The U.S. Federal Trade Commission (FTC) is distributing more than $1.1 million in refunds to American citizens duped by false advertisements from LCA-Vision, the country’s biggest provider of LASIK surgery.

The refund is the result of an order issued by the FTC against LCA-Vision in January 2023 which accused the firm of using “deceptive bait-and-switch advertising to trick consumers into believing they could have their vision corrected for less than $300,” according to an Oct. 3 press release. “In reality, only 6.5 percent of consumers lured in for consultations were eligible for the advertised promotional price for both eyes. To be eligible for the promotion, consumers had to already have near-normal vision [good enough to drive without glasses].”

Between 2015 and 2020, the firm ran ads on television, print, radio, and digital platforms offering surgery for a promotional price of $250 through its LasikPlus centers and for $295 via its Joffe MediCenter branches.

After customers approached the firm and underwent eye exams and in-person consultations that took “considerable time and effort,” the firm ended up typically quoting between $1,800 and $2,295 per eye.

Moreover, in some of its advertisements, LCA-Vision did not tell customers that the promotional price of less than $300 was per eye and not the total amount, the FTC noted.

In January 2023, the agency ordered LCA-Vision to pay $1.25 million to compensate customers. Both LasikPlus and Joffe MediCenter have paid the amount and settled the charges.

The FTC is sending more than $1.1 million of these funds to 12,077 affected individuals, with the remaining amount spent on administrative costs of compensation. The median refund for customers is estimated to be $91.

The money is being sent via checks and PayPal. Customers who receive checks have to cash them within 90 days. Those who receive PayPal payments have to redeem it within 30 days.

“LasikPlus lured customers in with a low-price offer that almost no one actually got, and today’s order requires the company to fix its advertising and compensate consumers for their wasted time,” Samuel Levine, director of the FTC’s Bureau of Consumer Protection, said in January last year when the FTC issued its order.

“Especially as costs rise, the commission will not tolerate companies that trick people into thinking they’ll save money on products or services.”

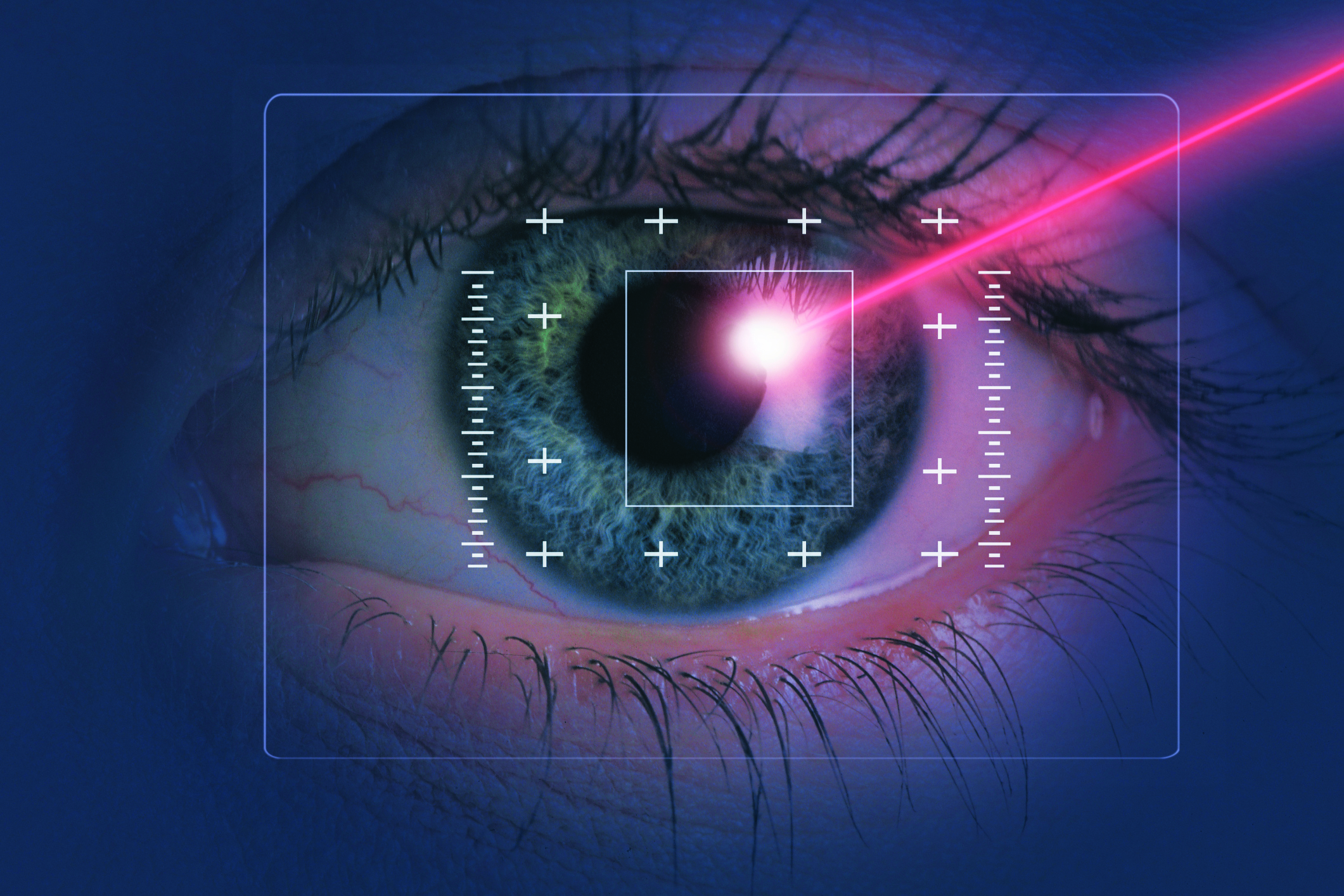

LASIK is an acronym for the procedure of laser-assisted in situ keratomileusis.

In 2022, the U.S. Food and Drug Administration, for example, issued a draft policy stating that people considering LASIK need to be better informed about potential side effects such as persistent eye pain, dry eyes, seeing glares or halos, double vision, and other issues.

In comments submitted to the agency, Dr. Peter Hersh, a clinical professor of ophthalmology and director of the cornea and refractive surgery division at Rutgers New Jersey Medical School, pointed out at the time that LASIK was an “extremely effective and safe procedure in well-selected and informed patients.”

He also said that “as with any other surgical procedure, there are risks and benefits, depending on an individual patient’s particular situation and examination.”

FTC Refunds

The FTC warns recipients of refunds to beware of scams. The agency “never requires you to pay upfront fees or asks you for sensitive information, like your Social Security number or bank account information,” it states.As such, if a customer were to be contacted by someone claiming to be from the FTC and asking for money, “it’s a scam,” according to the agency.

In some cases, the refunds received from the FTC could be subject to taxes. The agency generally does not issue a 1099 or other tax documents to recipients.

However, there are cases where the FTC is obligated to report such payments to the IRS. In such situations, the agency will include a 1099 tax form with the check. Individuals who get this tax form together with the refund check should report the payment as an income on their tax returns, the FTC states.

Sometimes, the recipient may not cash out their checks within the required time frame, leading to their expiry. In such cases, the IRS may reissue the payment only if there is money still available in the settlement fund.