Beverly Hills in attracting luxury shoppers.

Like the state of California, which has also enjoyed strong growth in annual revenues, their annual budgets have not concentrated on reducing their debts, specifically their unfunded pension and other post-employment benefit liabilities.

So, if anything should happen to the taxable sales revenues of either government, they will incur budget deficits. And if the decline in sales is due to an economic downturn, then the pension system may also incur investment losses, further exacerbating fiscal demands. That is why the first concern is a recession. Taxable sales decline when national or international economic downturns occur.

A second concern is internet sales. Shopping trips will slow down if individuals decide to hold onto their disposable income until the economy returns to former encouraging levels. One advantage that this mega-retail location has is that many of the wealthiest of the world are immune to economic cycles and can still afford high-end products. But going online is also an option. Fortunately, it doesn’t seem to have made a harmful impact on this retail dynamo.

A third concern is another pandemic. It was eerie to see empty parking lots at SCP for weeks and months, due to the COVID-19 lockdown.

The fourth concern is fear. In November, California voters passed Proposition 36, which will reform Proposition 47 (2014), an initiative that reduced shoplifting of goods worth $950 or less from a felony to a misdemeanor. This voter revolt could not have come sooner, as failing to crack down on such crime around the Golden State has had a massive impact on taxable sales revenues in the city and county of San Francisco.

Although SCP has its own security force, it has also been the victim of a flash mob, a shooting, and a recent parking lot luxury car owner robbery. This could discourage residents from enjoying a quality shopping experience.

The chart also provides the sales tax rates. Currently in California, the base sales tax rate is 7.75 percent. During 2023, 24 cities and Orange County, with its unincorporated areas, stayed at this level. Cities in California have few tax-increasing opportunities available, with bumping up local sales tax rates being the major one. Over the years, ten cities received voter approval to raise the rates, with La Habra at 8.25 percent, Fountain Valley, Garden Grove, La Palma, Placentia, Seal Beach, and Stanton at 8.75 percent, and Los Alamitos, Santa Ana and Westminster at 9.25 percent.

Retailers of high-end products, like furniture and jewelry, are probably not amused to be in a high sales tax rate city. When one buys a $10,000 item and pays 1.5 percent more, it means spending another $150. That may be fine if the buyer resides in the 9.25 percent city and considers it a charitable contribution of sorts. But if going to the city next door provides this form of discount, it easily covers the cost of the extra gasoline.

In the November election, five cities had sales tax increase measures on the ballot, Buena Park, La Habra, Orange, San Clemente, and Seal Beach. Three of the five were approved by the city’s voters. Orange and San Clemente’s voters did not provide the necessary two-thirds vote to assist their city’s budgets.

Westminster had a successful measure on the March Primary ballot, raising the sales tax to the legal limit of 9.75 percent. Being in 27th place for its fiscal standing, Westminster has historically been trying to dig out of a financial hole (see “Will Another Sales Tax Increase Really Help This Southern California City?” from Dec. 27, 2023).

The same can be said for Buena Park (25th place), La Habra (29th), and Orange (31st). Instead of reducing spending, the easy solution was to ask for more revenues. Seal Beach (20th place) is in fair shape, so a sales tax rate increase request is a head scratcher. But, asking for everyone to chip in to provide better public safety is a strong motivator that influences voters. Forget that the city’s leadership made the cost of public safety so expensive with generous employee benefit increases in prior years.

The largest city south of Orange County, San Diego, also attempted a sales tax increase in November. Being the worst fiscally managed city in San Diego County provides the explanation (see “Federal Coronavirus Funding Boosted San Diego County’s City Finances,” May 30, 2024).

San Clemente (16th place) requested a sales tax increase to purchase more sand for its beaches. Laguna Beach recently pursued a similar strategy to underground overhead electric power lines. The necessary two-thirds requirement was not met in both cases.

The big question will be whether the sales tax revenues for the 11 higher tax rate cities will go up by the recent increase in their rates, or if buyers will go to the 23 neighboring cities with the 7.75 percent rate in this suburban area that has the second highest density for a county in the state. What is the rate where diminishing returns occur? If the rate is increased, would it be possible for the actual revenues to decline?

Something tells me that the top seven strongest cities—Cypress, Dana Point, Irvine, Laguna Beach, Lake Forest, San Juan Capistrano, and Tustin—will not want to find out any time soon. Focusing on balanced budgets that aggressively pay down unfunded liabilities would be a better solution than admitting fiscal failure with the city’s leadership putting a sales tax increase measure on the ballot.