Commentary

We were only about ten days into October, but the first four days were already filled with surprises. First, The Longshoreman’s Union and their 25,000 members walked off the job on October 1st, but another surprise came when they ended the strike on Thursday after only three days – but it’s not really over. They only extended their current contract until January 15th, agreeing to a tentative six-year 61.5% pay increase.

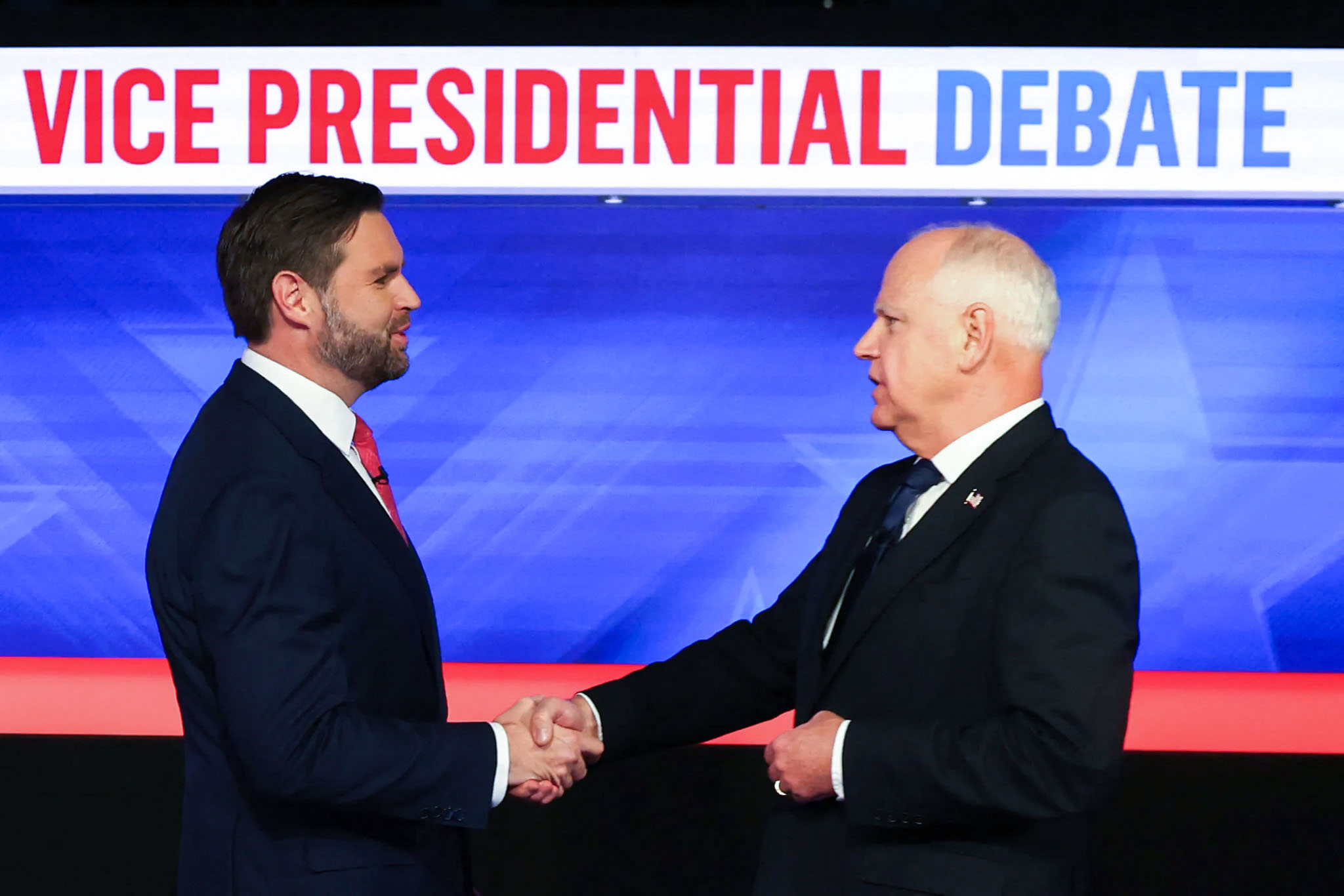

Tuesday’s vice-presidential debate may have surprised a few people, too, since most observers gave Republican J.D. Vance the edge in the debate. Even the liberal New York Times said that J.D. Vance overwhelmingly won the debate. Tim Walz had some awkward moments, and many felt sorry for him.

