Payments from the government have become the fastest-growing source of income for Americans, according to a new study.

A report by the Economic Innovation Group (EIG), a public policy research organization, titled “The Great Transfer-mation” states that Americans have become substantially more dependent on government support, with the share of national income coming from transfer payments more than doubling over the past 50 years.

Transfer payment programs include Medicare, Medicaid, Social Security, unemployment and disability, food stamps, and veterans’ benefits.

Transfer payments increased from 8 percent of U.S. total income in 1970 to 18 percent today, the report states, crowding out private income from wages and investments.

“There is a large range of experiences driving transfer reliance across communities,” Benjamin Glasner, an EIG economist and one of the report’s authors, told The Epoch Times. “But it’s unavoidable to look at the fact that transfer reliance has grown rapidly across the country, and it’s something we need to deal with.”

According to Federal Reserve data, government transfer payments increased from about $70 billion in 1970 to more than $6 trillion in 2020, during the COVID-19 pandemic, before falling back to the current level of $4.3 trillion. According to the EIG report, if government transfer payments were spread evenly among all Americans, they would have amounted to an annual payment of $11,500 per person in 2022.

One factor driving much of the shift from private income to government dependence is that the U.S. population is, on average, getting older. According to demographic data from USAfacts, the percentage of Americans 65 years and older increased to 17.3 percent in 2022 from 13.1 percent of the population in 2010. During the same period, the percentage of Americans younger than the age of 20 fell to 24.4 percent from 26.9 percent.

“The primary driver that we found in our report is demographic related, specifically the fact that the country has aged so rapidly,” Glasner said. “And the transfer programs that target that aging population also have grown significantly more expensive over time.”

Of all government assistance payments in 2022, 56 percent went to the elderly, mostly for Medicare, according to the EIG report. Health care costs were a major factor, both because more Americans qualified for Medicare and Medicaid and because the cost of medical treatment rose significantly.

According to data compiled by Peterson-KFF, a health care policy analytics organization, total health spending in the United States was $74.1 billion in 1970. By 2022, total health spending was $4.5 trillion.

Public Finances Under Strain

The growth in transfer payments has taken its toll on state and federal budgets.

The 2024 Pension Solvency and Performance Report, authored by Ryan Frost and Mariana Trujillo for Reason Foundation’s Pension Integrity Project, stated that public pensions are increasingly falling behind on their ability to pay.

As of 2023, the authors state, total unfunded public pension liabilities across the United States hit $1.59 trillion, and the median funded ratio was 76 percent. The U.S. federal deficit is currently $1.8 trillion, and interest payments on U.S. government debt increased to more than $1 trillion today from $31 billion in 1970.

Some analysts say this growing dependence on government comes at the cost of personal autonomy and responsibility.

“The surge in transfer payments during the past 50 years is just one manifestation of the trend to politicize and tangle up all aspects of Americans’ lives with the government,” Steve Hanke, professor of Applied Economics at Johns Hopkins University and a member of the board of directors of the Federal Fiscal Sustainability Foundation, told The Epoch Times. “It results because of politicians’ inevitable attraction to buy votes by promising ‘free lunches,’ and the fact that politicians don’t face statutory or constitutional spending constraints.”

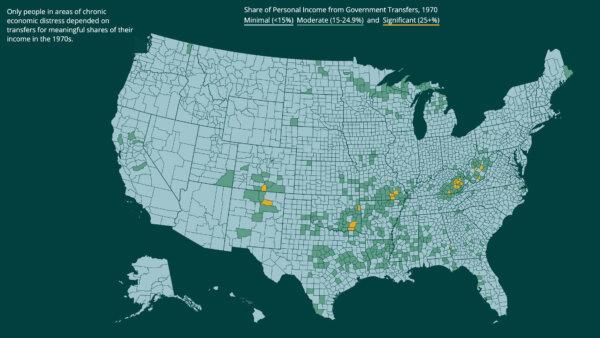

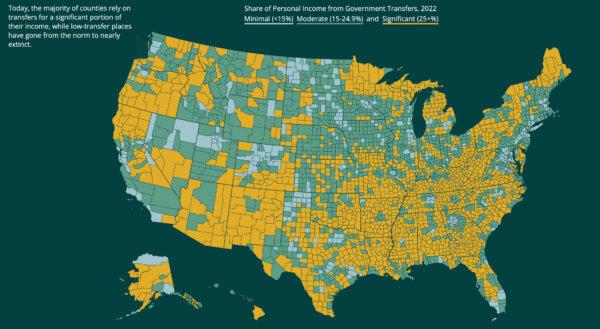

To illustrate the extent of the shift to government dependence, EIG created maps showing the percentage of income that came from transfer payments, broken down by county, over time.

