Commentary

Gov. Gavin Newsom’s new budget proposal released Jan. 10 actually keeps spending under control—if his assumptions continue and the Legislature doesn’t force increases. For fiscal year 2024-25, which begins on July 1, it would spend $209 billion in the general fund, down from $231 billion the previous years, a $22 billion cut. Those are the key numbers—but spending including all funds would be $291 billion.

In Sacramento parlance, he uses a lot of “gimmicks” to shift funds around and achieve the balanced budget the California Constitution requires to be passed by June 15. The proposal is a working document used by his Department of Finance and the Legislative budget committees until his May Revision comes out in four months. Then there’s a sprint to the June 15 deadline, although sometimes that isn’t met.

The main problem he had to deal with was the estimated $68 billion budget deficit which the state Legislative Analyst’s Office (LAO) warned about a month ago.

Mr. Newsom’s new budget instead anticipates a $38 billion deficit for 2024-25, with the discrepancy attributed to differences in revenue and spending projections.

However, the LAO also warned that previous state budgets have overestimated expected revenue in recent years.

“Specifically, we estimate that 2022-23 revenue will be $26 billion below budget act estimates. This creates unique and difficult challenges—including limiting the Legislature’s options for addressing the budget problem,” the LAO wrote.

Here’s Mr. Newsom’s excuse for the current revenue shortfall: “The stock market run-up through the end of 2021 led to the tax revenue surge that ended in 2022. The S&P 500 Index, which tracks the country’s 500 leading companies, declined by 19 percent in 2022. Over the same period, the NASDAQ Composite Index, which measures more than 2,500 stocks concentrated in technology companies that are a California mainstay—declined by 33 percent. These represent the most substantial annual declines in these key indices since the onset of the Great Recession in 2008, and a correction from strong prior market performance, a tightened monetary policy by the Federal Reserve Board that drove interest rates upward, and the expectation of a recession that never materialized.”

But many commentators warned that was likely to happen. A year ago in The Epoch Times I headlined my story, “Gov. Newsom’s Fantasy Budget.” I warned, “Gov. Gavin Newsom’s new budget proposal for fiscal year 2023-24, which begins on July 1, is more a wish list than an actual budget proposal.” At the same time, the LAO warned, “Recommend Legislature Plan for Larger Budget Problem. Our estimates suggest that there is a good chance that revenues will be lower than the administration’s projections for the budget window, particularly in 2022-23 and 2023-24.”