Iran also staged a surprise missile attack on Israel on Tuesday, so October 1st was a day full of surprises. This attack helped push crude oil prices up 9%, from $68.17 per barrel last Monday to $74.38 on Friday.

A bigger surprise came when the Labor Department reported on Friday that 254,000 payroll jobs were created in September, substantially higher than the economists’ consensus estimate of 150,000. An even bigger surprise was that the July and August payroll reports were revised higher by a cumulative 72,000 jobs, after months (even years) of downward revisions in monthly reports. Also, after months of rising, the unemployment rate declined to 4.1% in September, down from 4.2% in August. This was the strongest payroll report since May, indicating an improving economy, which may alter the Fed’s rate cutting pace.

Here are the most important market news items and what this news means:

- The stock market is now digesting what 4.05% 10-year Treasury bond yields are signaling, so many interest rate sensitive stocks remain nervous. Just a few weeks ago, the 10-year Treasury bond had a 3.62% yield on September 16th. Such a dramatic increase in Treasury bond yields is expected to adversely impact insurance companies, utilities and other interest rate sensitive stocks. I should add that Hurricane Milton is also weighing on many insurance companies since it is expected to cause significant damage in parts of Florida that are already saturated with excessive rainfall, so flooding and wind damage are widely anticipated.

- Super Micro Computer announced that it shipped a record 100,000 GPUs with liquid cooling in its most recent quarter. This announcement caused a short covering rally to ensue and also helped to lift Nvidia, which supplies Super Micro Computer with its regenerative AI chips.

- The Consumer Price Index and Producer Price Index that will be announced this week are expected to be favorable. However, higher energy prices may stall further inflation progress in the upcoming months. Hurricane Milton is not expected to disrupt many offshore oil rigs in the Gulf of Mexico, but it could disrupt Tampa, Orlando and other major metro areas in Florida with severe flooding. More hurricanes could continue to form in the Gulf of Mexico due to abnormally warm water, so the energy industry will likely welcome the end of the Atlantic Hurricane season in November.

- Since some consumers continue to struggle, Donald Trump has been getting stronger in some key swing states. As the Presidential Election nears, it appears to be increasingly boiling down to the fact that “it’s the economy, stupid,” which is a statement that James Carville made famous. Additionally, in front of a union audience, Kamala Harris was lambasting Donald Trump for being in favor of right-to-work laws that many unions and blue states oppose. However, when Harris’ opposition to right-to-work laws was replayed to national audiences, it alienated many voters, especially in Midwestern swing states that have lost manufacturing jobs. As a result, Donald Trump is breaking out, plus attracting bigger, more enthusiastic audiences (including Elon Musk in Butler, Pennsylvania) than Kamala Harris, so it appears that Trump voters have more enthusiasm.

- The big news this week will be if Israel retaliates against Iran for its recent missile attack since war in the Middle East keeps crude oil prices high. The Biden Administration told Israel to not strike Iran’s nuclear facilities or its oil fields and infrastructure. Frankly, I would not be surprised if Israel struck Iranian Republican Guard facilities and possibly its nuclear facilities.

- A green shoot emerged in Europe. Specifically, the German statistics agency, Destatis, announced on Tuesday that industrial output in August rose 2.9% after slipping 2.9% in July. This was the largest monthly rise in German industrial production since January 2023. Germany’s vehicle production surged 19% in August after declining 8.2% in July. Since Germany’s GDP has been a drag on overall economic growth in the eurozone, the August improvement in industrial production is a good sign.

Overall, the 3Q24 earnings season has come. The focus on macro trends will give way to a focus on earnings by the end of the week, which will likely remain the primary attention until the election is at the doorstep. I am expecting major banks, like J.P. Morgan, to report strong quarterly results and guidance. The Treasury yield curve is now very favorable to banks, so I am expecting upbeat guidance from Jamie Dimon and other banking leaders. I suspect that loan loss reserves may be boosted since the Philadelphia Fed has been reporting that 30, 60 and 90-day loan delinquencies have been increasing in recent months.

*Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times.