In 1970, only about 1 percent of all U.S. counties reported that government transfers made up more than 25 percent of total income in their county; by 2022, more than half of U.S. counties reported dependence at that level.

Transfer payments as a percent of total income, by county, in 1970—15 percent or more in green and 25 percent or more in yellow. (Source: Economic Innovation Group)

Government transfer payments as a percent of total income, by county, in 2022—15 percent or more in green and 25 percent or more in yellow. (Source: Economic Innovation Group)

Aging, Shrinking Populations

While the reasons for this dependence varied from region to region, aging populations and outward migration were common themes, particularly in rural counties. Often, young people leave small towns for better jobs in cities, and this both increases the percentage of retired people and decreases the number of people earning private wages in rural areas.

As societies industrialize, people migrate from farms to cities, women enter the labor force in larger numbers, and fertility rates fall. While this trend has been observed over the past several decades throughout the world, the United States has been experiencing this trend for two centuries.

In 1825, the average woman in America gave birth to more than six children, according to Statista, a data collection firm. As the United States industrialized and urbanized, the birth rate declined, hitting a low of two children per woman in 1940 before rebounding to 3.58 children in 1960, during the “baby boom.”

The minimum fertility rate to sustain a population is 2.1 children per woman. The United States dipped below this rate in 1973 and has remained below replacement level ever since, according to data from Macrotrends. While U.S. fertility rates increased marginally through 2008, they have since fallen back to a rate of about 1.8 children per woman.

While countries such as Japan have had their populations fall because of low fertility, the United States has experienced continuous population growth. But this is largely because of immigration rather than native-born Americans having children.

The Congressional Budget Office projects that, without immigration, the U.S. population will begin to shrink, starting in 2040.

Economic Security Versus Prosperity

The increasing dependence on the government for income raises the issue of how the United States can balance economic security for its dependents against overall economic growth and prosperity.

“The increased politicization of life will put a damper on economic prosperity,” Hanke said. “For every dollar taken out of one taxpayer’s pocket and put into another’s, there is a cost, an excess burden.

“This burden is the result of distortions thrown into the economy by imposing a tax, and the administrative costs of levying the tax and of running the government’s transfer payments system.”

Arthur Laffer, a noted economist who specializes in tax policy, wrote in his 2023 book, “Taxes Have Consequences,” that raising taxes much beyond current levels will choke off economic growth, thus reducing the tax base.

“The more you redistribute, the greater will be the drop in total income,” Laffer said in a 2023 interview with The Epoch Times.

Consequently, governments are increasingly caught between a rock and a hard place regarding how to pay for social programs.

Interest payments on the U.S. federal debt are currently the third-largest budget item, after Social Security and nondefense discretionary spending, exceeding Medicare and military spending, according to an August 2024 report by the Peter G. Peterson Foundation based on Congressional Budget Office projections published in June.

Treasury data for the fiscal year 2024, running Oct. 1, 2023, to Sept. 30, show that the interest expense was $896 billion.

According to projections from the Congressional Budget Office, interest payments on the federal debt will double as a percentage of gross domestic product by 2054 and will become the largest single item in the federal budget by 2051.

Potential Solutions

According to Glasner, there are three options for governments to continue providing transfer payments. The first is cutting benefits, but that appears to be politically untenable, and neither Democrats nor Republicans have expressed any intention to do so.

The second is raising taxes, he said, “but there’s some risk to that, because overdoing increases in taxation can potentially cut off sources of economic growth, undercutting our actual capacity to deal with this.”

The third and most viable option, Glasner argues, is to increase economic growth and private income. Among the ways to do this, he says, are “investments in research and innovation, better-designed immigration policy, and tax and regulatory policies that foster economic dynamism and increased participation in the workforce.”

Although the United States’ financial situation may appear dire, a September report from the Manhattan Institute titled “America’s Surprisingly Effective Welfare State” argues that the United States is in better shape than many other Western nations.

While Europe’s social programs provide support payments regardless of need, the U.S. transfer systems are more selective and thus less costly while delivering more money to the poorest.

“Europe’s welfare states are dominated by costly publicly funded ‘social insurance’ programs, which attempt to fully support middle-class lifestyles through periods of unemployment, ill health, disability, or retirement,” the report reads. “By contrast, American public entitlement programs are more focused on providing a safety net against poverty, and they more strictly limit eligibility for cash and health care benefits to those who are unable to work.”