Commentary

The last of the 28 school districts in Orange County in Southern California has released its annual audit for the year ending June 30, 2023.

Magnolia School District’s audit was completed by its new outside independent Certified Public Accounting firm on Oct. 3, 2024, and released to the public on Nov. 4. The other 27 school districts completed their audits on or before Feb. 21 of this year.

Magnolia School District recently changed auditors, which caused the eight-month delay in providing the annual ranking of Orange County’s school districts. The reason for the change in auditors is a sad one.

In a written statement from the District’s Chief Business Officer, Bill Bailey, “The delay occurred due to an embezzlement scheme by a former employee that was discovered in August 2023. The former employee has been tried, convicted and is currently incarcerated for this crime. In May 2024 it was determined that it was necessary to change audit firms.”

The annual audit report provided by the district does not mention this incident, but the report for the current fiscal year ending June 30, 2024, may provide more details.

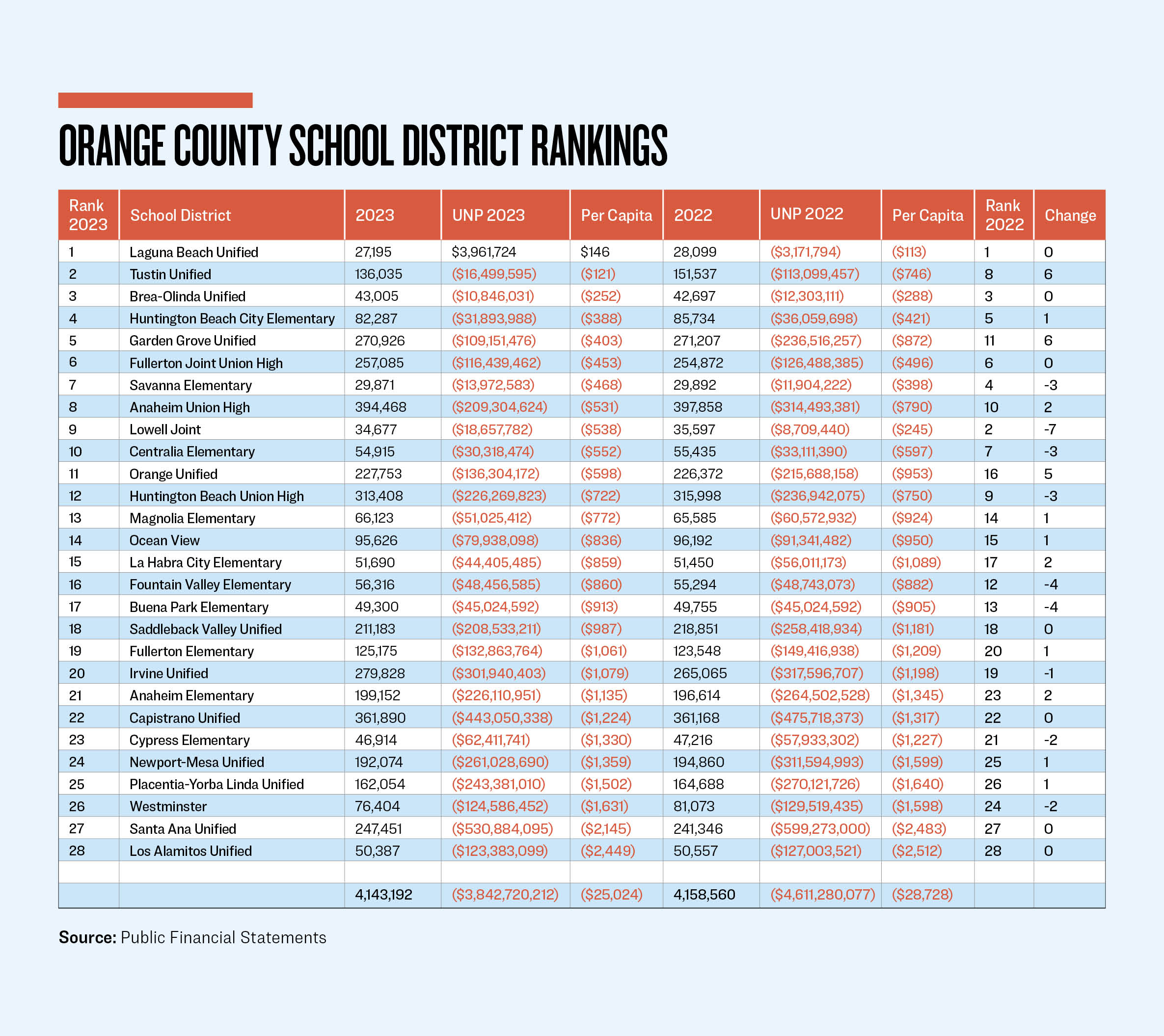

Now that all the audited financial statements are available, the big picture shows that the total unrestricted net position for all the districts improved by $769 million. This is probably due to the last of the federal coronavirus relief funding to local school districts. But it moved the overall needle in the right direction by 16.7 percent.

