President Joe Biden has announced that his administration will direct more funding to cancel or reduce the student loan balances of another 35,000 people through the Public Service Loan Forgiveness Program (PSLF).

In a July 18 statement, President Biden said the total number of Americans who have benefitted from the government’s various debt relief actions to date is at least 4.76 million and counting.

“Each of those borrowers has received an average of over $35,000 in debt cancellation,” he said.

“These 35,000 borrowers approved for forgiveness today are public service workers—teachers, nurses, law enforcement officials, and first responders—who have dedicated their lives to strengthening their communities, and because of the fixes we made to Public Service Loan Forgiveness, they will now have more breathing room to support themselves and their families.”

According to President Biden, this latest debt forgiveness totals $1.2 billion in student loan cancellation, adding to the nearly $169 billion already forgiven for 4.8 million people across the country.

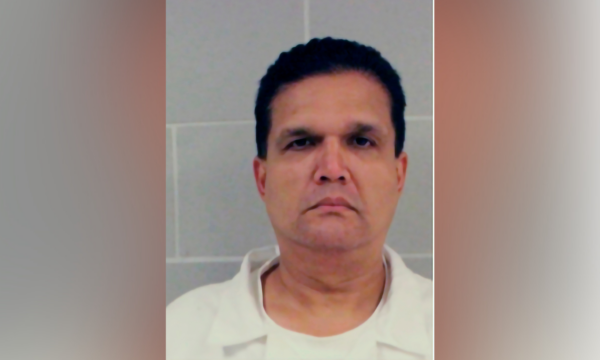

U.S. Secretary of Education Miguel Cardona said the additional people approved for the PSLF are “hardworking public servants” who will receive “financial breathing room.”

“This relief will bring real change in their lives and marks another win for this administration’s relentless and unapologetic work to fix a broken student loan system,” he said.

PSLF Program Changes Under Biden

The PSLF program supports employees of government or not-for-profit organizations and public servants, such as teachers, nurses, and firefighters. It forgives outstanding student loan balances, provided that 120 qualified monthly repayments under an accepted repayment plan are made first.It’s also a requirement to work full-time for an eligible employer. Full-time employment counts as working for a qualifying employer for a weekly average of at least 30 hours. Only about 7,000 public sector employees had qualified for loan forgiveness under the PSLF program prior to the Biden administration’s rule change.

As of July 1, the PSLF program is now fully managed by the Education Department. The latest debt forgiveness also includes borrowers who were part of the limited PSLF waiver, a temporary opportunity that ended in October 2022. According to the U.S. Department of Education (DOE), beginning in October 2021, nearly 616,000 public-sector employees had their student loan debts forgiven under the temporarily loosened rules.

“Today’s announcement comes on top of the significant progress we’ve made for students and borrowers over the past three years,” President Biden said.

“That includes providing the largest increases to the maximum Pell Grant in over a decade; fixing Income-Driven Repayment so borrowers get the relief they are entitled to under the law; and holding colleges accountable for taking advantage of students and families.”

Policy Meeting Resistance

Previously, some of President Biden’s efforts to forgive student loans had been unsuccessful.In June 2022, the Supreme Court in a 6–3 decision overturned the Biden administration’s original loan forgiveness plan on the grounds the executive branch didn’t have the authority under the HEROES Act. That proposal aimed to cancel $430 billion in repayments related to student loan debt without the approval of Congress.

The HEROES Act, a federal law passed after the Sept. 11 terrorist attacks in 2001, allowed the education secretary to change student loan programs for those affected by the attack. In 2003, Congress extended the law so the federal government could provide loan relief to students impacted by war or a national emergency. President Biden said he could extend that power to provide student loan relief to students affected by the COVID-19 emergency.

At the time, 21 governors signed an open letter calling for the debt forgiveness scheme to be scrapped on the grounds it would come at the expense of American taxpayers, encourage more student borrowing, incentivize higher tuition rates, drive further inflation, and penalize people who have paid their loans or those who chose not to borrow.

In March, attorneys general from Kansas, Alabama, Alaska, Idaho, Iowa, Louisiana, Montana, Nebraska, South Carolina, Texas, and Utah also filed a lawsuit to halt the Saving on a Valuable Education (SAVE) plan, which would introduce a income-driven repayment plan for student debt. The lawsuit argued that President Biden had overstepped his authority with the program.