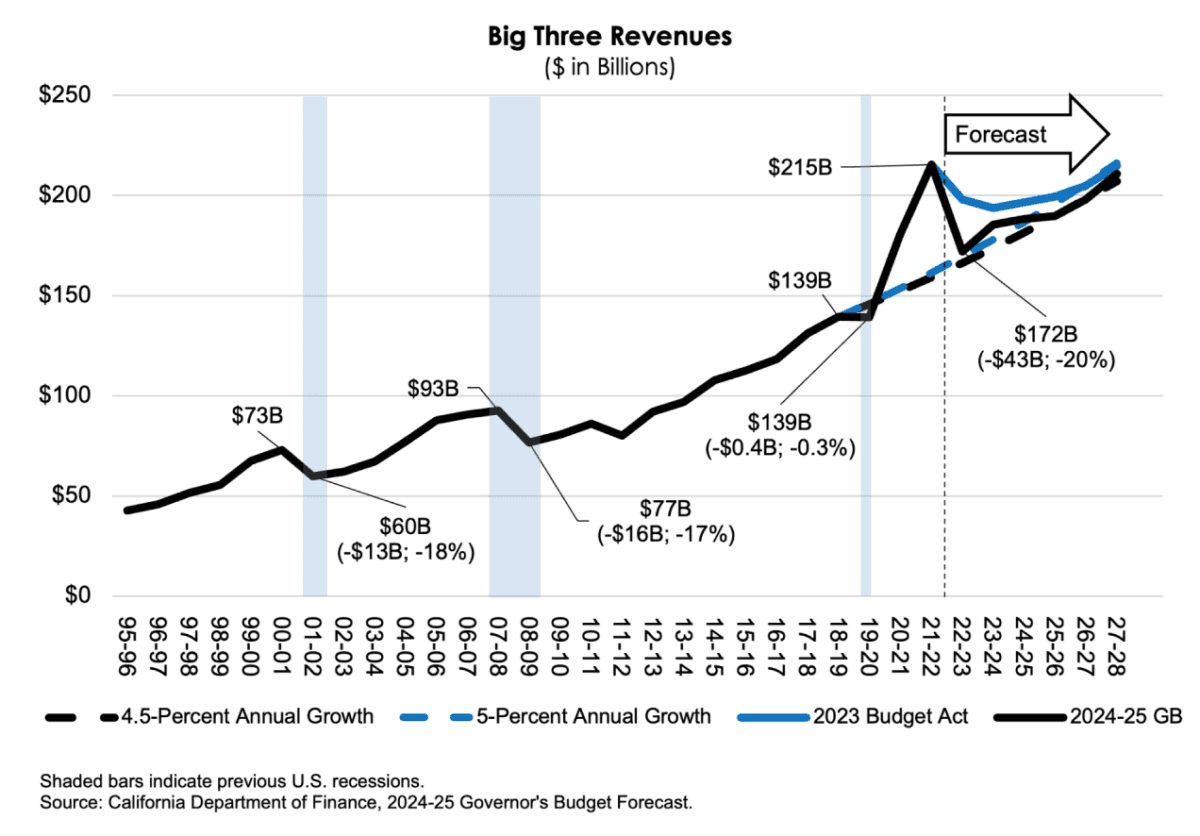

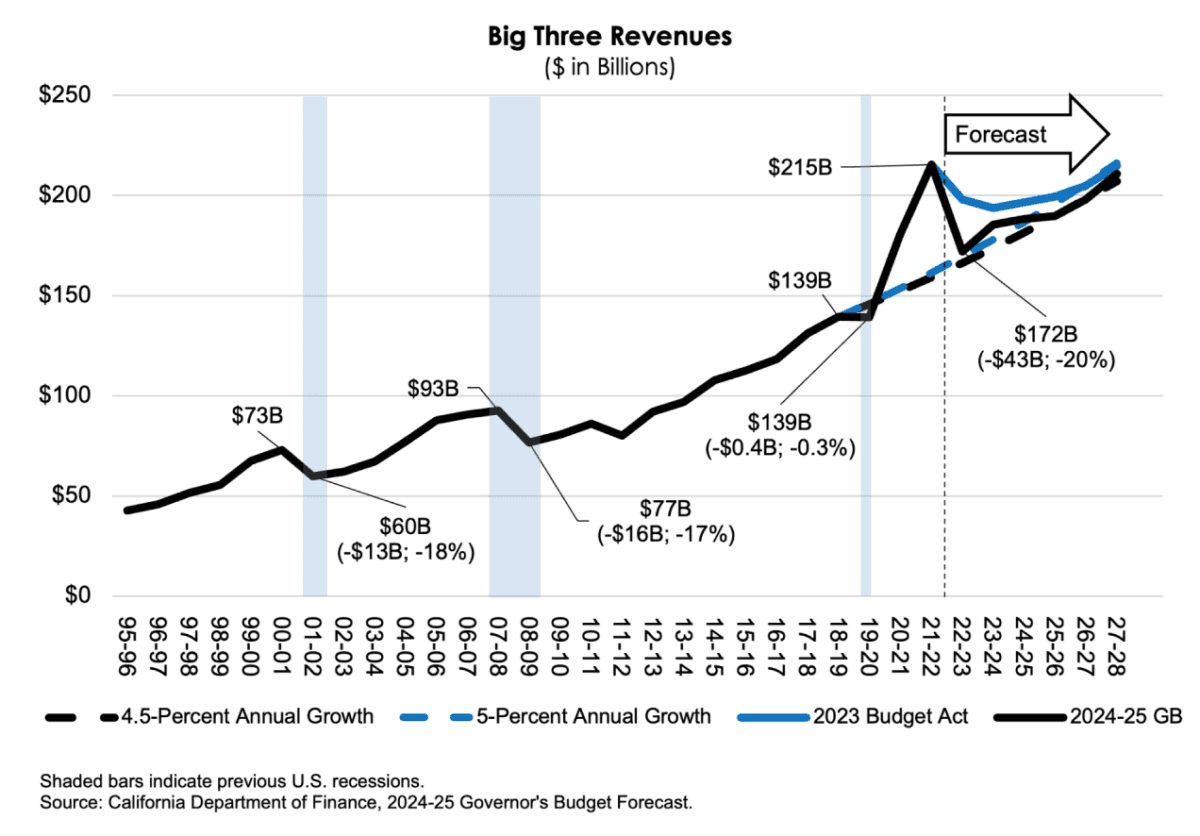

Here’s a good graph from the budget proposal showing the history of what are called the Big Three income sources: the personal income, sales, and corporation taxes. Notice the black line spiking from 2020-21 to 2021-22. That obviously couldn’t last, and didn’t.

(California Gov. Gavin Newsom/Screenshot via The Epoch Times)

Tax Delay Excuse

After that graph, the budget gives this headline, “2023’s Unprecedented Tax Filing Delay Masked Full Scope of Revenue Drop.” Then this explanation: “With reliable tax filing deadlines, the degree of the revenue drop associated with the 2022 market declines would have become evident as tax receipts were received in the spring. However, due to federal disaster declarations resulting from severe winter storms, the Internal Revenue Service announced that taxpayers in declared counties could delay filing their federal tax returns—first until October 16, and subsequently to November 16. ...