Those served by these districts saw a drop of 15,368 in population. However, some cities are served by more than one school district, which could overstate the actual net amount of individuals moving out of the county.

Recent accounting rule changes for governmental agencies have finally provided more accurate accounting of assets and liabilities. So audited financial statements from 2017 and on have been more useful in providing transparency for stakeholders that live within their boundaries. The one exception is that unfunded actuarial accrued liabilities are based on an estimate using assumptions that many may consider liberal, thus providing a lower amount for pension and other post-employment benefit obligations.

For those interested in reviewing prior year’s rankings, The Epoch Times has been the top provider of this critical financial data for its readers for the past few years. For 2019, see Most of Orange County’s School Districts Are in Debt, April 23, 2021. For 2020, see How’s Your Orange County School District Doing Financially?, Sept. 9, 2021. For 2021, see COVID Lockdowns Dealt a Huge Blow to OC School Districts’ Financial Health, Feb. 21, 2023. And for 2022, see Every School District in OC Improved Its Fiscal Health in 2022—Except for 2, June 19, 2023.

Why are the rankings important? The last thing stakeholders like are surprises, especially financial ones. The exercise of dividing a school district’s unrestricted net position by the population it serves provides a simple metric to compare against neighboring districts from the range that results.

Looking at the top Orange County school district, the residents of Laguna Beach should feel comfortable with the fiscal status of its Unified School District. In fact, LBUSD saw its unrestricted net position move into positive territory, the only school district in the county to do so. This is a district that also has a great relationship with its City Council.

How did the other 27 districts fare this past year? Three of the districts moved up five or more positions, one dropped seven places, two dropped by four places, and three dropped by three. So, let’s give them a look.

Despite losing school days due to the blimp hangar fire, Tustin Unified reduced its unrestricted net deficit by $96.6 million thanks to revenues exceeding expenditures by $71.7 million, due mainly to an increase in the Local Control Funding Formula (LCFF) of $26.2 million and an increase in property tax revenues of $16.2 million. The district also reduced its restricted assets by $30.5 million. But the real kicker was a source described as “Federal and state aid not restricted to specific purpose” of $89 million, exceeding the prior year’s amount by $14.8 million, a common trait for all of the districts. Combined, this helped move it into second place, moving up six places in the ranking.

Garden Grove Unified also moved up six places. This district reduced its unrestricted net deficit by $127.4 million through a similar story. Its revenues exceeded expenditures by $230 million, up $151 million over the preceding year, even though its expenditures increased by $107 million. Its LCFF was up by $86 million and other revenue sources were up by $108 million, but it moved $88 million of it into restricted funds.

Orange Unified had a busy year, including voting for parental rights and removing its superintendent. It would result in a union-led recall during the fiscal year. Orange Unified had $69 million in revenues in excess of expenditures, explaining the bulk of its $79.4 million reduction in its unrestricted net deficit, moving it up five places. The increase in LCFF and property tax revenues was also good for this district.

Lowell Joint School District dropped seven places and even removed its June 30, 2022, audited financial statements from its website to prevent those interested from analyzing the reasons for such a large fall. Fortunately, they provide the documents upon request. What did it reveal? Although revenues exceeded expenditures by $9.4 million, $19.5 million was moved into restricted assets, explaining the increase in its unrestricted net deficit of $9.9 million.

Now for those that fell three places. Savanna Elementary is one of the very few municipalities that does not have a webpage dedicated to listing its audited financial statements. To obtain them, one must email Eric Fano of Business Services for a copy. This district had revenues in excess of expenditures of $4.2 million, but added $6.8 million to its restricted assets, explaining why its unrestricted net deficit increased by $2 million.

Centralia Elementary, where I attended schools from 4th to 6th grade, and which has received distinguished school recognition, reduced its unrestricted net deficit by $2.8 million. But because Tustin Unified and Garden Grove Unified improved in a much stronger fashion, it dropped three places.

The same can be said for Huntington Beach Union High, which also reduced its unrestricted net deficit. But not as much as Orange Unified and Garden Grove Unified.

Fountain Valley Elementary, Buena Park Elementary, and Magnolia Elementary fell by standing still. Orange Unified and La Habra City Elementary moving up was the reason.

Newport-Mesa Unified moved up one position and even considered pursuing another bond measure, even though it committed to not doing so and self-funding for improvements when its last bond was approved by voters in 2000. Perhaps the current board should contact Mike Fine, the district’s chief business officer at the time, and now the chief executive officer of the Fiscal Crisis & Management Assistance Team (FCMAT). He may want to remind them that the proceeds from the sale of the district’s Banning Ranch property were to be used for building renovations.

Although Magnolia School District has been dealing with tragic fiscal drama, it actually moved up in the rankings. And even though Santa Ana Unified is near the bottom, its teacher’s union was successful in strong-arming its board for a raise. One of its board members also had some negative media attention during the current fiscal year.

With limited media coverage of school districts in Orange County, it’s important to determine how yours are doing. It’s unfortunate that Magnolia’s delay prevented the completion of the rankings at the time of the November election, and not in February, so you could have included fiscal performance by challenged incumbents on your ballot.