Japanese Prime Minister Sanae Takaichi said the government is collaborating with its Group of Seven allies to establish a supply chain that minimizes reliance on “any single country” for critical materials, as its economy endures escalating retaliation from Beijing.

Beijing’s new export controls that target only Japan are a significant departure from international protocols, Takaichi said in an interview on public broadcaster NHK that aired on Jan. 11. She called the curbs “unacceptable.”

“We will press ahead with initiatives to reinforce supply chains to reduce dependence on any single country for critical supplies,” Takaichi said.

Last week, China’s commerce ministry banned shipments of items with both civilian and military applications to Japan if they could be adapted to enhance Japan’s military capability.

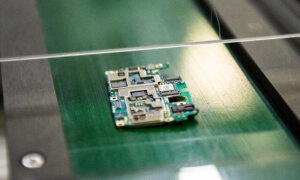

The measures, announced in a Jan. 6 notice, didn’t specify which products would be affected. Still, this year’s export control list contains more than 1,000 dual-use commodities and technologies, ranging from minerals critical in chipmaking to electronics and equipment used to produce aviation and space components.

Among the best-known dual-use items that Beijing is restricting are rare-earth elements, which China dominates at nearly every stage of the supply chain. At least seven of the 17 metallic elements known as rare earths are on China’s latest dual-use export control list, which was released by the regime’s commerce ministry in late December 2025.

When asked at a Jan. 8 briefing whether the new restrictions would cover rare earth exports, He Yadong, a spokesperson for China’s commerce ministry, would not confirm, saying only that products intended for civilian use would be unaffected.

“There is absolutely no need to be concerned” for those engaged in normal civilian trade, He told reporters in Beijing.

Japanese Industry and Trade Minister Ryosei Akazawa said on Jan. 9 that he has been aware of Beijing’s announcements but noted that many details surrounding the dual-use export curbs remain unclear.

He pointed out that since April 2025, China has been regulating exports of rare earths, critical raw materials used in a wide range of products such as electronic parts and cars, which he said has had “serious” effects across multiple industries, forcing some companies to adjust their production.

Given that 70 percent of rare earth imports come from China, Akazawa said, the effects of Beijing’s latest actions could be significant, and the government will carefully monitor the situation.

Japanese Finance Minister Satsuki Katayama (C) delivers a speech during the opening ceremony to celebrate the first trading day of the year at the Tokyo Stock Exchange in Tokyo on Jan. 5, 2026. (Kazuhiro Nogi/AFP via Getty Images)

Japanese Finance Minister Satsuki Katayama is set to travel to the United States on Jan. 11 to discuss critical mineral supply with her G-7 counterparts.

At a Jan. 9 briefing, Katayama said she plans to share Japan’s stance on China’s new export controls at the meeting hosted by the U.S. Treasury.

She highlighted that Japan has sought to diversify its supply chains away from China, seeking alternatives in countries such as Australia and Malaysia, since it began facing China’s rare earth export restrictions in 2010.

“The current consensus, at least among G7 nations, is that this practice—securing monopolistic positions through non-market means, and then using it as a weapon—is unacceptable,” Katayama told reporters. “It poses a crisis for the global economy and is extremely problematic in terms of economic security.”

The regime’s commerce ministry has described the latest export ban as a direct response to remarks made by the Japanese prime minister in November 2025 regarding Taiwan, claiming that the comments constitute interference in China’s internal affairs.

The Chinese Communist Party (CCP) views self-ruled Taiwan as its own territory, to be taken by force if necessary. After Takaichi linked a Taiwan contingency to a potential “survival-threatening situation” for Japan—a designation that could enable Japan to deploy troops—the CCP began an extensive retaliatory campaign against Japan. That includes warning Chinese citizens against traveling to Japan and canceling Japanese cultural events.

Takaichi has rejected the regime’s demand to retract her earlier comments, saying they align with the government’s long-standing stance on Taiwan, which lies just 68 miles from the tip of Japan’s westernmost island, Yonaguni.

The CCP has ramped up economic pressure against Japan this month. Hours after announcing the vaguely worded dual-use export ban, China’s state media indicated that licenses for shipping rare-earth products to Japan would be subject to stringent review. The regime’s commerce ministry also initiated an anti-dumping investigation into Japan’s dichlorosilane, a vital raw material for semiconductor manufacturing.

Japanese Foreign Minister Toshimitsu Motegi said on Jan. 9 that the government would refrain from commenting on any anti-dumping investigations initiated by foreign governments. As for the export ban, Motegi noted that Tokyo has lodged a strong protest with Beijing and requested the withdrawal of these new restrictions.

“We will continue to work with relevant countries, including the United States and G7 countries, to take necessary measures in a firm yet calm manner from the perspective of national interests,” he said.