LONG BEACH, Calif.—Six truck mechanics sat around a table at Silva Truck & Auto Electric repair shop in Long Beach, California, enjoying their midday break while waiting for work orders that might never arrive.

Araseli Soto, an office worker at the company, said she had not seen such a slow period in business before.

In the past, work orders arrived steadily as corporate truckers and owner-operators needed her company’s services. Its strategic location directly across the street from the Rocket Long Beach truck stop gave it a distinct advantage.

Soto said the widespread slowdown in trucking activity, fueled by concerns over global tariffs, is more than just industry rumor.

“I’m not hearing it—we’re seeing it,“ Soto said. ”Because we don’t have that much work. We used to have trucks parked all over the place.”

Soto estimated that since early April, her company has experienced an unprecedented 80 percent decrease in work orders.

“We’re really close to the truck stop,“ she told The Epoch Times. ”It’s basically empty—there’s no one.

“The only thing I’m hearing about other truckers is they’re trying to sell some of their equipment because there’s no work.”

Soto said the company will face difficult decisions if things do not improve.

“If we don’t work, we’re going to have to shut down after 35 years,” she said bluntly.

Across the street, commercial driver Phillip Guirre was busy fueling his company’s semitruck with diesel and said he was grateful to have work that day.

Recently, his company reduced his full-time schedule from five days per week to three, the lowest number of working days he has experienced since the COVID-19 pandemic.

Even during that time, he typically worked more hours, he said.

Commercial truck driver Phillip Guirre of Fontana, Calif., prepares to fill his company's semi with diesel in Long Beach, Calif., on June 5, 2025. (Allan Stein/The Epoch Times)

Less Work, More Worries

After President Donald Trump announced extensive global tariffs in April, citing a need to even the playing field and support domestic industry, Guirre quickly noticed a significant decrease in the arrival of cargo ships at the Port of Long Beach.

This directly affected truckers like him, as there were fewer containers available to transport.

“It trickles down from truck drivers to longshoremen,” he said. Even the food trucks that serve the longshoremen are losing money, he told The Epoch Times.

On March 3, the International Longshore and Warehouse Union, which represents 44,000 workers at 29 ports in California, Oregon, and Washington state, criticized the Trump administration’s new tariff policies as a burden on the supply chain and a tax on consumers.

“The reality is clear: these tariffs don’t put America First—they put American working people last,” the union said in a statement.

“They will kill jobs, raise costs, and fuel economic instability that will ripple through every community in this country.”

On May 12, the Trump administration announced that during a 90-day tariff truce with China, the tariff on U.S. goods exported to China had been reduced from 125 percent to 10 percent.

The 20 percent fentanyl-related duty imposed on Chinese imports remained in effect and the total tariffs on Chinese goods were set at 30 percent (including a 10 percent base tariff).

Both sides must reach a definitive agreement by Aug. 12, or the tariff on Chinese goods will increase by 34 percent, bringing the total tariff burden back to about 64 percent.

On May 12, just hours after news broke that the United States and China had reached a trade truce, California’s Port of Long Beach released its 2025 economic impact analysis.

“This 90-day reprieve is both a positive sign and a perfect example of the uncertainty that is threatening the powerful engine that fuels our regional, state, and national economy,” Mario Cordero, executive director of the Port of Long Beach, said in a statement to the Pacific Merchant Shipping Association on May 22. “That engine is the Port of Long Beach.

“While Americans are just beginning to feel the pain of these fluctuations in higher prices and fewer choices, the negative impacts are already evident at our port.”

The Trump administration maintains that the tariffs protect U.S. industries, especially manufacturing and steel, from unfair foreign competition—particularly from China.

According to officials, tariffs encourage domestic production, reduce reliance on overseas suppliers, and reduce the trade deficit. They also say tariffs create leverage in trade negotiations, pushing countries to agree to fairer terms.