“Based on the limited data available in the spring of 2023, the enacted 2023-24 budget reflected a decline in the revenue forecast from January. However, because of the unprecedented tax filing and payment delay, the full scope of the estimated revenue decline was unclear until all the delayed tax returns and payments were received by the extended November 16 deadline, which was only two months before the 2024 budget must be proposed to the Legislature. Once processed, personal income tax and corporation tax receipts through November were $25.7 billion—22 percent—lower than projected at Budget Act.”

But all that was known early. The Franchise Tax Board announced on March 10, “FTB extends filing deadline for taxpayers impacted by 2022-23 winter storms to Oct. 16, 2023.”

Are the Cuts Enough?

In the new budget, Mr. Newsom would nab $12 billion by reducing the Budget Stabilization Account/Rainy Day fund from $23 billion to $11 billion. Add the purported $22 billion budget cuts, and the total comes to $33 billion of the needed $38 billion in cuts. For the remaining $5 billion, Mr. Newsom proposes various smaller cuts, such as delaying the increase in the minimum wage for medical workers. So that might be adequate.

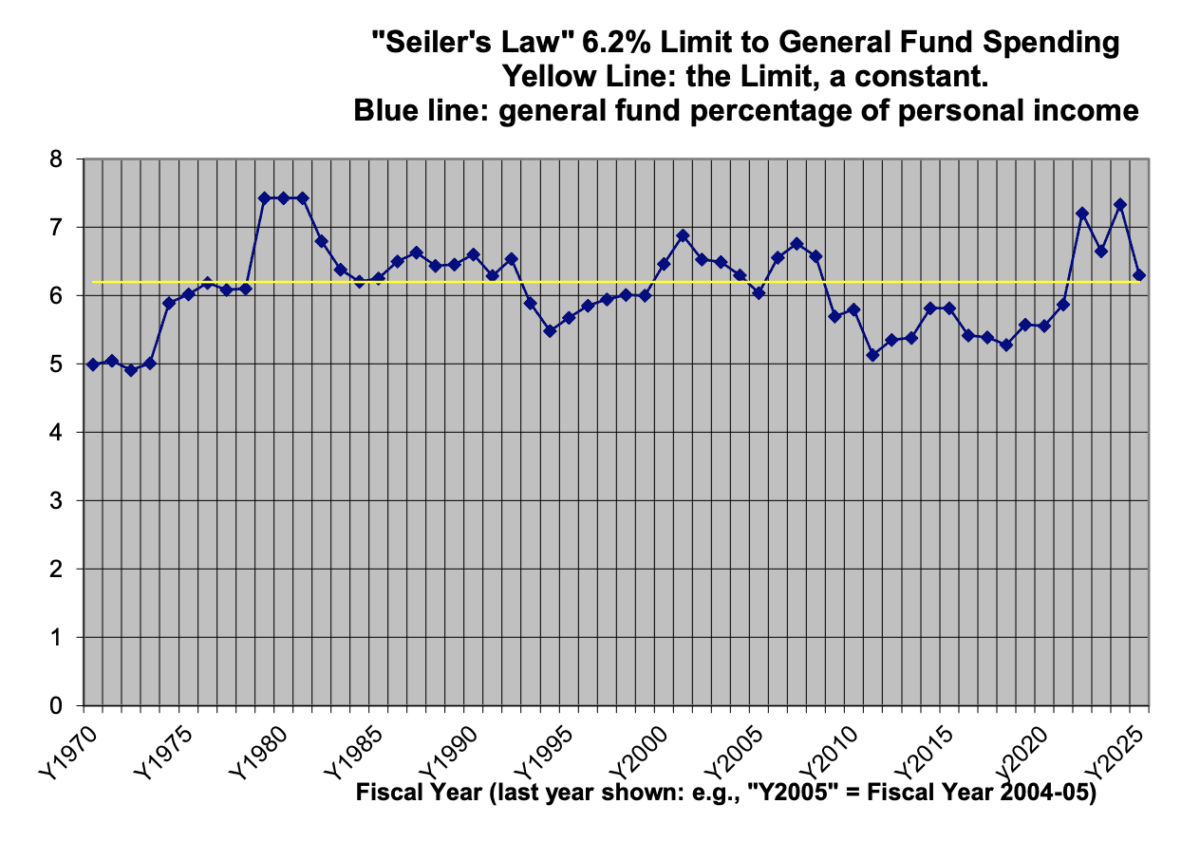

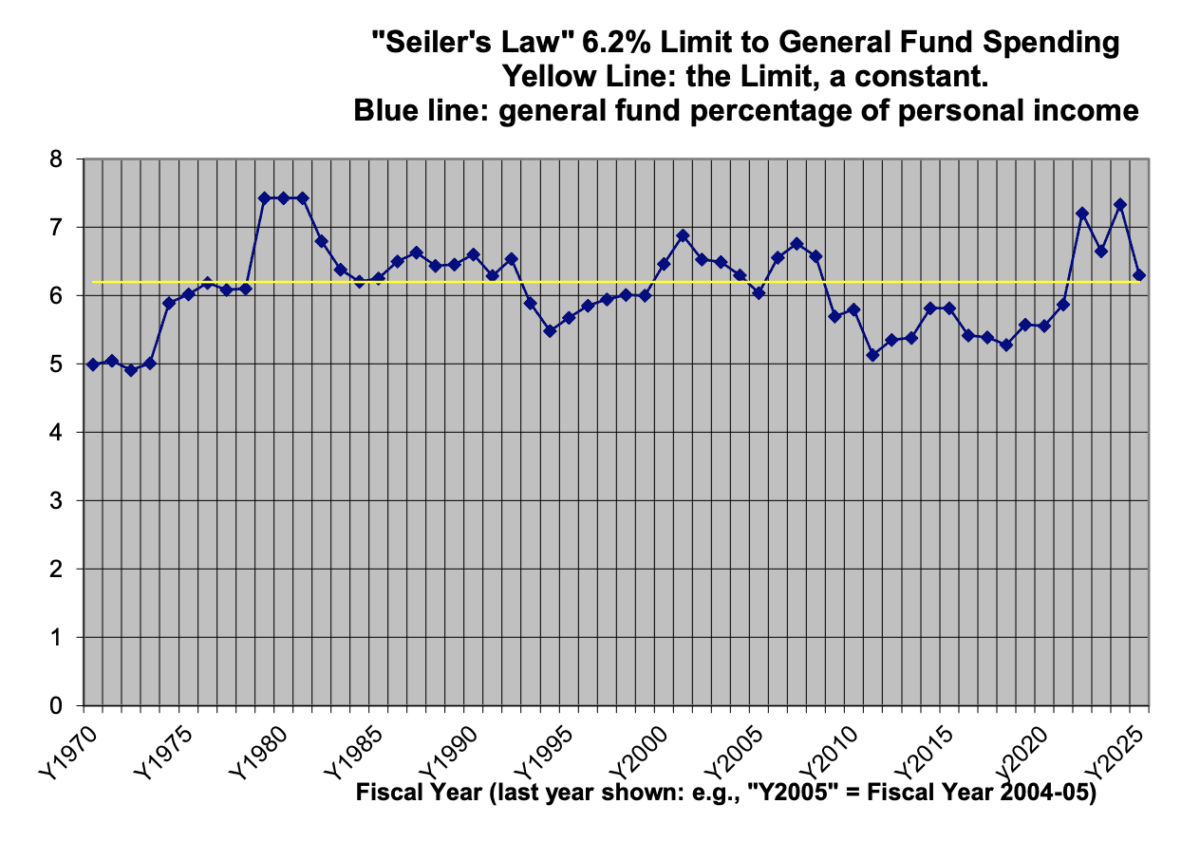

As I have written about a couple of times in The Epoch Times, two decades ago I developed a measure showing the state creates problems if it spends above 6.2 percent of Californians’ personal income—what I called Seiler’s Law on state spending. The LAO appeared to come to a similar conclusion a year ago, without giving me credit.

