As the October-through-March winter heating season unfolds, a number of forecasts indicate that the cost of electricity will double, if not triple, the projected 2 percent to 3 percent overall 2026 inflation rate and, regardless of fuel source, make it more expensive to stay warm this winter.

The U.S. Energy Information Administration (EIA), in its Oct. 15 Winter Fuels Outlook 2025–2026, projected that a nationwide average 5 percent increase in electricity costs in 2026 will raise winter heating costs by 4 percent—and even more for the 42 percent of U.S. households that use electricity for heating.

That 5 percent hike in retail electricity exceeds overall 2026 inflation projections ranging from 2.2 percent to 3.2 percent.

Data collected by the Bureau of Labor Statistics’ Consumer Price Index through August documents overall inflation of 2.9 percent over the previous 12 months, with electricity costs increasing by 3.1 percent, a gap that forecasters project will widen in 2026.

S&P Global, which based previous models on 2 percent inflation, now anticipates that overall prices will increase by 3 percent, “largely driven by ... tariffs on consumer prices.”

That forecast aligns with the 3.1 percent inflation Dow Jones’s consensus and Deloitte’s 3.2 percent projection but is higher than others, including J.P. Morgan Asset Management’s expectation that 2026 inflation will “drift down” from 2025’s peak of 2.8 percent.

Bankrate, documenting 24.3 percent cumulative inflation since 2020, projects 2.7 percent inflation in 2026, similar to the Congressional Budget Office’s 2.7 percent forecast, with expectations for it to fall to 2.2 percent in 2027 and 2028.

The Office of Management and Budget, as of September, was among outliers, sticking with its 2.2 percent inflation forecast, “consistent with reaching the Federal Reserve’s target.”

With so many inflation qualifications, forecasting how much it will cost to heat homes this winter is equally tentative. However, among certainties is that more than 100 gas and electric companies across 41 states raised rates in 2025 or plan to do so in 2026, according to a September Center for American Progress report.

While the EIA projected that “winter temperatures and residential energy consumption to be similar to last winter,” electricity costs will still be “higher than last winter across the country,” by about 5 percent.

Others are projecting higher increases, including a 7.6 percent hike in average electricity prices forecast by the National Energy Assistance Directors Association (NEADA) in its Sept. 19 Winter Outlook 2025–2026.

“Electricity prices are rising more than twice as fast as the overall inflation rate due to utility investment in transmission and distribution systems, [and] the rising cost of natural gas,” the association said in a statement accompanying the study, citing a 2024 Edison Electric Institute report that calculates that ratepayers are financing $1.1 trillion in grid updates planned by 2029.

