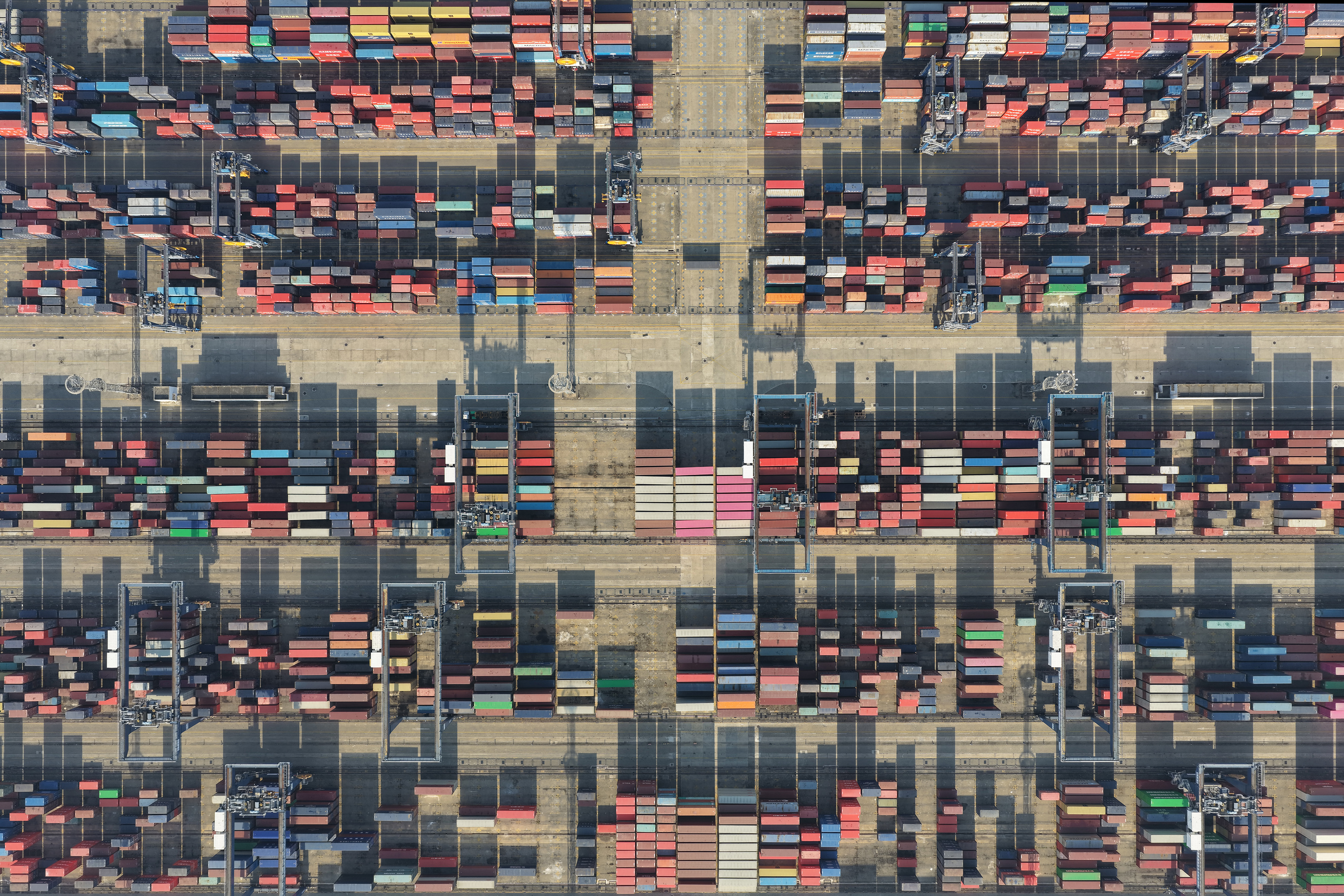

China’s trade surplus hit a record of nearly $1.2 trillion in 2025, as Chinese factories diverted an influx of goods facing levies in the United States to other global markets amid weak demand within the country.

Total exports from the Asian economic giant expanded by 6.6 percent year over year in December 2025 in dollar-denominated terms, according to data released on Jan. 14 from China’s General Administration of Customs. The surge was the fastest growth in three months and nearly doubled the 3 percent increase forecast by economists in a Reuters poll.

Imports also rose, climbing by 5.7 percent year over year in December, following a 1.9 percent increase the previous month. Economists had projected only a 0.9 percent increase.

That put China’s trade surplus at $114 billion in December, up from $111.7 billion the month before.

For the entire year of 2025, China accumulated its largest-ever trade surplus, of $1.19 trillion, which was a 19.9 percent increase from 2024. That number was roughly equivalent to the gross domestic product (GDP) of a top-20 global economy in the region, according to ING economists.

The trade imbalance is among the key reasons U.S. President Donald Trump cited for imposing additional tariffs on Chinese imports in 2025.

The Jan. 14 data showed that China’s exports to the United States plunged by 30 percent in December from a year earlier, the ninth consecutive month of decline. Over the full year of 2025, total exports to U.S. markets fell by nearly 20 percent year over year.

As a result, its trade surplus with the United States contracted significantly, shrinking by 22 percent to $280 billion last year. Even so, the value of China’s exports is still more than three times greater than the value of its imports from the United States.

China now faces an extra 25 percent U.S. tariff, following Trump’s recent threats to impose extra duties on all countries doing business with Iran, of which China is the largest trading partner and oil purchaser.

Speaking at a press conference shortly after the release of the trade data, Wang Jun, deputy director of the Chinese regime’s customs administration, cautioned that momentum for global trade growth appeared insufficient in 2026.

“The external environment facing China’s trade development is still grim and complex,” Wang told reporters.

Still, he struck an upbeat tone, highlighting confidence in China’s foreign trade growth.

“With more diversified trading partners and significantly enhanced ability to handle risks, the fundamentals of China’s foreign trade are still stable,” he said.

The latest customs data indicate that the deepening decline in U.S.-bound shipments was largely offset by rising sales to other markets.

In 2025, shipments to Africa rose by 25.9 percent, the fastest growth among China’s major trading partners. Exports to the Association of Southeast Asian Nations, China’s biggest trading partners, increased by 13.4 percent, and shipments to the European Union, its second-largest trading partner, grew by 8.4 percent.

The widening trade gap has stirred tensions between Beijing and the 27-nation EU. European officials are increasingly worried about the effect of the influx of Chinese goods on their domestic industries, as exporters in China shift their focus to Europe amid additional U.S. tariffs.

European Commission President Ursula von der Leyen told Chinese leaders in July 2025 that the bloc’s ties with Beijing have reached “an inflection point.” French President Emmanuel Macron later warned that the trade imbalance accumulated with China is “unsustainable.”

“I made it clear that either we rebalance economic relations co-operatively—engaging China, the US and the EU in a genuine partnership—or Europe will have no choice but to adopt more protectionist measures,” Macron wrote in a Financial Times op-ed published after a visit to Beijing in December 2025. “I much prefer co-operation, but will argue for using the latter if need be.”

The Jan. 14 data showed that China’s exports to the EU continue to outpace its imports more than twofold. Last year, the trade surplus with the region surged by 18 percent to roughly $292 billion.

Lynn Song, chief economist for Greater China at ING, said strong exports could help Beijing achieve its growth target of “around 5 percent.” The full-year GDP data are set to be released on Jan. 19.

“External demand has been a major driver of economic growth in 2025,” Song said in a Jan. 14 note. “For China, the key question is how long this engine of growth can remain the primary driver.”