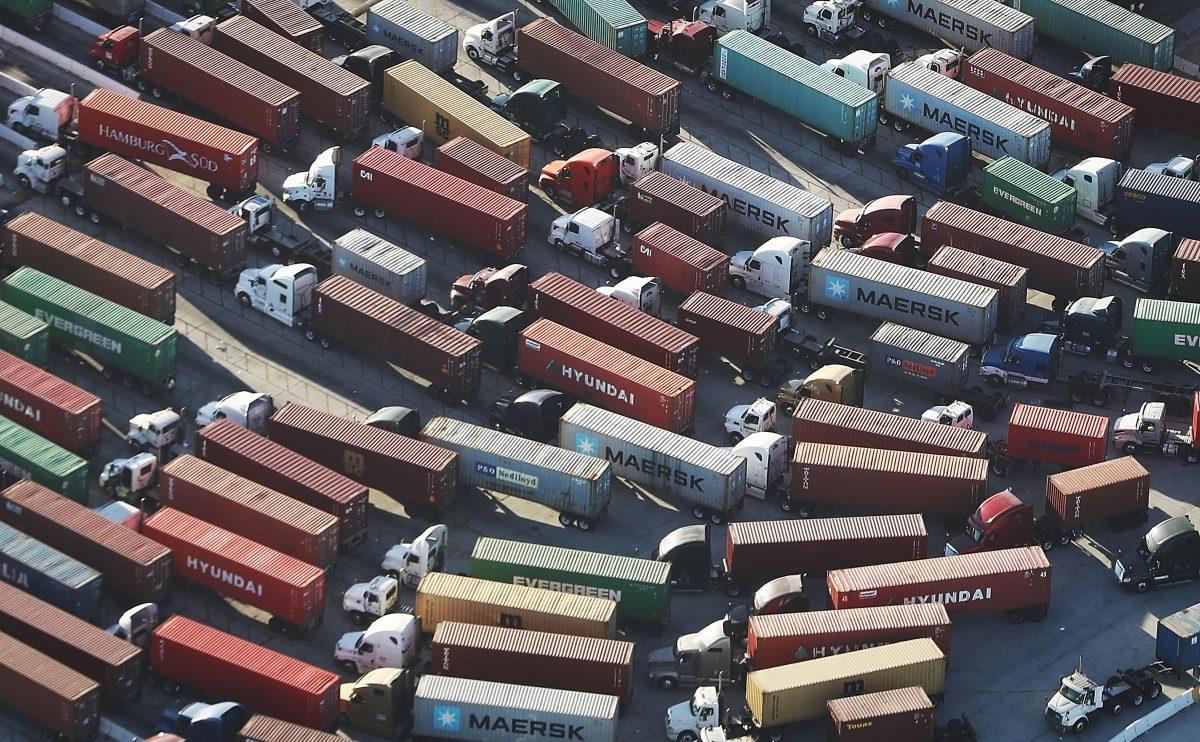

Shipping containers are stacked at the Port of Los Angeles in San Pedro, Calif., on Nov. 24, 2021. California boasts three of the top 10 container ports in the United States. (Mario Tama/Getty Images)

The Port of Long Beach is the nation’s second-busiest commercial port, covering an area of 3,520 acres. It features 12 piers, 80 berths, 73 gantry cranes, and 22 shipping terminals.

Approximately 63 percent of shipping containers from China pass through Long Beach.

Cordero said Long Beach was the leading container port in the nation at the start of 2025, benefiting from four strong months of activity.

The new tariff policy has created challenges for port authorities and shipping companies.

Between April and May, Cordero observed a sharp decrease in shipping volume at the port.

In April, the port processed 419,828 loaded incoming containers and 93,842 outgoing units.

In May, Long Beach processed 299,116 loaded incoming containers and 82,149 loaded outbound containers.

Cordero told The Epoch Times on June 4 that May’s statistics revealed a decline of about 10 percent to 15 percent compared with May 2024.

He said if the port experienced a 10 percent reduction in cargo volume, there would be a potential 10 percent reduction in port-related jobs in California, amounting to roughly 100,000 fewer jobs.