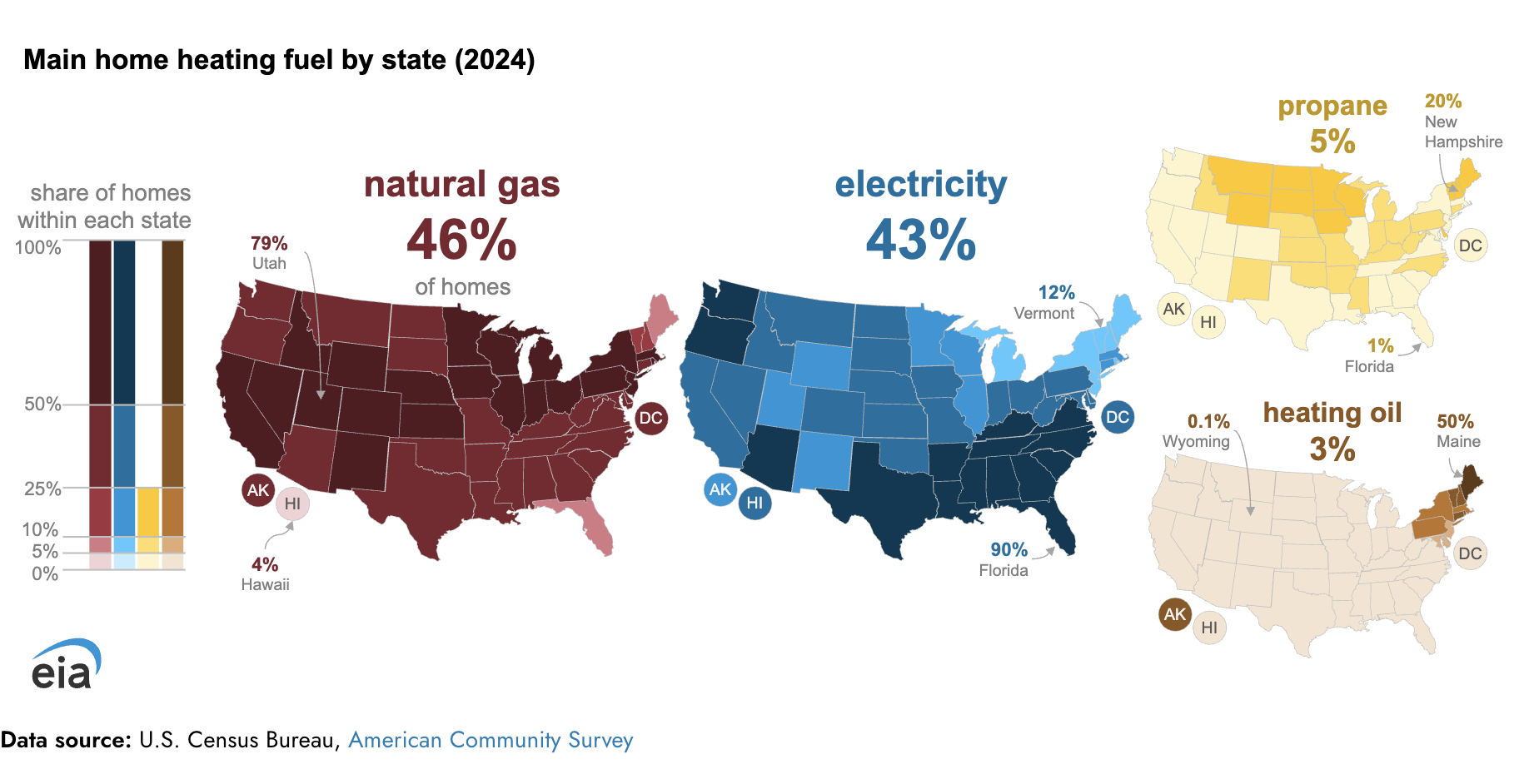

As noted by the EIA in its October short-term energy outlook, projected electricity costs for the upcoming winter vary according to where a consumer lives, what infrastructure improvement surcharges are being levied, the weather, and the type of fuel, with natural gas, electricity, propane, and oil used to heat 96 percent of homes in the United States.

Lower Natural Gas Forecast

The EIA’s outlook uses different weather models in calculating electricity-use and heating-cost projections to produce a base forecast, and it alternates modeling 10 percent colder or 10 percent warmer winters. It assumes that “this winter will be slightly milder than the last winter across much of the country, especially in the Northeast.”

Winter energy expenditures also vary by heating fuel.

“Homes heating with natural gas will pay about the same amount for natural gas as they did last winter, but homes heating with electricity will pay more,” the EIA projected. “Homes heating with propane or heating oil will pay less than they did last winter.”

More than 46 percent of homes in the United States burn natural gas in furnaces, making it the nation’s most common space-heating fuel, according to the administration.

The EIA’s outlook noted that mid-October natural gas inventories in the United States were about 5 percent above the previous five-year October averages.

“Going into winter, prices are expected to increase as natural gas exports increase and storage withdrawals outpace injections,” the EIA stated, projecting September’s $3 per million British thermal units average will top $4 in early 2026, but still be almost 50 cents lower than its August forecast.

“Our lower price expectation reflects our forecast that natural gas production will be higher than we forecast last month, leading to more natural gas in inventory through the winter than previously expected,” it stated, predicting that any increases in natural gas prices will be offset by “slightly higher” production and “slightly milder temperatures,” reducing natural gas consumption by 2 percent.

NEADA projected that consumers will pay 8 percent more for natural gas during the October-to-March heating season, with average costs increasing from $639 to $693.

Higher wholesale gas prices and strong liquified natural gas export demand are responsible for the price hikes, according to NEADA.

The Luxembourg-based Economy Forecast Agency projects that Henry Hub natural gas prices will creep above $4 per million units by December but that median averages will dip below $4 in 2026 until October, similar to the EIA’s forecast.

