The National Rifle Association (NRA) has filed a lawsuit against California, challenging its new excise tax on firearm and ammunition sales.

The NRA, along with several second amendment advocacy groups, filed the lawsuit on Tuesday, July 2. They argue that the measure, which imposes an 11 percent excise tax on sales by firearms dealers, manufacturers, and ammunition vendors, violates the Second Amendment to the Constitution.

The new 11 percent tax went into effect one day prior. It is in addition to the 10 percent federal excise tax on wholesale prices for handguns and 11 percent on long guns and ammunition.

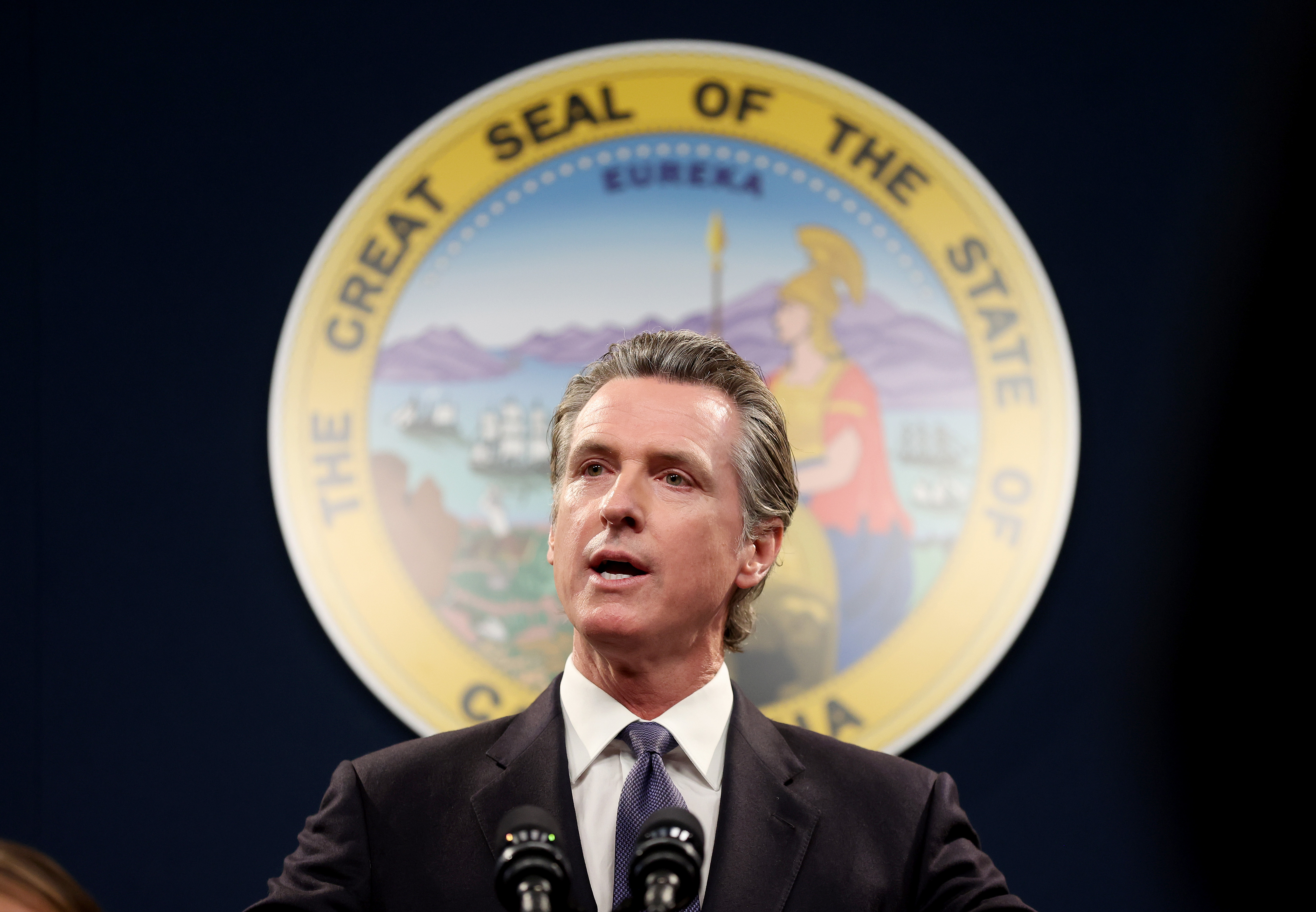

Last year, California Gov. Gavin Newsom signed into law the first-of-its-kind excise tax, which was included in a package of bills aimed at strengthening gun safety laws.

“California will keep fighting—because gun safety laws work,” the Democratic governor said in a statement after signing the package of bills. “The data proves they save lives: California’s gun death rate is 43 percent lower than the rest of the nation. These laws will make our communities and families safer.”

According to Mr. Newsom’s office, the tax is expected to generate $160 million annually. The money will be used to support state-funded school safety and gun violence intervention programs.

Danielle Jaymes, Joshuah Gerken, the Second Amendment Foundation, the Firearms Policy Coalition, and the California Rifle & Pistol Association (CRPA) are also named as plaintiffs in the lawsuit.

The plaintiffs have asked the court to issue a declaratory judgment and permanent injunction against the excise tax.

The lawsuit argues that while the excise tax is “technically levied on the sellers of these goods,” it is passed down to the consumer.

CRPA said the tax, which is collected through sellers, “represents a substantial financial burden“ on gun and ammunition purchasers.

“As Plaintiffs Jaymes and Gerken observed on July 1, 2024, the sellers of firearms and ammunition that they purchase from have added a line to customer receipts reflecting that the 11 percent tax is passed on to the purchaser of firearms and ammunition,” the lawsuit states.

The plaintiffs claim that the tax infringes on their rights protected by the Second Amendment to acquire and bear arms, adding that the U.S. Supreme Court has “repeatedly held that constitutional rights cannot be singled out for special taxation.”

“The excise tax impermissibly singles out constitutional rights for special taxation,” the court document continues.

California has the seventh lowest gun death rate in the nation, with 8.6 deaths per 100,000 people, according to 2022 data collected by the Centers for Disease Control and Prevention.