Cordero said the economic impact analysis of the port reveals that trade, construction, and tourism activities support a total of 2.7 million jobs, both direct and indirect, throughout the United States.

“Looking ahead, it’s clear that retailers are taking advantage of the 90-day tariff pause,” Cordero said. “We expect this to lead to a cargo surge by late June and into July—just in time for the traditional peak shipping season.”

Truckers prepare to pick up shipping containers from the Port of Long Beach, Calif., on March 28, 2025. (John Fredricks/The Epoch Times)

Policy changes can happen quickly, he said, but recovery may take longer and face logistical challenges.

Moreover, once things stabilize, there is no guarantee that foreign producers and consumers who have found new markets to avoid tariffs will return to the United States, Cordero said.

The Port of Long Beach supports 51,000 direct jobs. Each year, it manages about 2,000 vessel calls and 9 million container units, handling 90 million metric tons of cargo valued at $300 billion.

Declining Exports

On June 13, Gene Seroka, executive director of the Port of Los Angeles, described the tariff situation as fluid and complex.

In May, the nation’s largest commercial port processed a total of nearly 717,000 container units—about a 5 percent decline from May 2024, the port stated.

“[It] is just a little better than we expected,” Seroka said during a media briefing.

“We typically expect May volume to be a little stronger than that of April because we’re approaching peak season. And compared to our five-year running average for ... May, imports are down 17 percent.”

Meanwhile, the port handled loaded exports of 120,000 containers in May, representing a 5 percent decline from 2024.

Executive Director of the Port of Los Angeles Gene Seroka speaks in Long Beach, Calif., on Jan. 11, 2022. (John Fredricks/The Epoch Times)

Loaded imports in May came in at 355,950 containers, 9 percent less than the previous year, resulting in a 19 percent decline from April when combined with the number of container units processed.

And the port returned 240,000 empty containers to their points of origin across the Pacific, approximately the same amount as in 2024.

“The bottom line, May marked our lowest monthly volume in over two years,” Seroka said.

However, during the first five months of 2025, the Port of Los Angeles handled a little more than 4 million standard shipping containers, 4 percent more than the same period in 2024.

The port is the nation’s primary western commercial transport hub, covering 7,500 acres and stretching 43 miles along the waterfront.

It features 25 cargo terminals, seven container terminals, and 84 ship-to-shore container cranes, along with 2,174 pieces of cargo handling equipment.

In fiscal year 2023–2024, the port managed a cargo value of $333 billion.

A semitruck at the Port of Long Beach on June 5, 2025. (Allan Stein/The Epoch Times)

Canceled Deliveries

Soon after Trump announced his tariff policy, West Coast ports started to receive order cancellations from China.

In May, the Port of Los Angeles recorded 17 canceled sailings, and 225,000 container units that were planned for arrival did not show up, Seroka said.

“There’s less work on the docks,” he said.

Seroka said the impact is clearly visible at the loading docks in Los Angeles. So port authorities are pleased at the prospects of a 12-ship day when they occur.

“It’s one of the very few double-digit ship days we’ve had in weeks,” he said of one of those days.

Seroka said the tariff-driven effect on the trucking industry has been significant.

“If you’re a trucker who was hauling four or five containers a day prior to these announcements back in April, today you’re likely hauling two or three loads,” he said.

Trucks prepare to haul shipping containers at the Port of Los Angeles in San Pedro, Calif., on Sept. 18, 2018. (Mario Tama/Getty Images)

On March 4, American Trucking Associations President and CEO Chris Spear issued a statement in response to increased tariffs on China, Canada, and Mexico.

Spear commended Trump’s tariffs for addressing the harmful effects of fentanyl and uncontrolled illegal immigration.

Nevertheless, he warned of the unintended consequences, such as increased prices for goods and groceries.

“Imposing border taxes on our two largest and most important trading partners will undo this progress and raise costs for consumers,” he said.