The EIA projected lower natural gas prices in the Pacific West and little change across the Intermountain West. NEADA forecast a 13.5 percent increase in natural gas prices across the West.

Natural gas consumers in the South will see at least a 3 percent reduction in 2026 costs from 2025, the EIA projected, and as much as a 5 percent reduction if a milder winter unfolds. NEADA forecast a 5.3 percent increase across the region.

The Northeast will see stable, if not lower, natural gas prices as the Mountain View Pipeline reaches capacity, the EIA projected, while NEADA forecast an 8.1 percent increase in the mid-Atlantic and New England.

“The Midwest is the only region where we expect a slight increase in natural gas bills this winter in our base case,” the EIA projected. “Winter household natural gas bills in the Midwest are forecast to average about $610 in our base case, or 2 [percent] more than last winter.”

The Midwest is expected to experience a 16.4 percent jump in natural gas prices, growing from $600 in the past winter to $698 for the coming winter, NEADA countered in its forecast.

A propane holding tank at Blue Flame Propane in Worth, Mich., in December 2022. (Steven Kovac/Epoch Times)

Higher Power Cost Projections

Electricity is the second-most common heating method in the United States, increasing from warming 35 percent of the nation’s homes in 2010 to more than 42 percent in 2024, the EIA documented in an Oct. 10 analysis.

Electricity is reliant on a fuel source, so how much it costs is influenced by market fluctuations. According to EIA data, 40 percent of the nation’s electricity is generated by natural gas (down from 43 percent in 2023), 25 percent by renewables (solar, wind, hydro, biomass), 18 percent by nuclear energy, and 14 percent by coal.

“Higher winter expenditures for homes heating with electricity are primarily driven by higher retail electricity prices,” the EIA stated, basing projections on an average 5 percent increase in retail electricity.

The administration acknowledges electricity-for-heating estimates are “muted because the space-heating portion of electricity bills is relatively low” when factored with “water heating, cooking, or clothes drying.”

“The effect of higher electricity prices ... is slightly offset by [the] expectation that residential electricity consumption will decrease by 1 [percent] because of milder weather this winter,” especially in the South, so while overall electricity prices will increase by 5 percent, the electricity cost of space heating will be slightly lower, according to the EIA’s calculations.

“Winter residential electricity expenditures in the Midwest and South regions increase by a similar rate as the national average, 4 [percent], despite slightly lower electricity consumption,” the EIA projected. “Expenditures in the Northeast and West regions are expected to increase by 3 [percent] this winter.”

The Midwest could be hit hardest, with an estimated 19.7 percent increase in electricity costs—an average of about $1,500 for this winter, compared with $1,250 for the 2024–2025 winter—according to the NEADA forecast, with its estimate nearly $220 more than the EIA’s $1,280 tabulation.

The EIA forecast that consumers in the Northeast will see 2026 electricity costs increase by 6 percent, while NEADA forecast that homes heating with electricity in the Northeast will see costs increase by 7.2 percent and spend $1,520 this winter to stay warm.

The EIA projected electricity costs in the Pacific West to increase by 2 percent, “the lowest expected increase” in any region, and by 6 percent in the Rocky Mountain West, while NEADA forecast that “the West will see utility prices grow at a projected 18 percent for electricity.”

According to NEADA, the South could see a 21.4 percent hike in winter electricity costs, although EIA projected 4 percent to 6 percent increases in electricity-for-heating across the region.

Propane heats about 5 percent of the nation’s homes, according to EIA estimates, and is “more common in the upper Midwest and Northeast.”

The EIA forecast a 7 percent decline in propane prices this winter in tandem with sliding crude oil prices, while NEADA projected that propane gas users can expect to save up to 5 percent during the colder months, with average prices sliding from $1,316 to $1,250.

Oil heats about 3 percent of homes in the United States, mostly in the Northeast, where 80 percent of homes use it for heat, according to EIA.

“We expect these homes will spend 8 percent less on heating oil this winter,” it projected, while NEADA forecast that homes heated by oil “may see a decline of 4 percent this winter—dropping on average from $1,515 to $1,455.”

Mary Prenon contributed to this report.