Commentary

Today after market close, Nvidia will deliver the grand finale to the second-quarter earnings announcement season. In the last week, the analyst community has revised their consensus earnings estimate up 10.3%. Typically, positive analyst earnings revisions precede future earnings surprises, and that may be one reason the stock market has rebounded impressively after the Japanese carry trade sell-off that spooked many investors.

The Democratic National Convention (DNC) dominated the news last week, ending when Kamala Harris made it crystal clear that she wants to raise taxes on corporations (28% vs. 21%) as well as raising taxes on capital gains and dividend income (up to 44.6%). Furthermore, stock buybacks would be taxed at 4% (up from 1% currently) and Medicare taxes (currently 3.8%) would rise 32% to 5.0%. She also called for higher excise taxes on electricity and energy that would likely increase utility prices and gasoline prices, so maybe she thinks Americans will swallow $5 trillion in tax increases if she delivers them with a smile. Then, on Friday, Fed Chairman Jerome Powell talked about the U.S. economic outlook at the Kansas City Fed conference at Jackson Hole. He signaled that the Fed will be cutting key interest rates on September 18th. Specifically, Powell said, “The time has come for policy to adjust,” adding, “The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook and the balance of risks.” Powell also said that the slowdown in the labor market was “unmistakable,” echoing comments of other Fed officials, that unemployment concerns are now overshadowing inflation concerns. In fact, Powell said, “We do not seek or welcome further cooling in labor market conditions.”

Here are the most important market news items and what this news means:

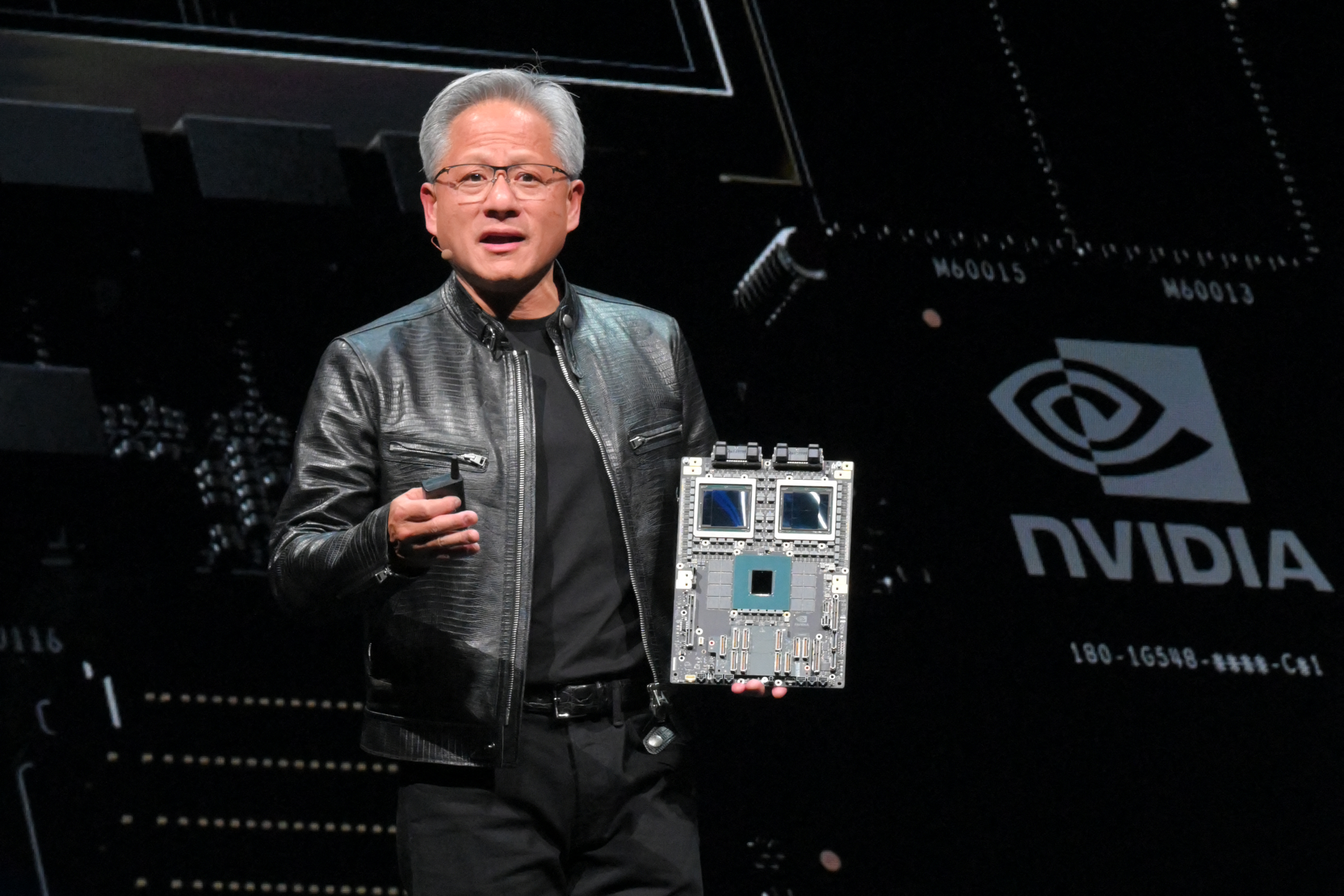

- Nvidia’s guidance on the delivery of its Blackwell GB200 GPUs and order backlog will be more important than its actual quarterly sales and earnings. There have been endless reports that Nvidia is delaying its Blackwell GB200 by at least three months reportedly due to a Taiwan Semiconductor Manufacturing Company (TSMC) glitch attaching two GB200 chips together. Google, Meta, and Microsoft are betting billions on Nvidia’s GPUs as the AI arms race escalates. For example, Google has ordered more than 400,000 GB200 chips, which is an order worth more than $10 billion. Meta also has a $10 billion order, while Microsoft is expecting to have 55,000 to 65,000 GB200 GPUs ready for OpenAI by the first quarter of 2025.

- It is important to stress that Nvidia is effectively a monopoly that spent approximately $2 billion to develop the Blackwell GB200 GPU. Furthermore, Nvidia is expecting to upgrade its flagship AI chipset every year until the end of the decade. Several years from now, Nvidia may not be able to make its chips much faster since its transistors will be so tiny and will be approaching the “atomic” level. Since splitting atoms is not a good idea, the next step to speed up AI calculation will be Quantum computing, which uses both 1s and 0s, in its calculations. Anticipating this change, Nvidia already has a Quantum Cloud Simulator up and running to prepare for the future acceleration of AI calculations.

- It is also important to mention that Nvidia’s competitors are making lower grade AI chipsets. Regenerative AI, which is effectively machine learning, remains Nvidia’s domain. To effectively compete with Nvidia, its competitors would have to spend several billion dollars over the next several years, which would likely prove to be a futile exercise. Momentum and market share are important in the technology world. With Regenerative AI moving so fast, it is hard for new competitors to emerge, let alone allocate the capital and resources required to try to compete with Nvidia.

- Historically, my biggest gains have come from investing in monopolies that emerged before competition caught up. Some of my past monopolies include Conair (hair dryers in the 1980s), Tyson Foods (McNuggets and chicken tenders in the early 1990s), Hanson Natural (in the mid-2000s that was subsequently renamed Monster Beverage) and Nvidia (back in 2016 through 2018). I recommended Nvidia in Growth Investor newsletter again in May 2019 and am proud that I am up well over 3,000% the second time around. However, unlike the past monopolies that I invested in where competition typically emerged in a few years, I am not anticipating any effective competitor to emerge to disrupt the Regenerative AI monopoly that Nvidia dominates. As a result, I am planning on holding Nvidia for several more years and I hope you are enjoying the ride in this great company that is truly a “once-in-a-lifetime stock” that can transform both your portfolio and lifestyle.

- Donald Trump wants to double electricity generation in the U.S. to support AI demand for power-hungry cloud computing centers. To do this, Trump needs cheap U.S. natural gas that is so inexpensive that it is increasingly flared, which is not ideal for the environment by the way. Instead, Trump would rather use natural gas for electricity generation rather than merely waste it. If Trump wins Pennsylvania and becomes the next President, then our cloud computing-related stocks, like CrowdStrike Holdings, Eaton, Emcor, Nutanix, Parsons, Quanta Services, Super Micro Computer and Vertiv Holdings are all expected to prosper.

- Now that inflation has been tamed, the Fed is turning its attention to the job market, since the unemployment rate has risen from 3.4% to 4.3% in the past 15 months. The rumblings that the Fed might cut 50 basis points persist, but the August payroll report would have to be truly horrible, and the unemployment rate would have to surge to coax the Federal Open Market Committee (FOMC) to cut 50 basis points. I am expecting a 25-basis point cut by the FOMC, but all that could change if the economic and unemployment news is dire.

- Crude oil prices have risen 7% this year. The latest catalyst for higher crude oil prices was the fighting between Israel and Hezbollah after Israel used more than 100 fighter jets to strike targets and Hezbollah launched over 200 missiles as well as drones. Russia’s crude oil exports also continue to sputter. Despite these supply disruptions, crude oil demand peaks during Labor Day weekend, so do not be surprised if crude oil prices moderate in September as seasonal demand drops.

Overall, this week should be very positive since we have Nvidia’s latest earnings announcement on Wednesday. Nvidia will be the grand finale for this earnings announcement season. We will also have the July Personal Consumption Expenditure (PCE) announcement on Friday. Since the PCE was unchanged (i.e., 0%) in May and rose only 0.1% in June and July (estimated), the PCE in the past three months is now well within the Fed’s 2% inflation target. Finally, we typically rally into Labor Day weekend, so this week should be positive.

*Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times.