Here’s my updated graph, using the revised numbers from Schedule 6 of the 2024-25 Newsom budget proposal.

(Courtesy of John Seiler)

You can see how the ratio spiked way above 6.2 percent: to 7.21 percent in 2021-22; to 6.65 percent in 2022-23; and to 7.34 percent in 2023-24, the current fiscal year.

For fiscal year 2024-25, it would drop back down to 6.3 percent, only slightly above the 6.2 percent maximum. So, Mr. Newsom’s cuts and “gimmicks” could possibly work out—assuming the Legislature goes along.

Conclusion: There Are Limits to Spending

The new budget shows Mr. Newsom has come to realize spending restraint is mandatory in California. If the spending rises above the Seiler’s Law 6.2 percent limit, large cuts must be made—in the future, perhaps larger than the ones he’s proposing now. Again referring to the graph, notice how Gov. Jerry Brown’s latest tenure in the office, from 2011 to 2019, kept spending below the 6.2 percent limit. On that, he should be the model.

The last thing Mr. Newsom needs now is an out-of-control budget crisis in which the Democratic supermajority in the Legislature would demand large tax increases. His Oval Office chances this year are not what they were a couple months ago, as I wrote in my previous article, “California Gov. Newsom’s 2024 Presidential Hopes Fade.”

But a smooth finish to his term-limited tenure in Sacramento in 2027 would grease his path to the nomination in 2028.