“The 100,000 full-time hardworking truckers hauling 85 percent of the surface trade in goods with Mexico and 67 percent of the goods traded with Canada will bear a direct and disproportionate impact.”

He said that not only would tariffs lead to a reduction in cross-border freight, but they would also increase operational costs.

The price of a new truck could increase by as much as $35,000, resulting in an annual tax burden of $2 billion and making new equipment unaffordable for small carriers, he said.

However, under the U.S.–Mexico–Canada Agreement, autos and parts meeting strict rules‑of‑origin requirements are shielded from the new 25 percent tariffs.

Only a few semitrucks sat awaiting repairs outside of Silva Truck & Auto Electric in Long Beach, Calif., on June 5, 2025. An employee said the street used to be lined with trucks. (Allan Stein/The Epoch Times)

Weathering Tariffs

Robert Loya is president and board member of Harbor Trucking Association in Long Beach, as well as CEO of T.G.S. Logistics in Fresno, California.

He said he believes that small and mid-sized trucking companies face greater challenges in surviving a prolonged tariff war.

“A larger company may have deeper pockets, and they’re able to kind of withstand this,“ he said. ”Of course, you’re taking cost measurements as well, reductions, [and related costs].

“I can tell you that we’ve had to reduce 60 percent of our employees.

“We had 40 drivers and roughly 25 office staff. We had to immediately cut costs and [make] some tough decisions. We had to return trucks. We had to surrender trucks back to the bank because they refused to renegotiate our terms.

“There is a common theme that I’m hearing from the big guys who’ve had to reduce their fleet size, [or redeploy across the country].”

He noted that several of the company’s customers are holding on to products because there are fewer buyers, given the uncertainty of the markets.

“It’s very concerning because no one’s buying,” Loya told The Epoch Times. “What happens is that everybody tightens their belt. No one spends money.”

A truck passes by containers at the Port of Los Angeles, after new tariffs on Chinese imports were imposed, in Long Beach, Calif., on Sept. 1, 2019. (Mark Ralston/AFP via Getty Images)

Loya said that if the U.S.–China tariff negotiations collapse or fail to reach an agreement, more companies could go under because of higher operating costs and prices.

“I’m talking small to mid-sized that can’t withstand this kind of downturn in economics [when] revenue is down and we don’t have the bankroll to carry these costs,” he said.

Under these conditions, it comes down to basic company survival, he said.

“Everybody’s different, but everybody’s hurting, I can tell you that,” Loya said. He said he remains hopeful that the downturn will not signal worse troubles for the industry.

“I honestly don’t think that the problems are going to be as significant as some people think,” he said.

The mutual trade agreement with China on May 12 has provided hope to some international shipping companies of an end to the trade war.

According to supply chain management and logistics specialist Flexport, demand from China to the United States has surged since the May 12 agreement.

Port capacity has significantly improved, with the rate of blank sailings—canceled shipments—falling by 15 percent as of May 26.

Flexport anticipates an additional 10 percent reduction in cancellations for the week of June 9, which would mark the fewest blank sailings since late March. Full capacity is expected to be reached by the end of June.

The company noted that existing backlogs and the upcoming peak season will further support an increase in shipping volume.

From the perspective of the Port of Los Angeles, Seroka said the ideal scenario would involve collaboration between the world’s two largest economies, China and the United States.

“We’ve said often that rules-based trade is an American imperative to protect jobs and iconic brands and help us grow our economy,“ Seroka said. ”But it’s not simply one lever that we can pull.”

In the short term, he told The Epoch Times, he anticipates lower inventories, fewer selections on store shelves, and higher prices at the cash register.

“Our supply chain is vast, from farms to factories and everywhere in between,“ he said. ”We need to keep this economic engine running.”

Cordero said he is optimistic that the United States and China will reach a favorable trade agreement by Aug. 12.

“Having said that, clearly, we still remain in an environment of uncertainty,” he said. “On the other hand, the worst scenarios that we thought would happen a few weeks back have not come to fruition.”